-

The reverse mortgage companies squeezed thousands of dollars out of aging homeowners through various illegal fees, according to a new class action suit.

January 30 -

The Department of Housing and Urban Development is selling more due-and-payable HECMs on homes that are occupied while reviewing the loan program.

January 7 -

Finance of America is buying Onity's MSRs and loan pipeline in this niche as PHH retains its role as a subservicer and remains involved in buyout securitization.

November 20 -

Home price modeling changes hurt FOA's third-quarter interim results but it was in the black between January and September on a continuing operations basis.

November 4 -

The former American Fidelity Financial Services LO helped others scam homeowners out of their loan proceeds for shoddy or nonexistent home repairs.

October 17 -

One loan sale is planned for Wednesday, while the other is tentatively happening in September. All-in-all, the two offerings are worth close to $1 billion.

August 6 -

Prior to the earnings release, Finance of America announced it was buying out Blackstone's equity stake in the mortgage lender for $80 million.

August 5 -

Proprietary reverse loans are typically available to a larger range of borrowers and come with higher loan limits than the Home Equity Conversion Mortgage.

May 30 -

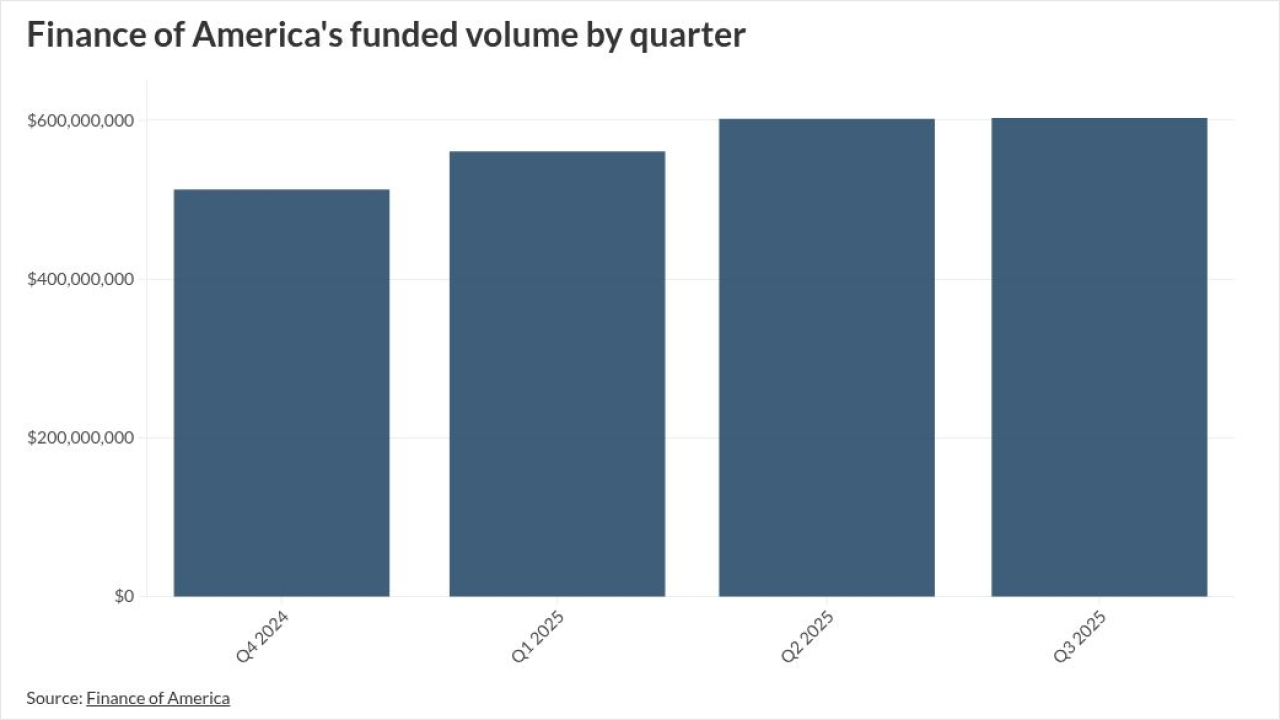

Much of the increase came from the wholesale channel, where margins were thinner, leaving them flat on for the origination unit on a sequential quarter basis.

May 6 -

Longbridge Financial's Christopher Mayer discusses the mortgage industry's opportunities in today's market and its shortcomings when serving older Americans.

April 29 -

The bank said it will appeal the judge's ruling, which it suggested would have a chilling effect on lenders participating in such government programs.

April 3 -

The company is a leading player in the primary and secondary markets for government-backed reverse mortgages and also has been developing proprietary products.

March 11 -

A year that saw businesses express growing interest in the segment ended with a more subdued outlook due to interest rate trends, according to a new report.

January 3 -

The company plans to increase investments in its proprietary products as well as marketing initiatives with expectations of originations growth next year.

November 6 -

Longbridge asserts its rival is unfairly funneling business via a number of websites containing fake reviews allegedly run by Mutual of Omaha itself.

September 30 -

James B. Nutter & Co., after its legal victory over the Justice Department in July, agreed to a $2.4 million False Claims Act settlement over poorly underwritten reverse mortgages.

September 24 -

The CFPB changed how reverse mortgage lenders can appeal to older Americans. Their value is now pitched mainly through direct education, rather than through Tom Selleck.

September 9 -

Guild Mortgage is now referring to its reverse loan offerings, including FHA and private-label jumbo, as Flexible Payment Mortgages.

September 6 -

A summary judgment from a Missouri district court denied the government from seeking federal damages for violations of the False Claims Act following alleged underwriting misconduct by the lender.

July 11 -

The agency is looking to improve liquidity for its reverse mortgage-backed securities issuers who have to buy back loans.

June 28