Earnings

Earnings

-

Pretax income in the servicing segment outpaced its loan production unit in the fourth quarter, as the company launches new branding initiatives.

February 4 -

But the company was able to increase the share of its top line that came from recurring income streams while minimizing the impact of more volatile transactional-based ones.

February 3 -

While bullish on the future, CEO Anthony Hsieh noted that the company is “doing the necessary work to ensure our operations appropriately reflect our expectations for the changing market."

February 1 -

Multifamily and specialty finance loans, which were highlights during the fourth quarter, should increase further in 2022, company executives said.

January 26 -

Despite that year-over-year decline, the company beat analysts' expectations with fourth-quarter net income of $5.8 billion. Stronger commercial lending and lower expenses cushioned the blow in consumer credit.

January 14 -

The company's fourth-quarter trading revenue declined notably more than analysts had expected, while its business and consumer lending each dropped 1% year over year.

January 14 -

Higher sales commissions helped to drive production costs to their second-highest level since the Mortgage Bankers Association started its survey in 2008.

November 30 -

The company was able to generate a relatively higher margin than the previous quarter, in contrast to broader industry trends, bringing its bottom line back into the black.

November 12 -

The company’s servicing operations also reported a quarterly profit, with its portfolio increasing by 20% annually.

November 11 -

The company increased and diversified its income streams beyond the mortgage sector but expenses associated with stock-based compensation and a recent acquisition outweighed these gains.

November 11 -

Amid its first post-IPO securitization of loans made outside a regulatory definition for standard products, the company has seen purchases accelerate, but it underperformed by some analysts’ estimates.

November 10 -

The wholesale lender's net income of nearly $330 million factored in a $170.5 million hit from a reduction in its mortgage servicing rights fair value.

November 9 -

The company’s gains, which far exceeded analysts’ expectations, were partially offset by thinner production margins.

November 8 -

The company’s six acquisitions since last March will contribute to increased revenue in both of its software and data and analytics segments.

November 8 -

All six companies, however, remained highly profitable, as the delinquency and forbearance outlook is favorable for the possibility of rising claims payments.

November 5 -

A greater share of the company's future earnings are likely to come from servicing as rates rise, Chief Operating Officer Andy Chang said.

November 5 -

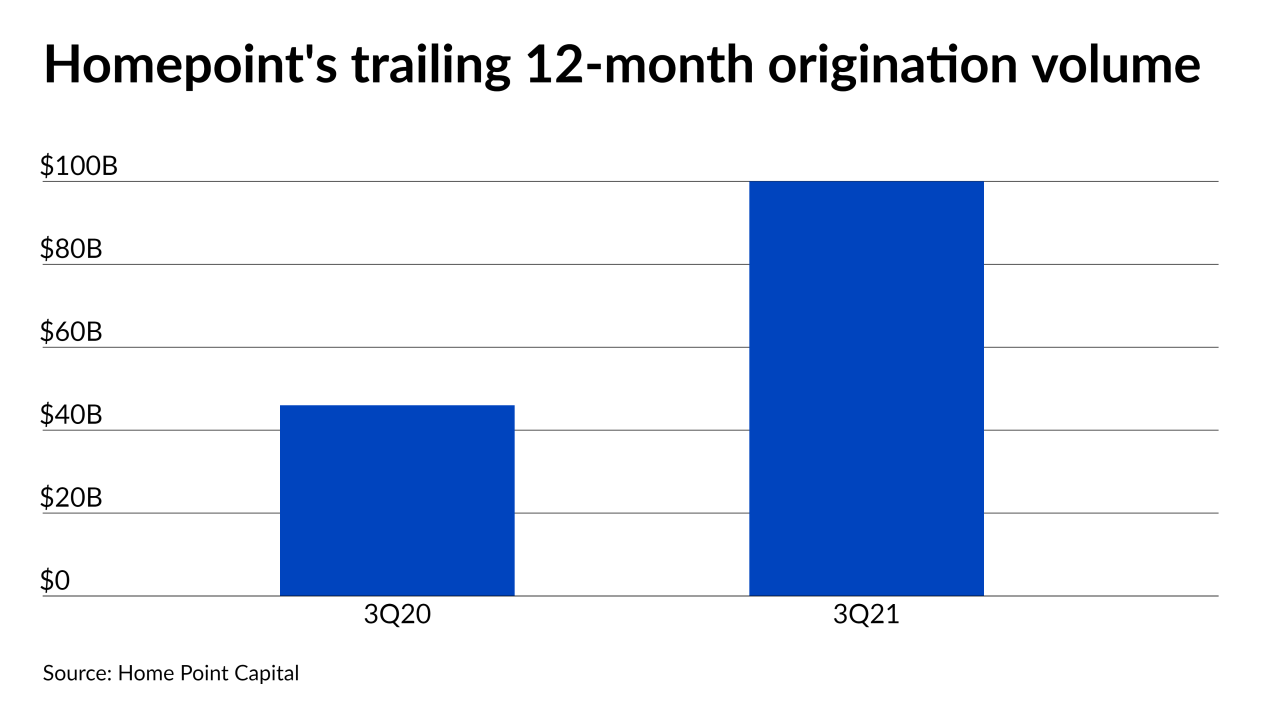

While the company produced $88 billion during the period, it had a major margin squeeze in its TPO Pro channel.

November 5 -

The company is repositioning its secondary market sales of loans and servicing and implementing cost-cutting measures as the market normalizes.

November 4 -

Applications related to Zillow Offers made up 70% of the mortgage lender's purchase business in the third quarter.

November 3 -

After closing its merger with Caliber, the company also hopes to pare down expenses by at least 10%.

November 2