Earnings

Earnings

-

Crossroads Systems Inc. has relaunched with the acquisition of a community development financial institution focused on the Hispanic mortgage market.

March 9 -

The Federal Agricultural Mortgage Corp. reported significant gains in new business volume, but also realized a big jump in 90-day delinquencies.

March 9 -

The servicing business drove Nationstar Mortgage Holdings' fourth-quarter profitability and will be a major factor going forward after the company is acquired by WMIH.

March 1 -

Ocwen Financial Corp.'s acquisition of PHH Corp. will help the nonbank servicer rebuild scale that's been diminished by years of regulatory restrictions and the decline in distressed mortgage volume brought about by improvements in the overall housing market.

February 28 -

A $2.38 million loan Remax founder and former CEO David Liniger provided to the company's then-chief operating officer, Adam Contos, violated the company's code of ethics because its board of directors was never told about it, the company said as it announced it had completed an internal investigation.

February 23 -

The House Financial Services Committee chairman is calling out Fannie Mae and Freddie Mac's regulator for authorizing payments to two housing trust funds while the mortgage giants have their own financial struggles.

February 16 -

National MI set a record for new insurance written in the fourth quarter, but its parent company reported a net loss for the period due to tax reform.

February 16 -

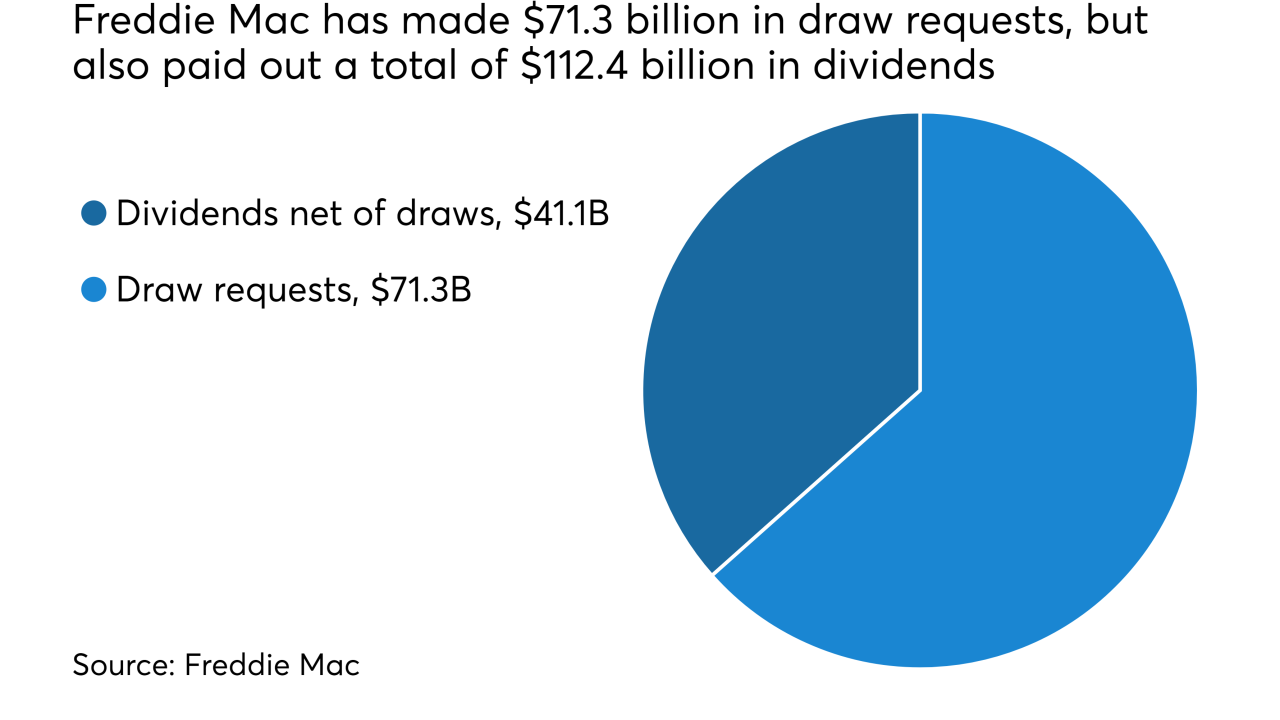

Freddie Mac posted a fourth-quarter net loss of $3.3 billion and will request $312 million from the Treasury after recent tax reform legislation forced it to write down the value of deferred tax assets.

