Earnings

Earnings

-

Fannie Mae's current tack could help it weather some of the new challenges confronting the government-sponsored enterprises, including the planned expiration of its qualified mortgage rule exemption and rate-driven earnings volatility.

August 1 -

Mr. Cooper Group reported a second-quarter net loss of $87 million as the company took a $231 million fair value hit to its mortgage servicing rights portfolio.

August 1 -

Taylor Morrison Home Corp. recorded earnings that outpaced analysts' estimates and announced a partnership in the growing rental market.

July 31 -

The oft-delayed sale of Genworth Financial might need new approvals from U.S. insurance regulators if and when it disposes of its Canadian mortgage insurance stake.

July 31 -

Freddie Mac continues to churn out steady financial returns, with the growth in first-time home buyers and credit risk transfers providing the GSE stable footing when a recession comes, according to new CEO David Brickman.

July 31 -

New Residential Investment Corp. took a $32 million net loss in the second quarter as it diversified its business lines and repositioned to protect its mortgage servicing rights from falling rates.

July 30 -

Title insurers benefited from the increase in origination volume — especially refinancings — during the second quarter, as open order counts increased compared with one year prior.

July 25 -

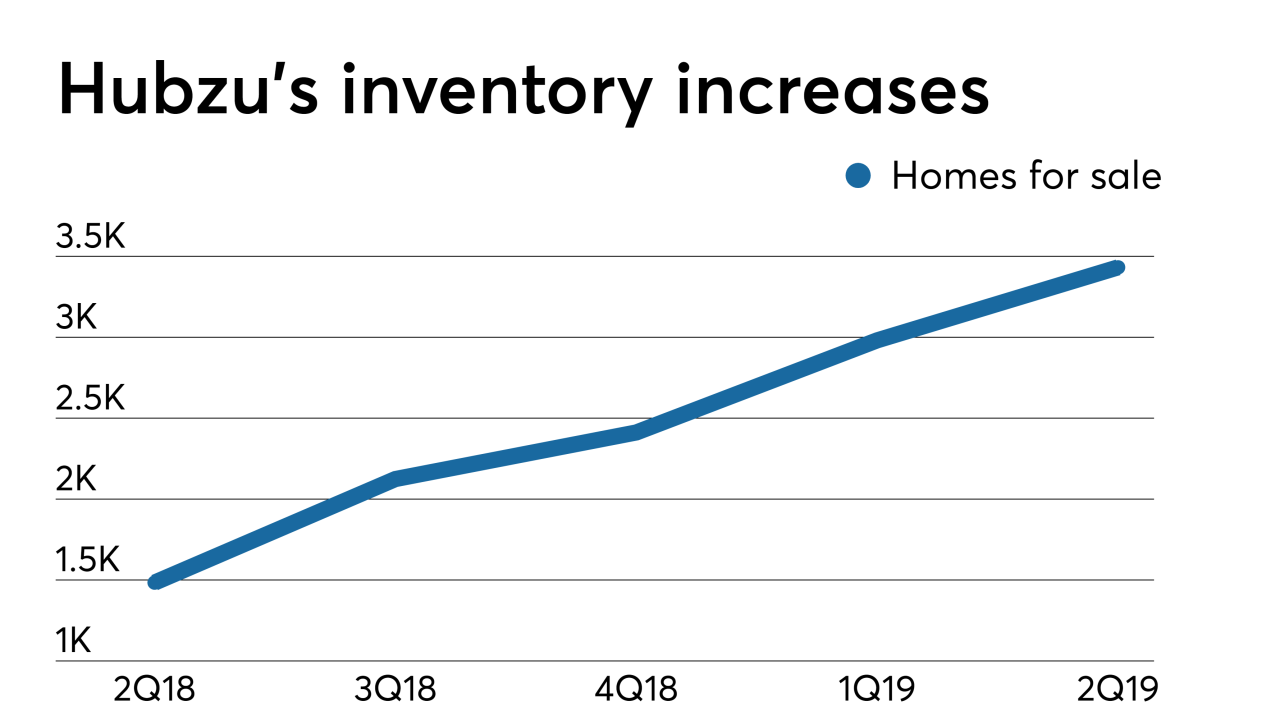

Altisource Portfolio Solutions cut its previous-quarter net loss by 49% in its most recent fiscal period, when property maintenance revenue and new Hubzu real estate auction site inventory increased.

July 25 -

MGIC reported higher-than-expected earnings, seen as a positive for the other mortgage insurers, plus Flagstar and KeyCorp had strong quarters for their mortgage businesses.

July 23 -

Pretax mortgage income at NVR Inc. surged 37% year-over-year in the second quarter while originations rose 1%, contrasting more tepid home-loan earnings results relative to originations at big banks.

