-

Growth in conventional originations at U.S. banks came with the unexpectedly rapid rise of 30-year fixed interest rates in 2022, Federal Reserve researchers found.

July 9 -

JPMorgan Chase & Co. plans to sell credit risk on a $531 million portfolio of adjustable-rate mortgages, a new kind of offering by the bank and the latest example of the industry's efforts to de-risk balance sheets.

August 15 -

At current levels, monthly payments could surge by 39% between 2023 and 2025 for an approximately $250,000 loan, according to new research.

March 11 -

The loans accounted for 18.6% of conventional single-family dollar volume in April, quadrupling its share of business at the peak of the refinance boom, according to Corelogic.

June 29 -

Consumers taking out adjustable-rate mortgages last year put down a median down payment of 23.6%, researchers at the real estate brokerage found.

August 29 -

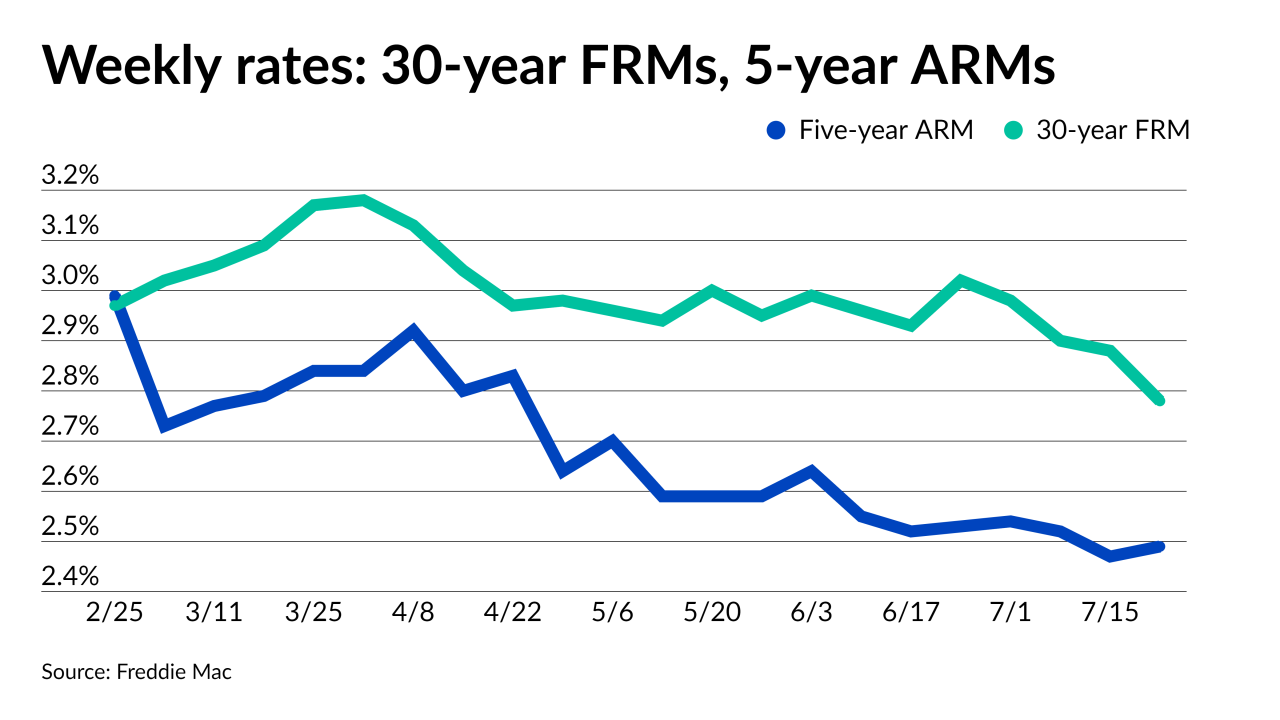

A change in the relationship between fixed and adjustable loans has increased some consumers’ interest in the latter market.

