-

The parent company of Newrez saw mortgage segment profits of over $200 million and the successful close of its merger with Specialized Loan Servicing in the second quarter.

July 31 -

The company earned about the same in the second quarter but less versus the prior period as it added to credit reserves due to loan acquisition activities and higher mortgage rates.

July 31 -

Yields are expected to range from 5.75% on the A1A notes to 6.55% on the M1, all priced on the three-month, interpolated yield curve.

July 31 -

The Hammond, Louisiana, company, which announced changes to its business strategy, cut 71 jobs and reduced its dividend to 8 cents per share.

July 30 -

Nearly all of the business came from home purchases, but reflecting the decline in mortgage volume and a revived Federal Housing Administration offering, fewer people overall used the product.

July 30 -

Election speculation about policy change at Fannie Mae has boosted its stock slightly this year. It's also profitable, but there's much more to consider.

July 30 -

Kroll Bond Ratings Agency offers some preliminary guidance on examining newly available, historical data that may aid stakeholders in a credit score transition.

July 30 -

But the industry-backed proposal differs by $13 million from the House version of the appropriation bill and it is not likely to get resolved until after the November election.

July 29 -

Catch up on the housing and mortgage industry issues pushing to the forefront of the 2024 election — and how each campaign is responding.

July 29 -

The second quarter for the subsidiary of Waterstone Financial posted its highest net income since the same period in 2022, while its volume was the most in seven quarters.

July 26 -

First Foundation in Dallas recently got a $228 million capital injection led by Fortress Investment Group. Now it's announced plans to pivot away from its heavy focus on multifamily loans, which lost value as interest rates rose.

July 26 -

Third-party origination operations are also going to Mr. Cooper in the $1.4 billion deal, in which the seller cited interest in improving its capital position.

July 25 -

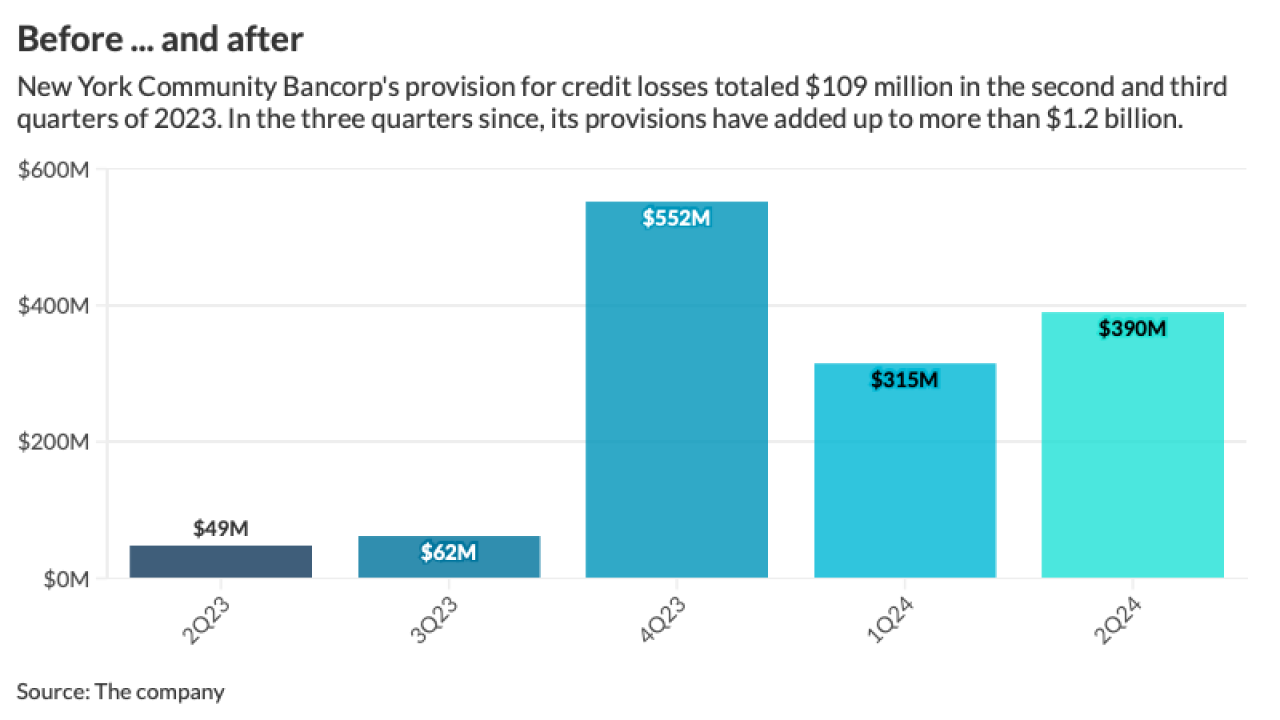

The parent company of Flagstar Bank reported a net loss of $323 million for the second quarter after boosting loan-loss provisions and recording a steep increase in net charge-offs. Still, it says it's making progress on a turnaround plan, including by agreeing to the sale of its mortgage servicing business.

July 25 -

Government data reports from June, though, point to an inauspicious start for new construction in the current quarter.

July 24 -

ACNB is acquiring Traditions Bancorp in an in-market deal where the latter's mortgage ops will add to its insurance and wealth management units.

July 24 -

Climate change is leading to an increase in frequency of catastrophic weather events, causing property damage and issues with homeowners insurance.

July 24 -

Sluggish gain-on-sale margins however were the result of competitive pricing in the market, the company said.

July 23 -

Nearly 56,000 home-purchase agreements were voided in June with the underlying cause likely affordability, a Redfin report claims.

July 23 -

When the superregional bank sold its insurance business for $10.1 billion, it laid out three ways to use the proceeds: buybacks, a balance sheet repositioning and loan growth. The latter plan is so far proving to be elusive.

July 22 -

Bank OZK is the latest commercial real estate-heavy bank to announce plans to diversify its business. CEO George Gleason emphasized that he's confident in the bank's loan portfolio, but said he thinks misperceptions are dragging down the stock price.

July 22