-

Just as the Trump administration appears focused on releasing a framework without Congress, the Senate Banking Committee has re-entered the policy fray with a new proposal.

February 1 -

Nonbank mortgage companies cut payrolls by 3,100 full-time employees in December, bringing the level of the hiring in the industry to its lowest point in more than two years.

February 1 -

The Senate Banking Committee chairman released an outline for overhauling the U.S. housing finance system more than 10 years after the government put Fannie Mae and Freddie Mac into conservatorship.

February 1 -

Affordability remains a challenge for homebuyers, but barely any mortgage lenders attribute last year's sluggish home sales to insufficient consumer income or lack of loan products for new buyers, according to Fannie Mae.

January 31 -

The agency's acting director said he welcomes lawmakers' “insight and perspective” on how to end the conservatorships of Fannie Mae and Freddie Mac.

January 30 -

A White House spokeswoman said the administration wants to work with Congress on a housing finance reform plan, providing evidence that changes might not be imminent.

January 29 -

Fixing the housing finance system is "the last piece of unaddressed business from the financial crisis," according to a summary of to-do items released by the Banking Committee's chairman.

January 29 -

As 30-year fixed-rate mortgages rose 30 basis points year-over-year, non-QM originations are estimated to grow 400% in 2019.

January 28 -

The acting head of the Federal Housing Finance Agency has promised substantial changes for Fannie Mae and Freddie Mac, but the exact mechanics and timeline of an administration plan are still a mystery.

January 28 -

Recent comments attributed to the acting head of the Federal Housing Finance Agency (who is also comptroller of the currency) have stoked speculation about the Trump administration’s housing finance policy.

January 25 -

While Fannie Mae's multifamily origination volume took a step back from 2017's record high of $67 billion, its delegated underwriting and servicing program provided $65 billion in financing in 2018, led by Wells Fargo.

January 25 -

Rising mortgage rates will only be "a mild deterrent" to home purchase activity during 2019 as other indicators like price and demand will cancel that out, according to Standard & Poor's.

January 23 -

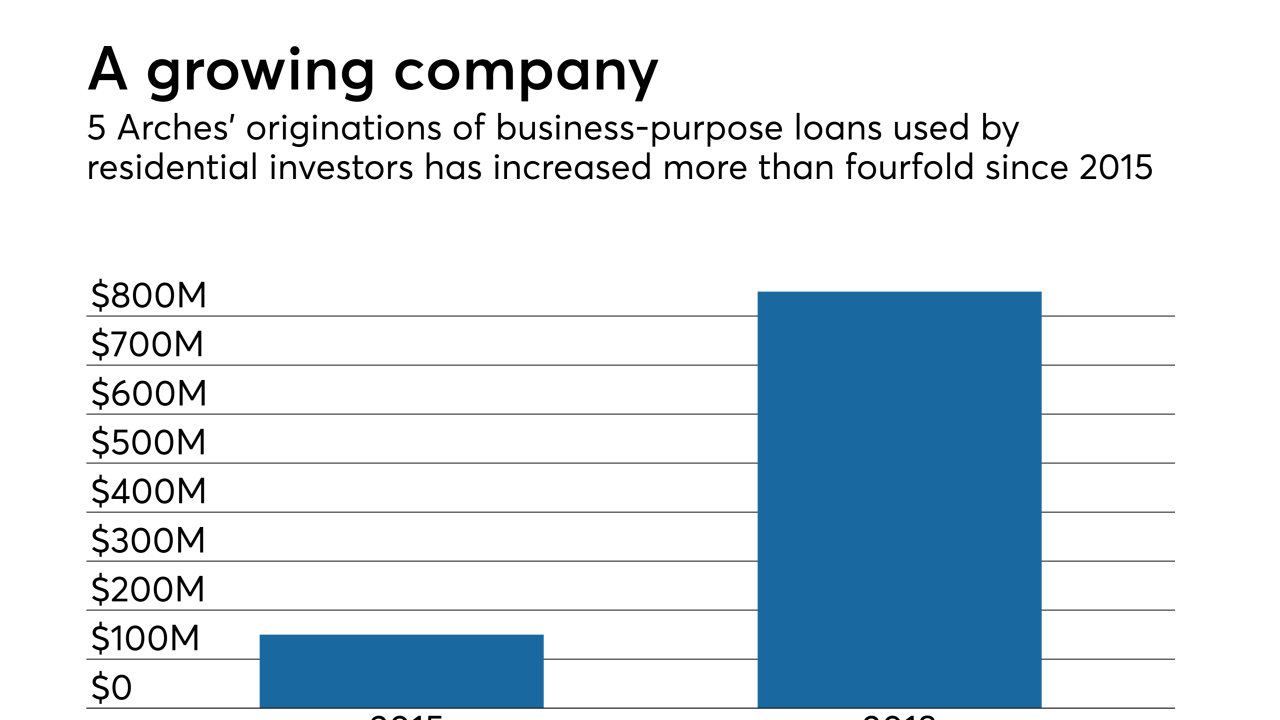

Redwood Trust has exercised its option to expand its minority stake in 5 Arches to 100%, increasing Redwood's exposure to loans used for house flipping and other types of residential investment.

January 23 -

Timothy Mayopoulos is back in the mortgage industry, becoming the new president of the digital mortgage technology developer Blend, months after leaving his post as Fannie Mae’s CEO.

January 22 -

Slower growth to interest rates and home prices will boost housing affordability in 2019, according to Fannie Mae.

January 22 -

Fannie Mae and Freddie Mac shares soared Friday amid fresh reports that the Trump administration is working on proposal that would recommend freeing the mortgage-finance giants from government control.

January 18 -

The Milken Institute's plan to address the housing finance system proposes a number of measures that could be carried out by regulators, after years of stalled legislative attempts.

January 17 -

Fannie Mae and Freddie Mac are adding another round of new underwriting requirements and a workaround for employment verification in response to the prolonged government shutdown.

January 17 -

A federal appeals court ruling that found the leadership structure of the FHFA unconstitutional will face an "en banc" review later this month.

January 16 -

Residential lender and Warburg Pincus portfolio company Newfi Lending is helping tackle upfront costs for homebuyers with the launch of its 2-1 Buydown Program.

January 10