-

JPMorgan Chase is known to eschew selling conforming mortgage loans to Fannie Mae and Freddie Mac, preferring to securitize them in the private-label market.

February 13 -

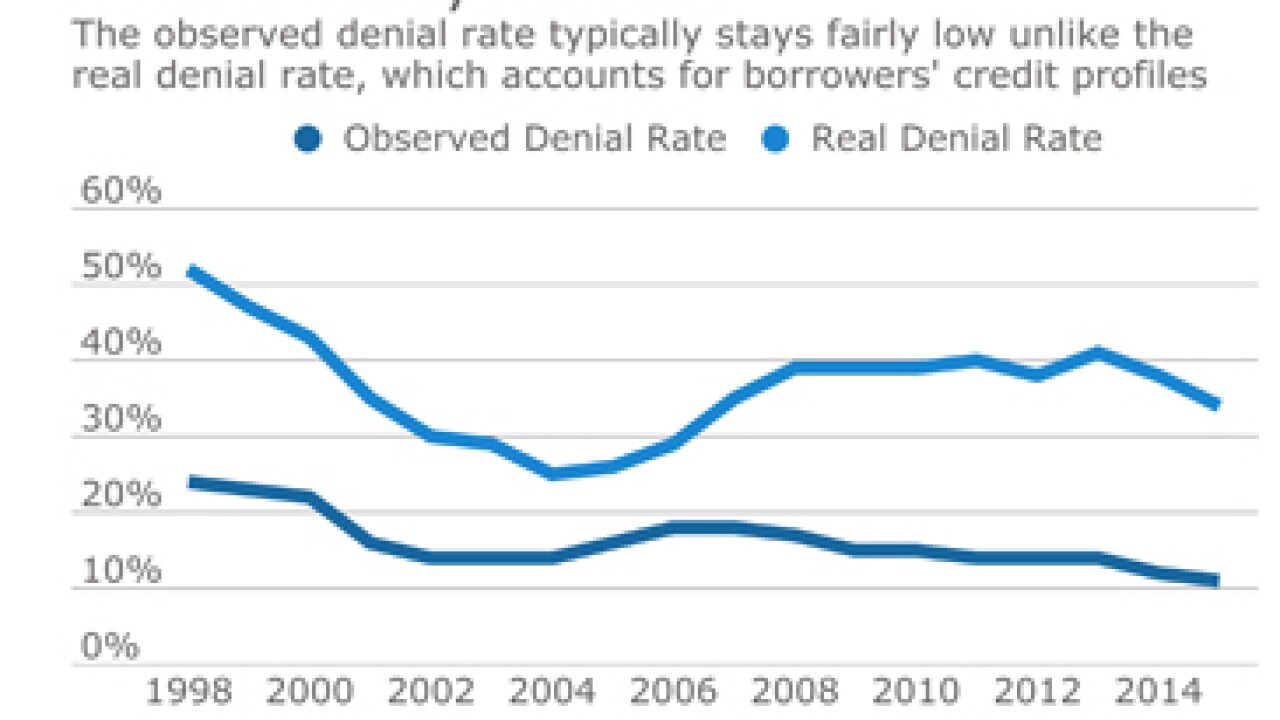

The denial rate traditionally used by the mortgage industry is hiding the fact that fewer borrowers with lower credit are applying for loans, according to the Urban Institute.

February 13 -

While lenders support the intent of a proposal to encourage the growth of private flood insurance, they claim a regulatory proposal doesn't give lenders enough flexibility and remains too complicated.

February 10 -

The rise in home values is good news for homeowners looking to tap the equity in their homes to pay down debt or make big purchases, but some consumer groups fear it could lead to a new wave of loan defaults.

February 9 -

Federal Reserve Bank of St. Louis President James Bullard said the central bank ought not rush to raising interest rates next month because uncertainty over the fiscal policies of the Trump administration clouds the U.S. economic outlook.

February 9 -

Uncertainty about the economy caused mortgage interest rates to stay within a 2-basis-point range for the third straight week, according to Freddie Mac.

February 9 -

The Fannie Mae Home Purchase Sentiment Index rose two percentage points to 82.7 in January, reflecting the more positive consumer outlook following November's presidential election.

February 7 -

Ellie Mae has launched a new version of its Encompass mortgage management product, which features expanded support for construction loans and streamlined integrations with Fannie Mae and Freddie Mac.

February 6 -

The Trump administration was set to release an executive order Friday calling for a review of the Dodd-Frank Act, but the immediate questions about the order focused on what authority the White House has to enact real change.

February 3 -

A federal appeals court ruling has opened the door for litigants to challenge a 2012 decision by the U.S. government to sweep all of Fannie Mae and Freddie Mac's profits into the coffers of the Treasury Department.

February 2 -

Mortgage interest rates held steady after rising last week because of weaker-than-expected gross domestic product numbers, according to Freddie Mac.

February 2 -

Fannie Mae and Freddie Mac have released the final specification update regarding the Uniform Closing Dataset, the digital file format for the TRID Closing Disclosure form.

February 1 -

The federal government needs to recognize Ginnie Mae's importance to the housing industry and divorce its funding and oversight from the Department of Housing and Urban Development.

February 1 Chrysalis Holdings

Chrysalis Holdings -

The Mortgage Bankers Association is trying to jump-start discussions around housing finance reform even as political dysfunction on Capitol Hill is reaching new lows.

January 31 -

Citigroup's decision to exit mortgage servicing by the end of 2018 is part of a long-term strategy to increase returns and sharpen the bank's focus on its core retail customers.

January 31 -

The Mortgage Bankers Association unveiled a new housing finance reform plan on Tuesday designed to kick-start congressional discussions over what to do with Fannie Mae and Freddie Mac.

January 31 -

An explicit government guarantee of Fannie Mae and Freddie Mac is imperative to reform the secondary market, but needs be carefully circumscribed covering only the securities and invoked only after multiple, significant layers of private capital have been exhausted.

January 31 NorthMarq Capital

NorthMarq Capital -

A federal appeals court ruled Monday that the Treasury Department will have to hand over more documents to investors of Fannie Mae and Freddie Mac related to its profit sweep of the two government-sponsored enterprises.

January 30 -

Citigroup's plans to sell a $97 billion mortgage servicing portfolio and subservice its remaining accounts highlights the growing prevalence of nondepository servicers and raises questions about how much capacity exists for these institutions to absorb more large deals.

January 30 -

New Residential Investment Corp. is planning a public offering of more than 49.2 million shares of its stock to pay for its purchase of mortgage servicing rights from CitiMortgage.

January 30