Earnings

Earnings

-

In a long-term attempt to stabilize its earnings from the cyclical nature of home loans, HomeStreet took a loss in the opening quarter of 2019.

April 30 -

The Boston company gained the mortgage platform when it bought First Choice in 2017.

April 30 -

Title underwriters and other vendors reported year-over-year declines in business activity (although some reported improved profitability), but lower interest rates made them optimistic about their prospects going forward.

April 26 -

Even after integrating the 52 Wells Fargo branches acquired in December as part of its efforts to diversify beyond home lending, Flagstar Bancorp's first-quarter earnings were driven by increased mortgage revenue.

April 23 -

MGIC Investment Corp. posted better-than-expected first-quarter earnings as expenses were lower than projected while net premiums came in higher.

April 23 -

The bank is expecting to benefit from the discount airline's first flights to the Aloha State even as a white-hot local housing market starts to cool.

April 22 -

The Minneapolis bank reported mid- to high-single-digit improvement in those categories, but total loan growth was curbed by declines in CRE and other credit types.

April 17 -

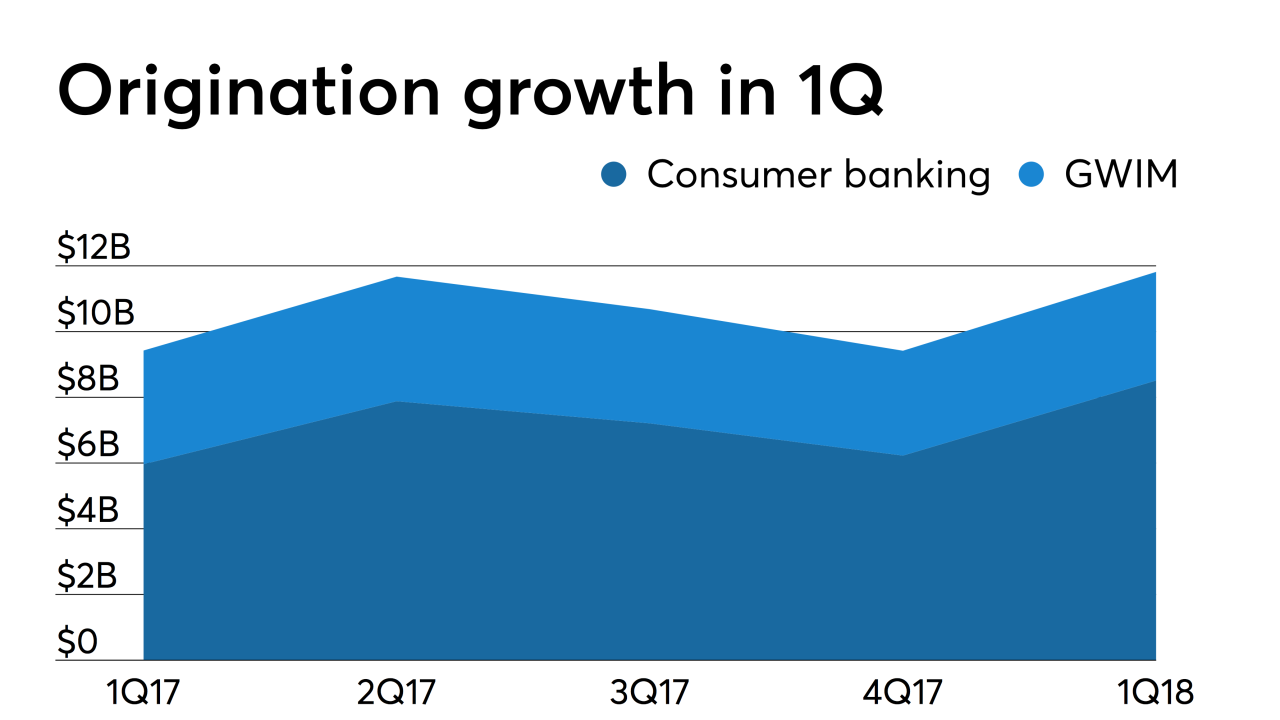

Lower interest rates increased Bank of America's first-quarter residential mortgage volume by 21% over the previous year, while home equity dropped by 25%.

April 16 -

Citigroup's first quarter mortgage-related revenue increased compared with the fourth quarter — although down slightly from the same period last year — as its lending operations continued to contract.

April 15 -

First-quarter mortgage banking results at Wells Fargo and JPMorgan Chase could be an early sign of an improving industry.

April 12