July 28 -

The acquirer will use the liquidation of a residential mortgage company’s assets to move several notches up in the rankings.

July 26 -

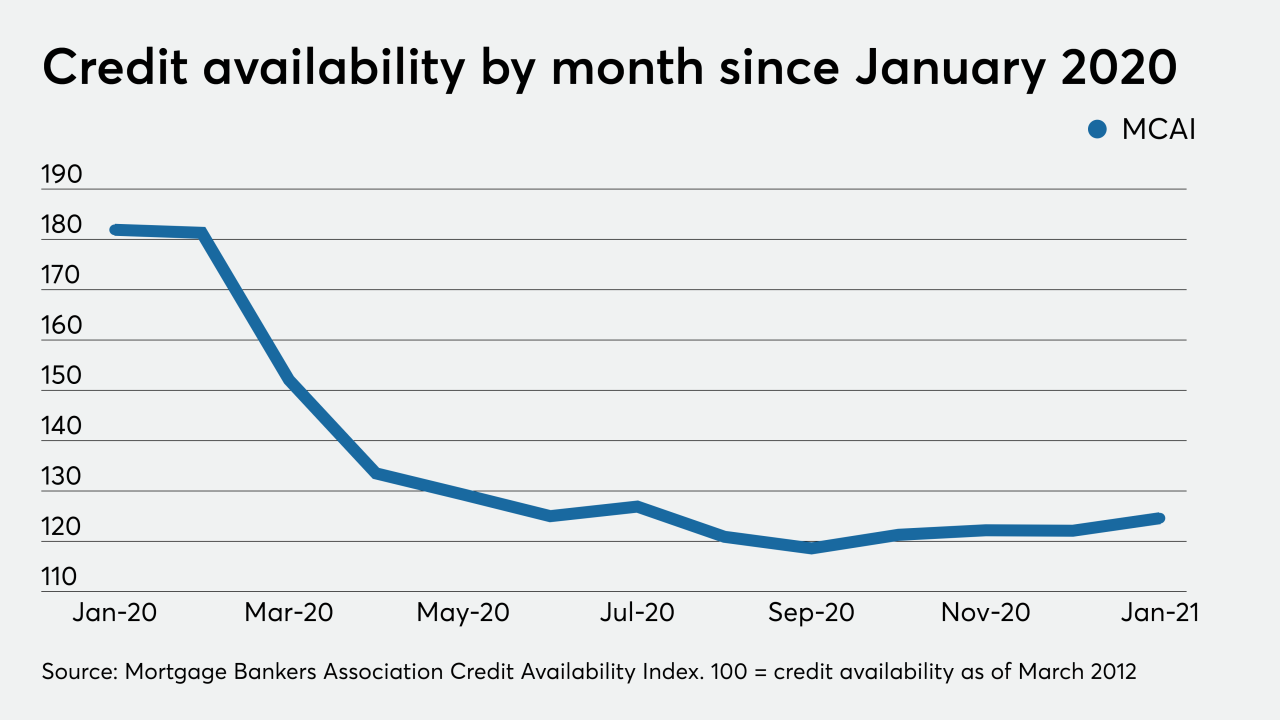

Even though product availability is now at the same point where it was one year ago, it remains at 2014 levels.

June 10 - LIBOR

The modifiable templates are a follow-up to a similar notification the organization created in 2019 for lender use.

April 27 -

The movement in the MBA’s credit availability index suggests that, amid forecasts of diminished refinancing, lenders want to accommodate consumers buying homes, but they aren’t yet ready to lend as freely as they did before the pandemic.

