-

The Federal Housing Finance Agency is suspending its ongoing review of new credit scoring models and will instead move forward with creating a regulatory framework for providers of alternative credit scores to apply and be evaluated for use by Fannie Mae and Freddie Mac.

July 23 -

The fees that Fannie Mae and Freddie Mac charge for low down payment mortgages disproportionately reflect their risk exposure and make homeownership more difficult for underserved borrowers.

July 23 Milken Institute Center for Financial Markets

Milken Institute Center for Financial Markets -

As purchase mortgages continue to dominate overall industry volume, lenders aren't letting the extra work required to close these loans affect their productivity.

July 18 -

Rising median home prices and tight housing inventory led purchase and overall mortgage application volume to fall although refinances rose.

July 18 -

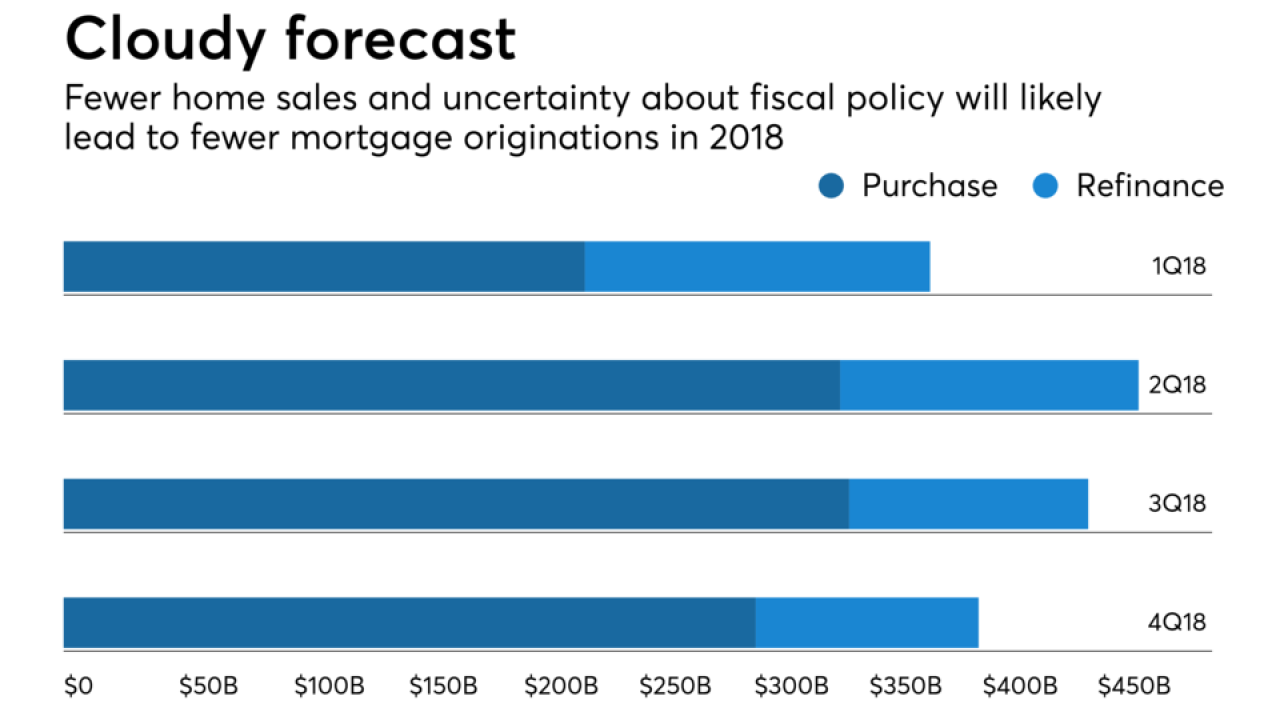

Fewer sales of existing homes and uncertainty around future fiscal policies will result in fewer mortgage originations than previously expected, according to Fannie Mae.

July 17 - Finance and investment-related court cases

With ruling in GSE case, the two agencies are emerging as the test subjects for a legal showdown over their authority.

July 17 -

A federal appeals court in Texas agreed with Fannie Mae and Freddie Mac shareholders that the FHFA, led by a single director, violates the separation of powers.

July 17 -

The collateral includes both QM and non-QM loans; however, certain loans are designated as QM even though the borrower’s DTI may be above 43%, due to a temporary exemption for GSE-eligible loans.

July 13 -

Fannie Mae and Freddie Mac may need to tap into U.S. Treasury funds when they adopt CECL, a new accounting rule that makes companies set aside money upfront for expected loan losses.

July 12 -

A Fannie Mae test to handle the private mortgage insurance process for lenders may raise concerns that it's going outside the scope of its secondary market mission. But the effort reflects its mandate to explore new credit-risk transfer alternatives, a company executive said.

July 10 -

Slight declines in consumer expectations for more favorable future job security, income and interest rates knocked Fannie Mae's Home Purchase Sentiment back down from a record high in June.

July 9 -

With better-than-expected performance of the underlying mortgages, Fitch Ratings cut its loss projections for seasoned government-sponsored enterprise credit risk transfer deals.

July 3 -

Fannie Mae and Freddie Mac enjoy considerable advantages because of their lower cost of capital and significant government subsidies. But with some conforming loans, the private market is finding a way to compete.

July 3 -

Fannie Mae and Freddie Mac are making condominium loans eligible for automated appraisal waivers that could reduce mortgage borrowers' fees and shorten closing times for lenders.

June 28 -

Instead of shrinking the GSEs, the housing regulator is letting them expand into a host of new products and programs.

June 28 American Enterprise Institute

American Enterprise Institute -

The Trump administration's plan to end the conservatorship of Fannie Mae and Freddie Mac marked its first effort to solve a problem left over from the financial crisis, but ultimately raised more questions than it answered.

June 27 -

Meet the new housing finance reform plan, same as the old ones. While that gives it legs, it also presents big challenges.

June 25IntraFi Network -

The plan would end the GSE conservatorships and create an explicit federal guarantee, but it's unclear if even other parts of the Trump administration support it.

June 21 -

Incenter Mortgage Advisors is facilitating the sale of more than $10 billion in mortgage servicing rights tied to Fannie Mae and Freddie Mac loans originated by mortgage brokers.

June 21 -

Paycheck information gleaned from bank accounts is emerging as an alternative to verifying a mortgage applicant's income and employment with a 4506-T tax transcript request to the IRS.

June 20