-

Shaw, which was part of last year's standstill agreement with Third Point, said it will support shareholder-driven change on Costar's board.

February 4 -

Shore Capital Partners, a Chicago-based private equity firm founded by billionaire Justin Ishbia, has raised more than $400 million for its second industrial fund.

February 4 -

Despite a weak ADP jobs print, Treasury yields went nowhere, reinforcing a growing bearish, defensive case for rates, according to the CEO of IF Securities.

February 4 AD Mortgage and IF Securities

AD Mortgage and IF Securities -

Pulte says a GSE stock offering remains likely in 2026, but other policy paths are in play. NMN survey data shows the industry expects broader changes first.

February 4 -

WomenVenture, a Minneapolis-based Community Development Financial Institution, was already under strain from stalled federal CDFI funding. The recent immigration crackdown added significant uncertainty for its customers as well.

February 4 -

Federal Reserve Gov. Stephen Miran, who had been on a leave of absence from his position as Chair of the White House Council of Economic Advisers since he was confirmed to the central bank in September, resigned his CEA role Tuesday to uphold his promise to resign his White House role if he remained past the expiration of his term, which concluded Jan. 31.

February 3 -

Property inspection waivers were granted on 40.2% of the underlying mortgages, reflecting an increasing trend of agency mortgages being originated without them.

February 3 -

Less than 45% of mortgage residential properties in the United States were equity-rich last quarter, a 1.5-percentage-point drop from the third quarter.

February 3 -

The partial US government shutdown is on track to end later Tuesday after the House passed a funding deal President Donald Trump negotiated with Senate Democrats, overcoming opposition from both ends of the political spectrum.

February 3 -

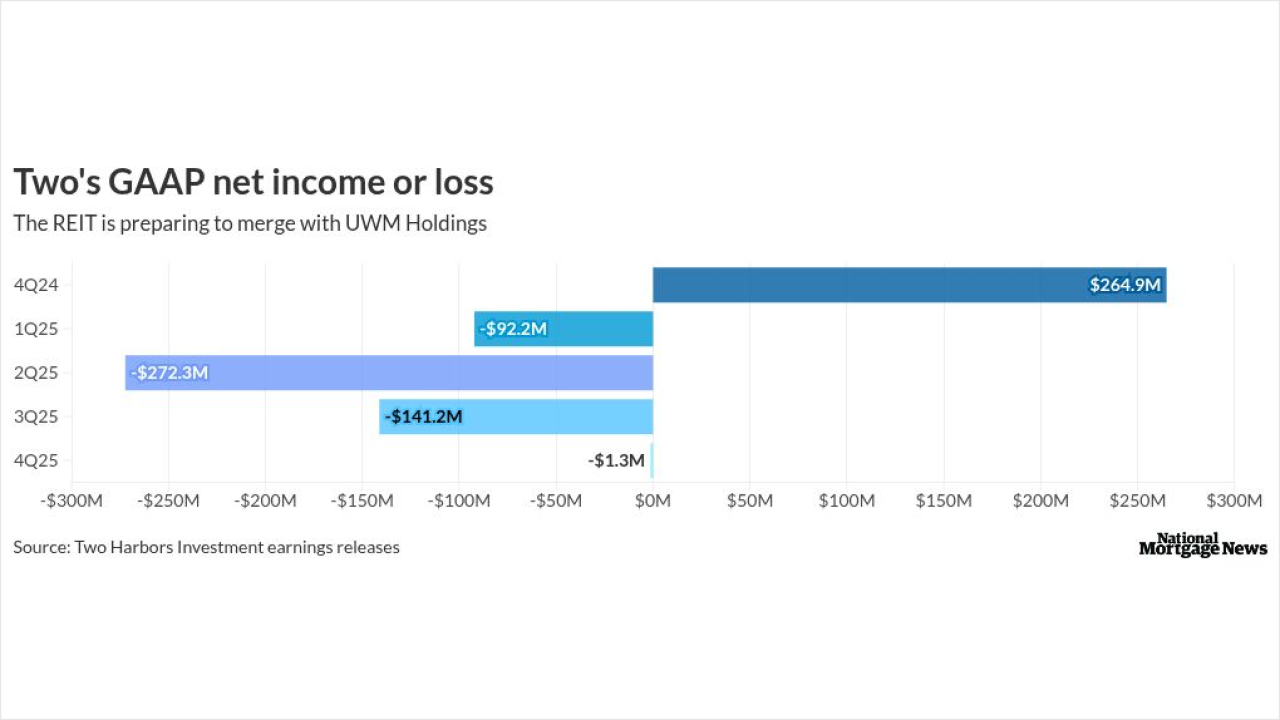

As measured by earnings available for distribution at the REIT, Two posted a profit of $0.26 per share but this was well below the consensus estimate of $0.37.

February 3