February 15 -

Tax reform caused Fannie Mae to burn through retained earnings that had been approved just two months ago and to post a fourth-quarter loss. CEO Timothy Mayopoulos argued it was a one-time event that overshadowed strong fundamentals.

February 14 -

Fannie Mae will request an infusion of taxpayer money for the first time since 2012 because of an unintended but anticipated side effect of the corporate tax cut signed into law in December.

February 14 -

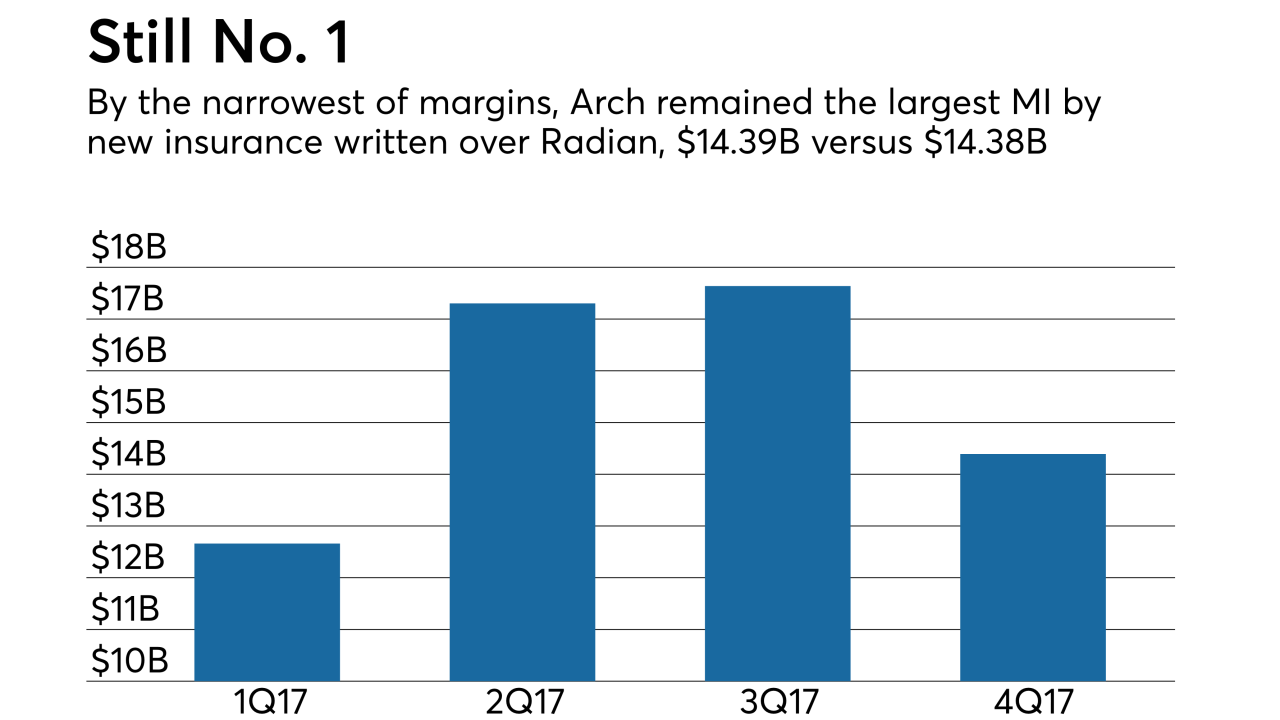

Arch Capital Group's mortgage insurance subsidiary increased its cushion under the secondary market capital standards in the fourth quarter even as its delinquent inventory grew.

February 13 -

Ellie Mae's fourth-quarter and full-year revenue increased over the corresponding prior periods following its acquisition of Velocify.

