-

While all six companies were profitable in the third quarter, most had earnings which were down from the prior periods, with MGIC setting a milestone.

November 11 -

Two government-sponsored enterprises are looking into expanding mortgage transfers between borrowers, according to the head of their oversight agency.

November 11 -

Federal Reserve Governor Stephen Miran said emerging stresses in housing and private credit markets warrant a reduction to short-term interest rates. While preferring a 50 basis point cut in December, Miran said he would settle for a 25 basis point reduction.

November 10 -

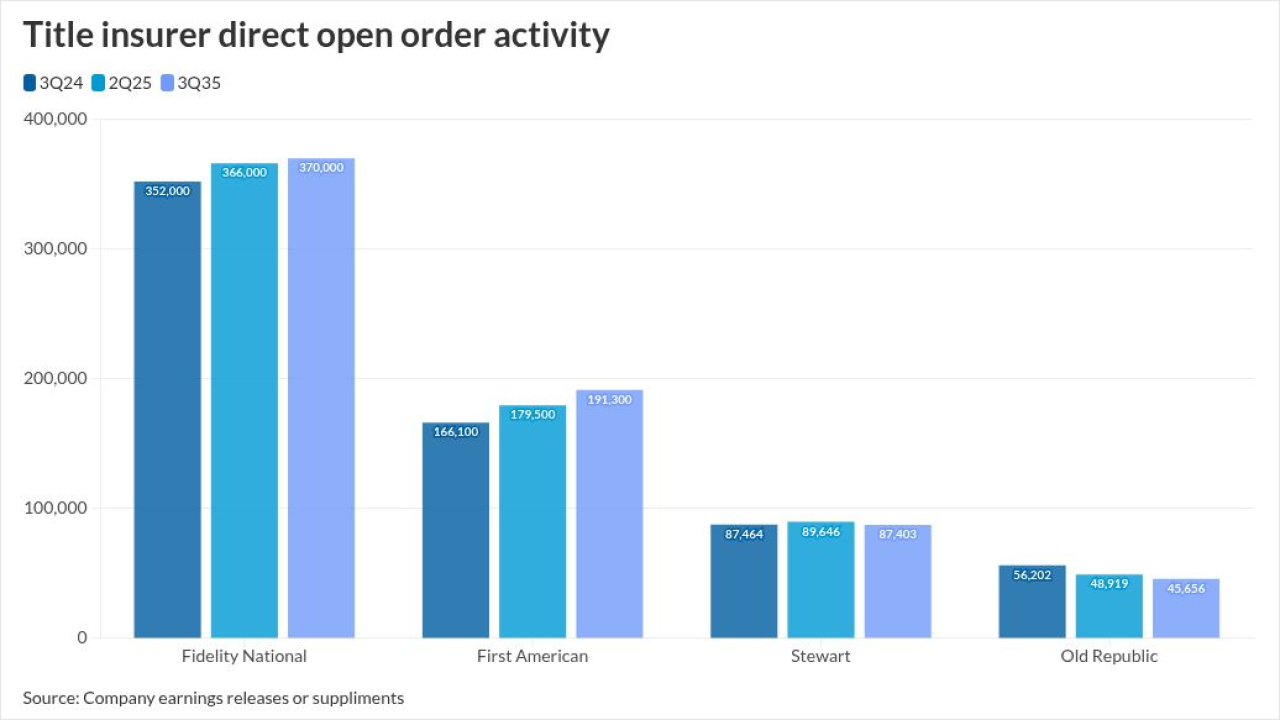

All five publicly traded title insurance companies reported a year-over-year increase in earnings during the third quarter, but only two had higher orders.

November 10 -

President Trump and housing regulator Bill Pulte are considering introducing a 50-year fixed rate mortgage that Fannie Mae and Freddie Mac would purchase.

November 9 -

Company leaders said current strategy sets it up to profit and compete against its rivals as the mortgage market improves in the coming months.

November 6 -

UWM Holdings set a single-day record for rate locks in September at $4.8 billion, taking advantage of the window of opportunity leading up to the FOMC meeting.