February 9 -

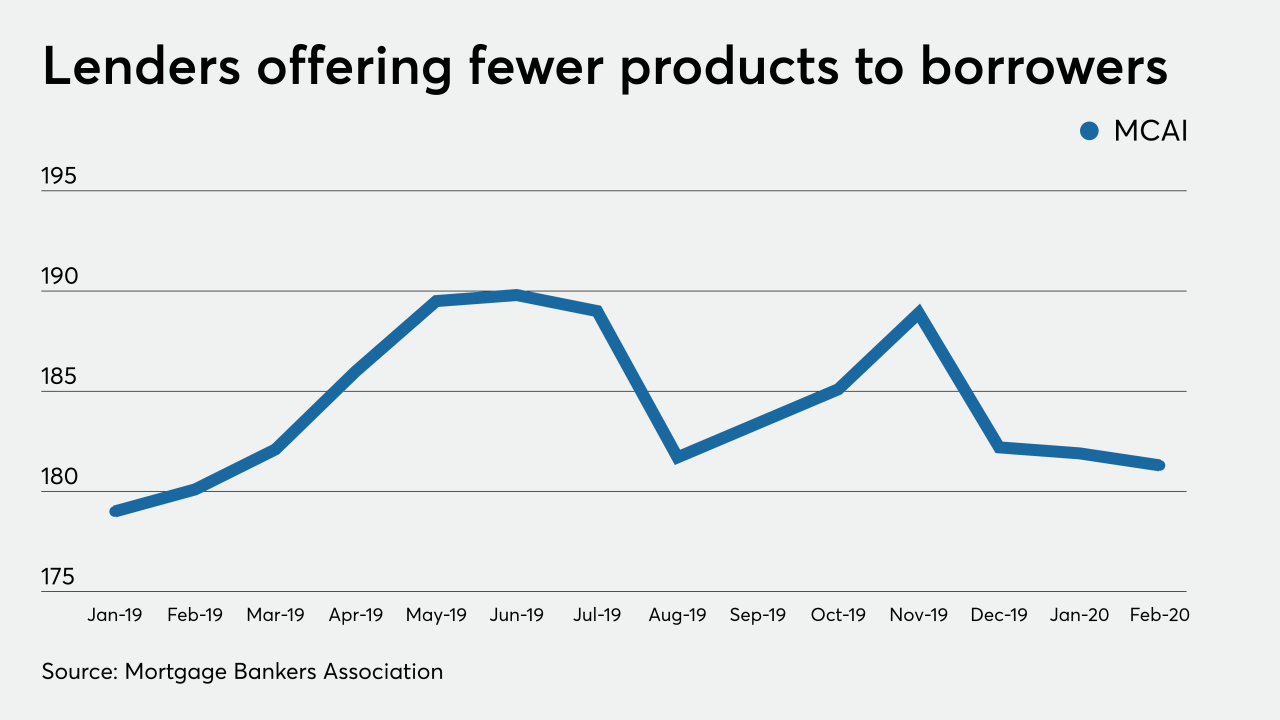

Lenders also increased jumbo product availability as well as rolling out new SOFR-indexed ARMs.

November 16 -

Bondholders could see principal losses if, due to the way the documents are worded, the rate is frozen at the last published amount.

September 18 -

Conditions have improved for the first time since November.

August 6 -

The Consumer Financial Protection Bureau seeks to address challenged posed by the sunset of the London interbank offered rate at the end of 2021.

June 4 -

Fannie Mae and Freddie Mac have different timelines for the switch.

May 28 -

Mortgage credit availability dropped slightly in February, making three consecutive months of tightening, but that streak will likely end with falling interest rates, the Mortgage Bankers Association said.

March 10 -

Mortgage rates fell to their lowest level since October as the financial markets reacted to rising tensions caused by the U.S. government's killing of an Iranian general, Freddie Mac said.

January 9 -

If the first weekly Freddie Mac report of the year is any indication, there could be far less volatility for fixed mortgage rates in 2020 than there was in 2019.

January 2 -

Mortgage application activity rose 1.5% compared with one week earlier as interest rates remained below 4%, according to the Mortgage Bankers Association.

November 27 - LIBOR

Trustees are concerned about obtaining proper consents from legacy residential mortgage-backed securities investors in a timely fashion in order to make the switch from Libor to another index, Fitch Ratings said.

August 21