-

With ongoing affordability issues, the Federal Housing Administration program will keep taking low down payment market share from the private mortgage insurers.

January 9 -

Housing starts in the US fell in October to the lowest level since the onset of the pandemic as data delayed by last fall's government shutdown showed builders continued to cut back amid still-high prices and mortgage rates.

January 9 -

Rochester, New York, and Harrisburg, Pennsylvania, stood atop Realtor.com's list for the second consecutive year, due to their affordability.

January 9 -

President Trump's concept, which is framed as a potential bipartisan effort, could mean a new route to a goal Dems targeted via foreclosure sale restrictions.

January 9 -

The rule, effective July 7, puts into place requirements similar to those for banks, except nonbanks do not have to make community investments or grants.

January 8 -

US President Donald Trump said he was directing the purchase of $200 billion in mortgage bonds, which he cast as his latest effort to bring down housing costs ahead of the November midterm election.

January 8 -

Yields across maturities were higher by less than three basis points after rebounding from session lows.

January 8 -

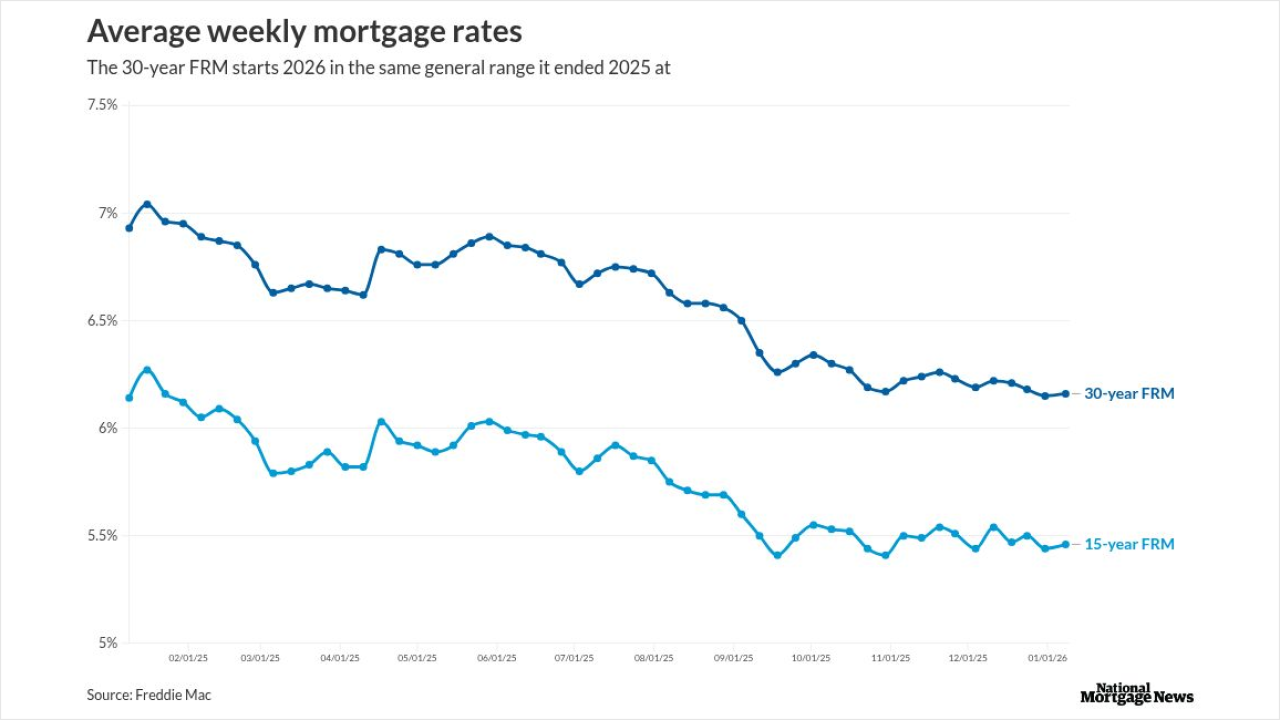

The 30-year fixed remains in its current range, but most expect the rate to reach 6% for 2026, and one observer feels it could actually break under this point.

January 8 -

Across-the-board decreases across all loan types drove the Mortgage Bankers Association's full credit availability index to its lowest in three months.

January 8 -

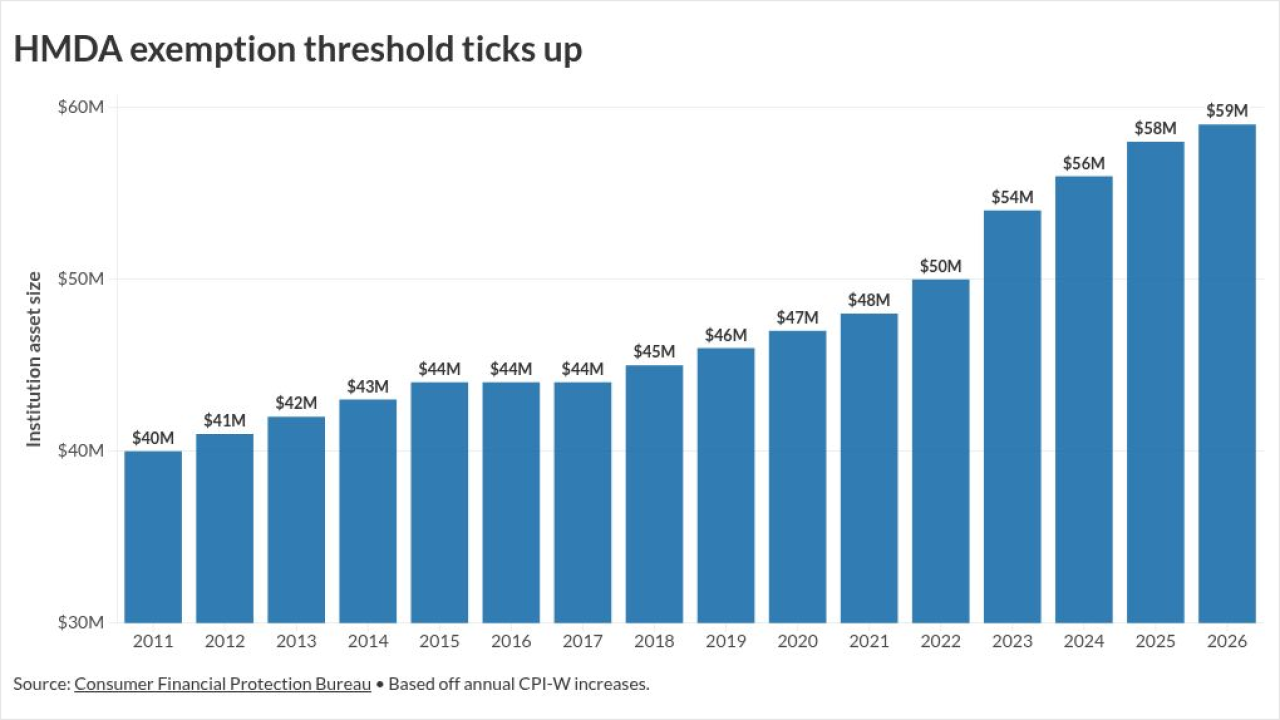

Originators with less than $59 million in assets don't have to share their loan data with CFPB, as the semi-shuttered regulator continues mortgage oversight.

January 8