November 6 -

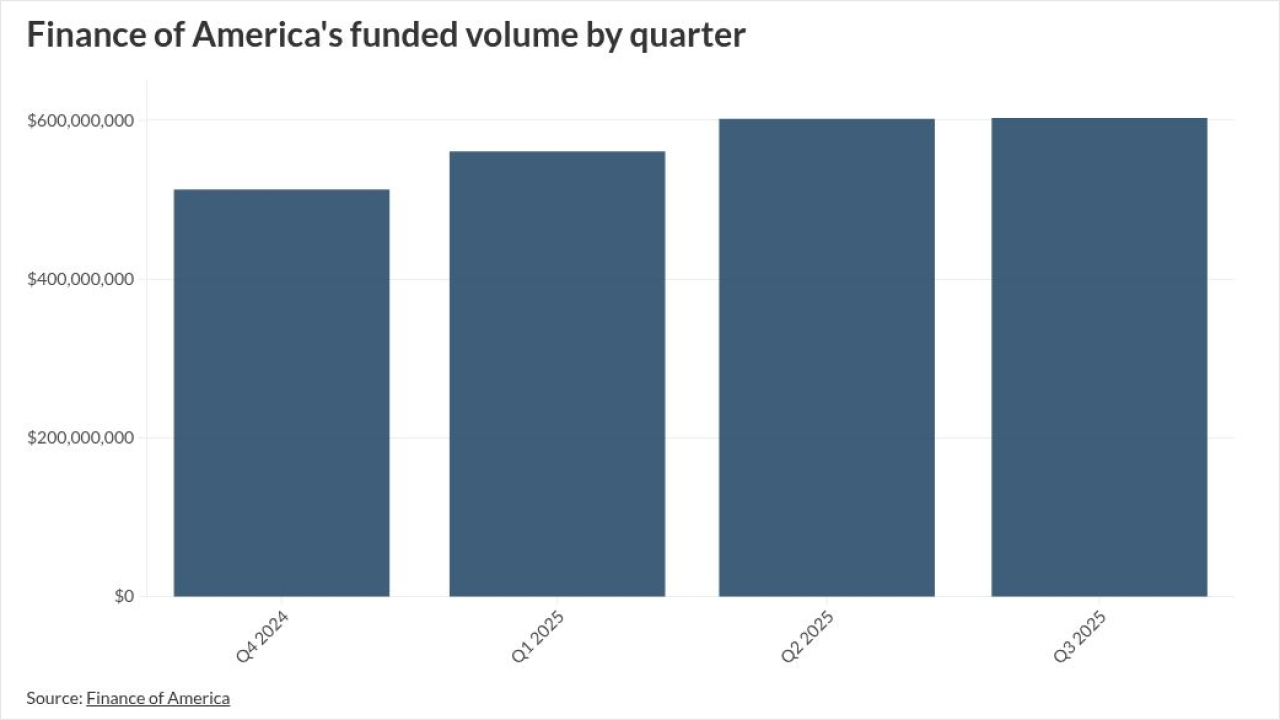

The company posted its best quarter for funded loan volume and shared other green shoots including greater margins on less reverse mortgage business.

November 6 -

The lender reported $33.3 million in net income in the third quarter this year, up from the second quarter and same period a year earlier.

November 5 -

Southern states' government-sponsored enterprise share lags outside of a small number of metros, the Center for Mortgage Access' analysis of HMDA data shows.

November 5 -

Home price modeling changes hurt FOA's third-quarter interim results but it was in the black between January and September on a continuing operations basis.

November 4 -

While FHFA reduced most of the single-family low-income goals, the MBA wants the refinance target for Fannie Mae and Freddie Mac cut as well, its letter said.

November 4 -

Most of the pool of 1,011 residential mortgages, 69.7%, are considered non-prime mortgages, primarily due to the documentation and styles of underwriting.

November 3 -

Now that quantitative tightening is ending, the debate on who should be the MBS buyer of last resort, Fannie Mae and Freddie Mac, or the Fed, is taking hold

November 3 -

In her first public appearance since President Trump moved to fire her from the Federal Reserve Board of Governors, Fed Gov. Lisa Cook reiterated her commitment to bringing inflation under 2% and said that the labor market remains "solid."

November 3 -

Vic Lombardo, new head of mortgage services, has identified growth ideas and new revenue streams for Motto Mortgage and Wemlo, Remax CEO Erik Carlson said.

October 31 -

Zillow Home Loans originated 57% more purchase mortgages versus the third quarter of 2024, with production and segment revenue growth beating estimates.

October 31 -

The head of the government-sponsored enterprise's oversight agency said the cuts were made to positions that weren't central to mortgages and new home sales.

October 30 -

Rocket Companies lost $124 million on a GAAP basis, but its management celebrated milestones regarding its Redfin and Mr. Cooper acquisitions.

October 30 -

The tech giant provided context around Flagstar and Pennymac's moves, as it reported more Encompass and MSP clients and greater mortgage income.

October 30