-

Noninterest income at the Minneapolis-based company jumped more than 10% during the third quarter, while asset quality improved and expenses held steady. "Our focus is very much on organic growth," said CEO Gunjan Kedia.

October 16 -

CEO Bill Demchak said there seemed to be "some confusion," after PNC's stock fell some 4% on Wednesday.

October 15 -

The Federal Deposit Insurance Corp.'s Q3 Quarterly Banking Profile report highlighted net bank income falling 8.6%, but also showed slow delinquency growth in commercial real estate and core income metrics improving across the banking sector.

December 12 -

The Consumer Financial Protection Bureau will take a bite out of bank profits in 2024 by issuing final rules on overdraft and credit card late fees, among other major rulemakings.

December 27 -

The Consumer Financial Protection Bureau found that more consumers are being charged late fees, while determining that the average cardholder carried $5,288 in total credit card debt last year.

October 25 -

Consumer Financial Protection Bureau Director Rohit Chopra said the CFPB is enforcing a long-dormant provision of Dodd-Frank in its advisory opinion prohibiting banks from charging fees to obtain basic account information.

October 11 -

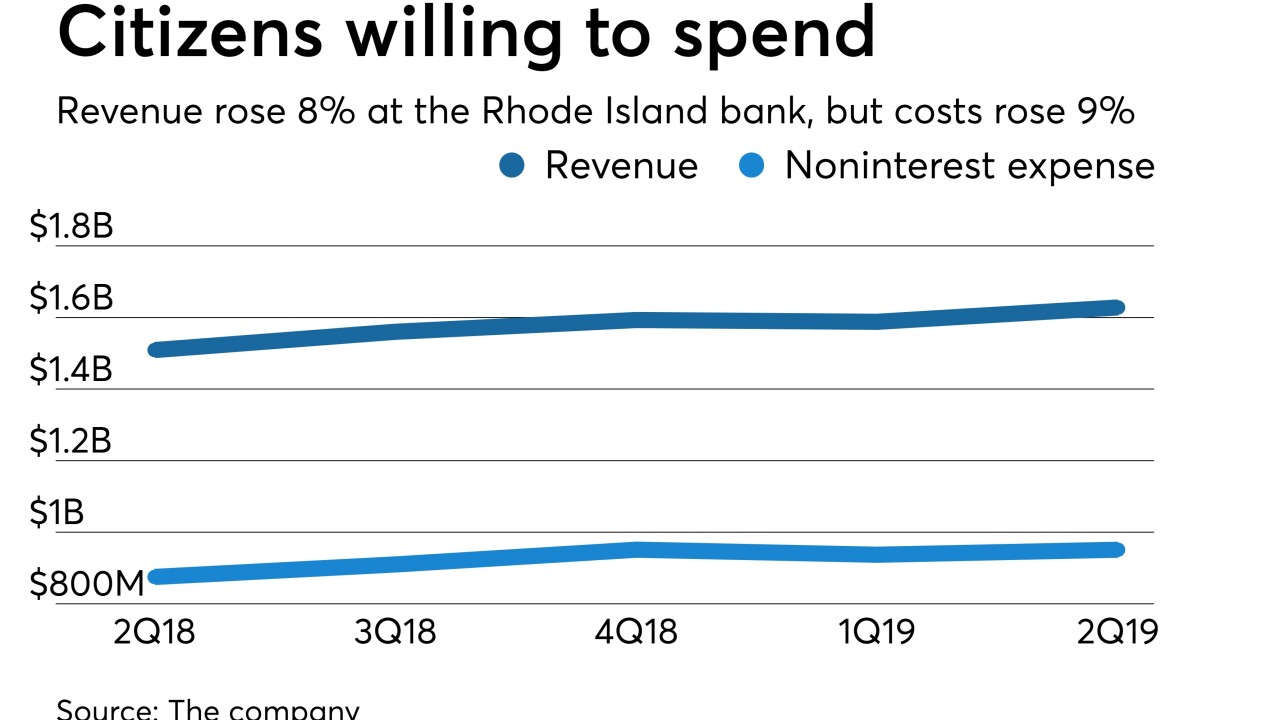

The Rhode Island bank endured a sharp decline in fee income from home loans, which had spiked earlier in the pandemic. But CEO Bruce Van Saun says the company is well positioned as the refinancing boom fades and the home purchase market becomes more important.

July 20 -

Acquiring AmeriHome would provide the fee revenue the Phoenix company seeks to compensate for low interest rates and tepid commercial loan demand. The deal also would allow it to reinvest billions of dollars of excess liquidity.

February 17 -

Amerant Mortgage includes several former bankers from City National Bank of Florida in Miami.

January 26 -

Noninterest income has bolstered profits this year. But its growth is expected to slow over the next two years, making for a gloomy earnings outlook unless vaccine distributions and the economic recovery are relatively swift.

December 17 -

Strong mortgage and capital markets activity helped offset credit costs and one-time items in the third quarter at Citizens Financial Group. In a period of low rates, CEO Bruce Van Saun says he’d like to buy more fee-generating businesses.

October 16 -

Bankers say they understand the need for an extraordinary government response to the coronavirus outbreak, but worry that even slashing interest rates won’t stimulate demand.

March 16 -

Count Citizens Financial’s Bruce Van Saun among those who think interest rate cuts could halt by mid-2020. The key, he says, is to focus on delivering services customers are willing to pay fees for and to skillfully reprice deposits until then.

October 18 -

The Minneapolis company attributed the uptick to new tech tools, additional loan officers and other process improvements — not to mention the refi boom fueled by lower rates. It’s a formula other banks are expected to copy.

October 16 -

The Minneapolis bank says recent investments in its retail operation contributed to strong improvement in home lending and mortgage banking fees.

October 16 -

Weighing in on interest rate and other uncertainties facing all banks, Citizens Financial CEO Bruce Van Saun emphasized investments in point of sale, digital banking and other initiatives meant to enhance revenue down the road.

July 21 -

The Minneapolis bank reported growth across several lending and noninterest income categories in the second quarter, which offset net interest margin pressures and declining deposit service fees.

July 17 -

The Minneapolis bank reported mid- to high-single-digit improvement in those categories, but total loan growth was curbed by declines in CRE and other credit types.

April 17 -

The Ohio company agreed to buy TransCounty Title Agency, which has five offices around Columbus.

September 4 -

Net interest income has surged thanks to rising rates, but noninterest income has lagged as trading revenue has weakened, refi demand has softened and fees from deposit service charges have barely budged. Is this the new normal?

January 24