Earnings

Earnings

-

The parent company of Newrez saw mortgage segment profits of over $200 million and the successful close of its merger with Specialized Loan Servicing in the second quarter.

July 31 -

The company earned about the same in the second quarter but less versus the prior period as it added to credit reserves due to loan acquisition activities and higher mortgage rates.

July 31 -

The Hammond, Louisiana, company, which announced changes to its business strategy, cut 71 jobs and reduced its dividend to 8 cents per share.

July 30 -

Election speculation about policy change at Fannie Mae has boosted its stock slightly this year. It's also profitable, but there's much more to consider.

July 30 -

The second quarter for the subsidiary of Waterstone Financial posted its highest net income since the same period in 2022, while its volume was the most in seven quarters.

July 26 -

First Foundation in Dallas recently got a $228 million capital injection led by Fortress Investment Group. Now it's announced plans to pivot away from its heavy focus on multifamily loans, which lost value as interest rates rose.

July 26 -

Third-party origination operations are also going to Mr. Cooper in the $1.4 billion deal, in which the seller cited interest in improving its capital position.

July 25 -

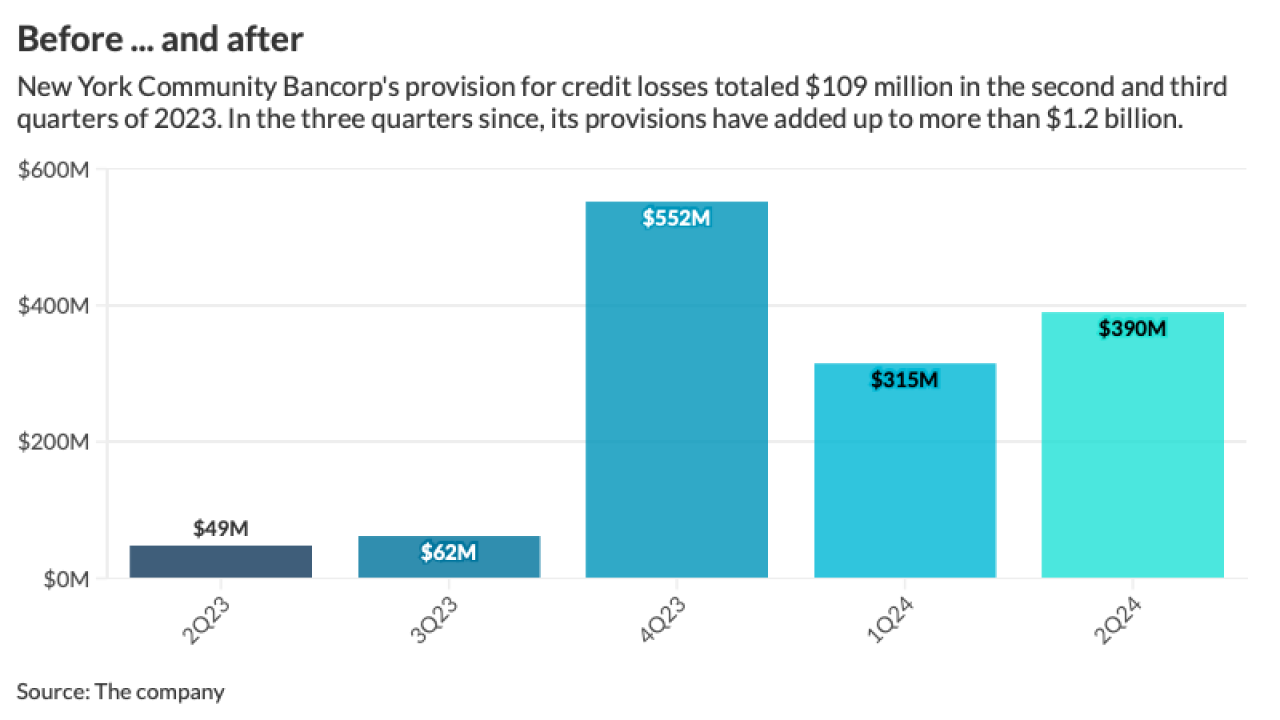

The parent company of Flagstar Bank reported a net loss of $323 million for the second quarter after boosting loan-loss provisions and recording a steep increase in net charge-offs. Still, it says it's making progress on a turnaround plan, including by agreeing to the sale of its mortgage servicing business.

July 25 -

Government data reports from June, though, point to an inauspicious start for new construction in the current quarter.

July 24 -

ACNB is acquiring Traditions Bancorp in an in-market deal where the latter's mortgage ops will add to its insurance and wealth management units.

July 24 -

Sluggish gain-on-sale margins however were the result of competitive pricing in the market, the company said.

July 23 -

When the superregional bank sold its insurance business for $10.1 billion, it laid out three ways to use the proceeds: buybacks, a balance sheet repositioning and loan growth. The latter plan is so far proving to be elusive.

July 22 -

Bank OZK is the latest commercial real estate-heavy bank to announce plans to diversify its business. CEO George Gleason emphasized that he's confident in the bank's loan portfolio, but said he thinks misperceptions are dragging down the stock price.

July 22 -

The Dallas-based company, whose earnings per share fell short of consensus by 6 cents, lowered its revenue forecast and raised its expense outlook. Its stock price fell more than 8% on Thursday.

July 18 -

The Cleveland-based regional bank continues to benefit from strength in investment banking, though concerns about stalled loan growth emerged as CEO Chris Gorman described demand as tepid.

July 18 -

For at least the fifth consecutive quarter, the Providence, Rhode Island, company increased its allowance for credit losses on general office loans, which continue to be a problem area for banks.

July 17 -

The Charlotte, North Carolina-based bank saw profits and net interest income dip in the second quarter, but made up lost revenue through investment banking fees.

July 16 -

The Pittsburgh-based superregional bank reported a small quarter-over-quarter advance in net interest income, and it expects loan growth to pick up in the second half of the year. PNC, which announced job cuts last year, also said that it has identified an additional $25 million in cost savings.

July 16 -

Second quarter margins at the three big banks were lower versus three months' prior, missing Keefe, Bruyette & Woods expectations of a flat comparison.

July 12 -

Two days after the megabank was hit with $136 million of fines, Citi executives said they aren't changing the company's full-year expense guidance. Citi has 30 days to submit a plan to regulators showing that the bank has allocated enough resources to achieve compliance in a timely and sustainable manner.

July 12