Want unlimited access to top ideas and insights?

The mortgage industry is calling on the Consumer Financial Protection Bureau to revise its Loan Originator Compensation rule in favor of better protection for consumers and lesser regulatory burdens for lenders.

The Mortgage Bankers Association and nearly a dozen trade groups said that after more than five years under the LO Comp rule, changes to the order should be among the CFPB's top priorities in its review of the mortgage rules, according to a letter sent to acting CFPB Director Mick Mulvaney.

"The LO Comp rule, while well-intentioned, is causing serious problems for industry and consumers due to its overly strict prohibitions on adjusting compensation and the amorphous definition of what constitutes a 'proxy' for a loan's terms or conditions," the letter said.

"These harms are felt when borrowers are unable to obtain lower interest rates from their lender of choice when shopping for a mortgage, or when lenders are unable to hold loan officers accountable for errors in the origination process. Consumers are also harmed when lenders limit their participation in special programs designed to serve first-time and low-to-moderate income borrowers," the groups wrote.

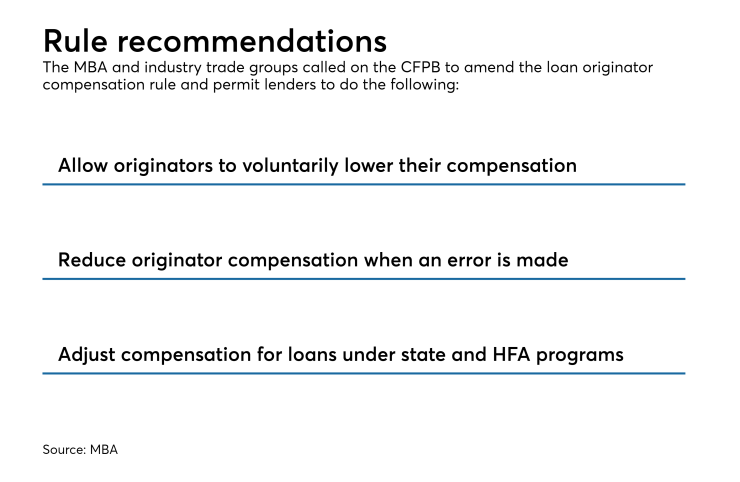

The bureau should allow loan officers to voluntarily lower their compensation to pass more savings on to the consumer, according to the letter, which highlights terms in the rule stating originator compensation may not be altered once a borrower has received loan terms.

The trade groups' letter does not provide suggestions on what measures should be taken to ensure that such reductions are indeed voluntary and protect loan officers from being pressured by their employers into taking lower compensation.

Under the current law, a lender must choose between lowering the interest rate, fees or discount points to match competition, or declining to compete with other mortgage offers.

"The requirement to pay the loan originator full compensation for a discounted loan creates a strong economic disincentive for lenders to match interest rates," the letter said. "For the consumer, the result is a more expensive loan or the inconvenience and expense of switching lenders in the midst of the process."

Revisions would significantly increase competition in the marketplace, the letter said.

The CFPB should allow lenders to reduce a loan originator's compensation when the originator makes a mistake, the letter states. Currently, the LO Comp rule does not allow companies to hold employees financially accountable for losses incurring from errors made on a loan.

The rule also prohibits varying compensation for different loan types, including Housing Finance Agency loans. But, lenders should be allowed to adjust loan compensation to offer loans made under state and local HFA programs, the letter argues.

"HFA programs are particularly important for first-time homebuyers and low-to-moderate income families who are often underserved and face affordability constraints under market interest rates and terms," the trade groups wrote.

Originally, the LO Comp rule was created to protect consumers from steering, which is pretty much a non-issue following newer regulatory actions adopted from the passage of the Dodd-Frank Act, according to the letter. The CFPB's TILA-RESPA integrated disclosure rule also aimed to provide clarity on mortgage terms and costs by elevating disclosure requirements.