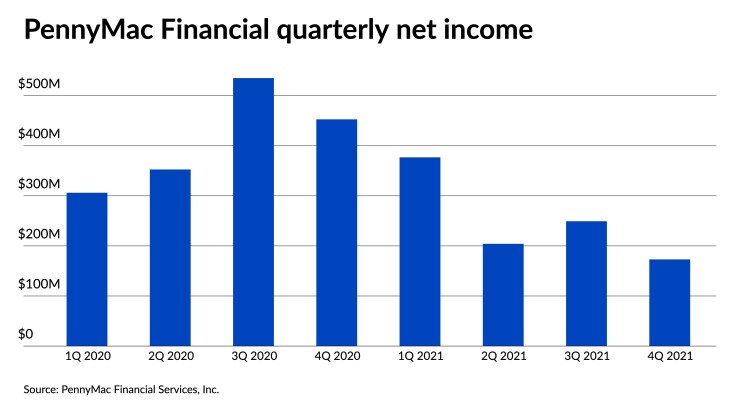

Net income at PennyMac Financial Services came in lower on a quarterly and annual basis, reflecting industry headwinds in the current market, while pretax servicing income exceeded the amount earned from production channels.

The nationwide lender and servicer, a subsidiary of Pennymac, posted net income of $173.1 million in the final three months of 2021, but profits were down 31% from $249.3 million in

Total net income for full-year 2021 was reported at $1 billion, 60% below profits of $1.6 billion from 2020.

The decline reflected

Pennymac officials took a cautious tone when discussing the outlook for the months ahead. “We believe the decline in overall originations will continue to drive significant competition and pressure on gain-on-sale margins until the current excess industry capacity is reduced,” CEO David Spector said in the company’s earnings presentation.

With its large servicing segment to go alongside originations, companies like PennyMac should be able to withstand the slowdown that has been expected following three years of growth, said Henry Coffey, managing director, equity research at Wedbush Securities, in a recent interview with National Mortgage News.

“If you happen to be a servicer, it's pretty good because your servicing business is going to be so much more profitable,” he said. “And successful companies — their earnings might be down on the origination front, but they'll still be profitable.”

Net revenue generated across the company amounted to $693.8 million for the fourth quarter, in part thanks to $500.1 million worth of gains on loans held for sale. But revenue was 11.8% below third-quarter numbers of $786.6 million and 30% under the $1 billion mark achieved a year earlier. Annual revenue totaled $3.2 billion compared to $3.7 billion for 2020

Despite industry forecasts for fewer originations in 2022, direct lending at PennyMac is taking on increased importance at the company if recent initiatives are any indication.

In January, the company embarked on rebranding its PennyMac Broker Direct unit,

“Our newly evolved brand and marketing focus along with deployment of transformational technologies in our direct-lending channels are key components of multiyear investments to achieve our medium-term goals,” Spector said. He also indicated that upcoming marketing campaigns may include Pennymac TV commercials and increased content on social platforms.

Pennymac also announced last month plans to

The growth strategy isn’t as unexpected as it may first appear in the current lending climate, and it’s tied to the company’s reputation as a servicer. “That wasn't a decision they made yesterday,” Coffey said.

“If you have this many servicing customers, it's just a natural outgrowth of that business. They're harvesting their own servicing,” he said.

Originations generated via the consumer-direct channel amounted to $10.6 billion in the fourth quarter, according to company officials, while broker-direct production came out to $3.7 billion. Its correspondent channel produced $30.3 billion.