February 9 -

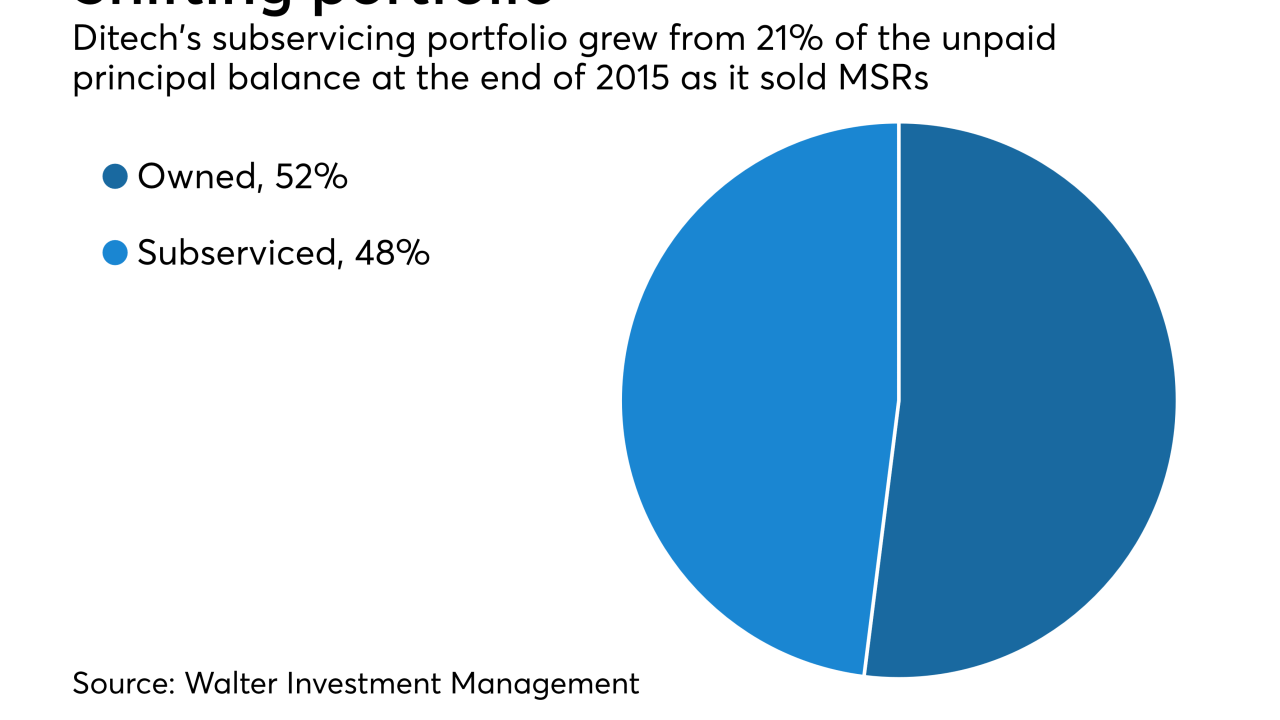

Anthony Renzi, the former Freddie Mac executive brought in to try and right the ship at Walter Investment Management Corp., will be leaving the company once a replacement is found.

February 2 -

The changes to the tax code reduced Radian Group's fourth-quarter net income as the company took an incremental provision of $102.6 million.

February 1 -

Walter Investment Management Corp. pushed back the date it would emerge from bankruptcy to no earlier than Feb. 2 from the originally planned Jan. 31.

January 31 -

The company, which has been actively curbing growth to avoid becoming a systemically important financial institution, reported lower loan balances and reduced fee income after exiting the residential wholesale mortgage business.

January 31 -

The strong housing economy in 2017 led to an increase in premiums earned and lower claims costs for Old Republic International's title insurance business.

January 25 -

Net interest income has surged thanks to rising rates, but noninterest income has lagged as trading revenue has weakened, refi demand has softened and fees from deposit service charges have barely budged. Is this the new normal?

January 24 -

The Oregon company's commercial and consumer lending grew even though fee income declined sharply.

January 23 -

Flagstar Bancorp swung to a fourth-quarter loss as the company took an $80 million noncash charge to earnings because of the tax reform bill.

January 23