Earnings

Earnings

-

Fidelity and Essent reported higher year-over-year profits in the last three months of 2019 as refinancing increased business volume, but Black Knight took a hit on its Dun & Bradstreet investment.

February 14 -

Freddie Mac saw a decline in net profit in 2019 due to decreased interest rate income, lower amortization revenue and risk-reducing investment costs, but its consecutive-quarter results improved.

February 13 -

Fannie Mae identified the adoption of hedge accounting and regular issuance of multifamily Connecticut Avenue Securities deals as among strategies it could continue to pursue while navigating regulatory uncertainties and change.

February 13 -

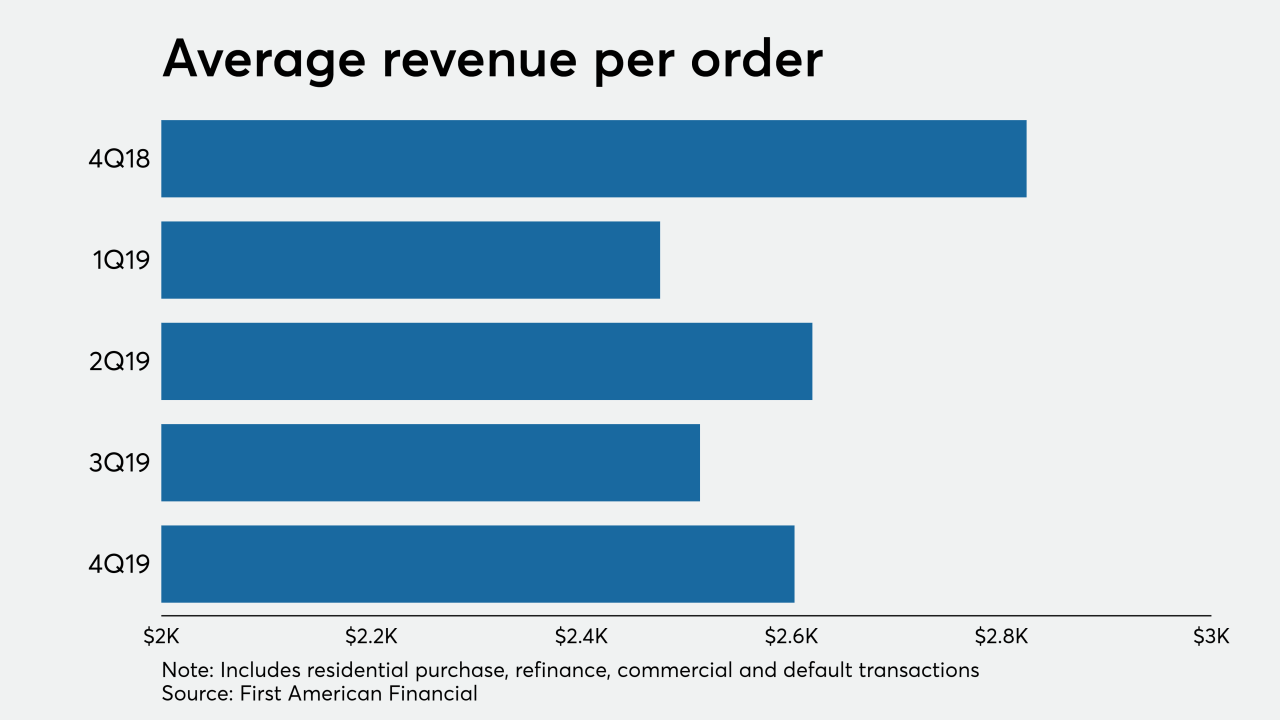

First American Financial, a title insurance underwriter and settlement services provider, is acquiring mortgage document firm Docutech for $350 million in cash.

February 13 -

NMI Holdings saw its insurance-in-force grow 38% over the past year as 90% of its clients used its black box pricing module during the fourth quarter.

February 12 -

Ocwen Financial Corp. is on track to become profitable on a pretax basis by the third quarter without any special items enhancing earnings, according to a preliminary release of its fourth-quarter results.

February 7 -

The strong refinance market in the fourth quarter propelled earnings at three different mortgage-related business that also were dealing with merger and acquisition activity during and after the period.

February 6 -

The U.S. mortgage insurance business remained a bright spot for Genworth Financial, as fourth quarter adjusted operating income increased 29% and new insurance written rose nearly 95% over the prior year.

February 5 -

A booming housing market coupled with low interest rates helped M/I Homes report record results for 2019.

February 5 -

Mortgage refinancings made up slightly under one-third of MGIC Investment Corp.'s new insurance written during the fourth quarter, contributing a significant percentage of its business.

February 4