July 19 -

Bank of America says rate cuts could reinvigorate mortgages and that its digital and cards strategies will help it grab more market share to offset shrinking margins.

July 17 -

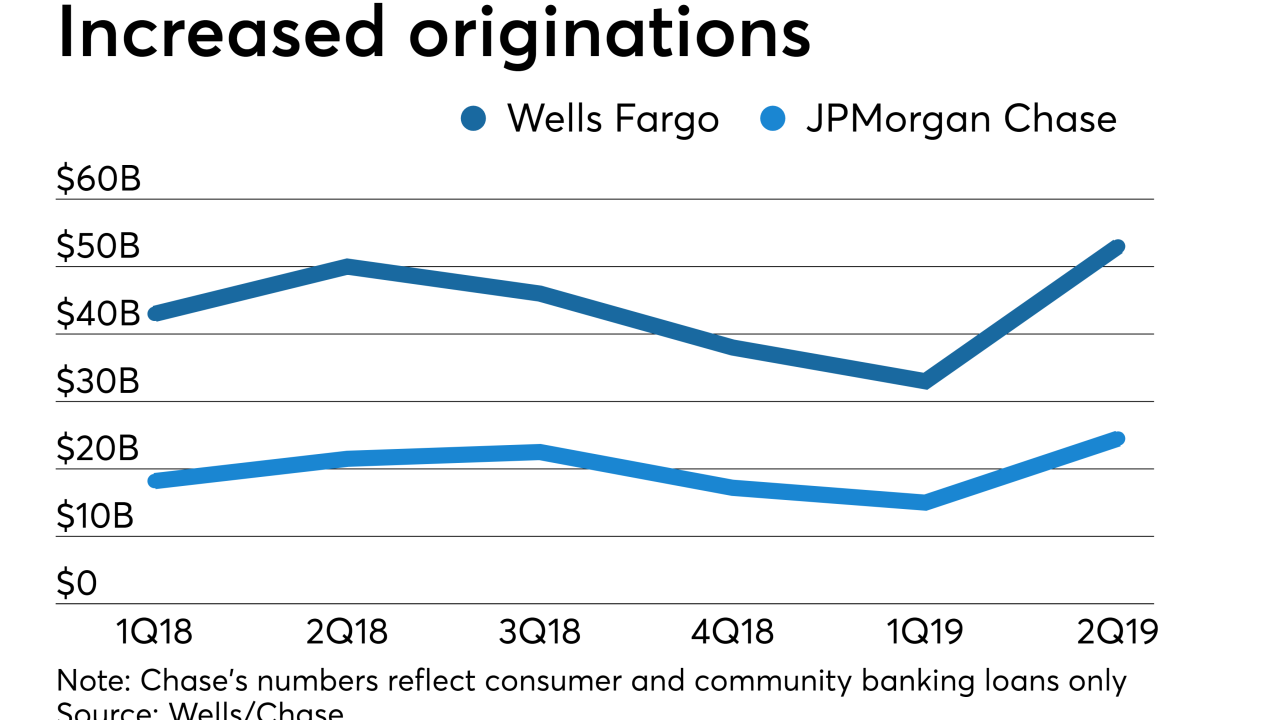

The second quarter continues to shape up as a good one for bank mortgage lenders — and one ancillary service provider — that are benefiting from a spike in volume.

July 17 -

The Minneapolis bank reported growth across several lending and noninterest income categories in the second quarter, which offset net interest margin pressures and declining deposit service fees.

July 17 -

Wells Fargo and JPMorgan Chase recorded stronger mortgage originations in the second quarter as rates fell, but profits from single-family loans were lower than a year ago due to decreased servicing revenue.

July 16 -

Despite a significant rise in first-mortgage production due to lower interest rates, profits from home lending in Citigroup's retail banking division fell slightly in the second quarter.

July 15 -

Builder MDC Holdings' preliminary numbers for net new home orders registered their highest quarterly increase in years, adding to signs of growing demand for housing.

July 8 -

FB Financial is selling its correspondent lending channel to Rushmore Loan Management Services, which will complete the bank holding company's restructuring of its mortgage business.

June 27 -

The two lenders are bucking the trend for the overall industry, which saw year-over-year mortgage growth slide to a 17-year low in March, according to the Bank of Canada.

May 23 -

First-quarter operating revenue in Equifax's Mortgage Solutions unit was the lowest it's been for the fiscal period since 2016, and the company anticipates declines in this division will remain a concern.

May 13 -

Zillow's mortgage division experienced better customer demand in the first quarter than it expected, but its revenue was outweighed by expenses that led to a pretax loss of $9.6 million.

May 10