A significant percentage of consumers are willing to turn to technology companies for their financial needs, including applying for a mortgage, although they have trust issues with them, a Fannie Mae report said.

"These new entrants are looking to

"Given the digital and customer experience prowess and resources of big tech firms, they may be especially well-situated to compete against traditional financial institutions."

Less than half of those surveyed were very likely to recommend their primary bank or financial institution to others. Most people keep using their bank due to convenience and trust; however, few stay because of speed, rates or the online interface.

But trust is an issue those surveyed had with their favorite technology company. Nearly seven in 10 trusted their primary bank with their money, but just 3% trusted a tech company, primarily because of

"Big tech firms

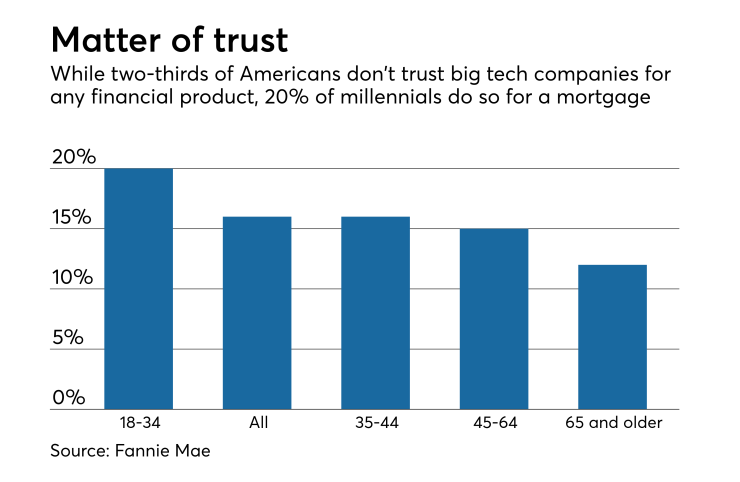

Only 16% of all respondents, but 20% of those between 18 and 34, trust their favorite technology company to handle their mortgage activities, the Fannie Mae third-quarter National Housing Survey found. For respondents between 35 and 44 it falls to 16%, between 45 and 64 to 15%, and 65 and older to 12%.

Google was cited by 29% of the respondents as their favorite technology company, followed by Amazon at 16%, Apple at 12% and Facebook at 11%.

But 21% of those with incomes over $100,000 would trust a technology company for their mortgage activities, while 25% of Asian-Americans respondents would.

Renters gave an 18% positive response versus just 15% for current homeowners.

Meanwhile, 79% of all respondents, but 81% of renters and 77% of current homeowners, prefer to talk with a live person when applying for a mortgage, echoing results of other surveys.