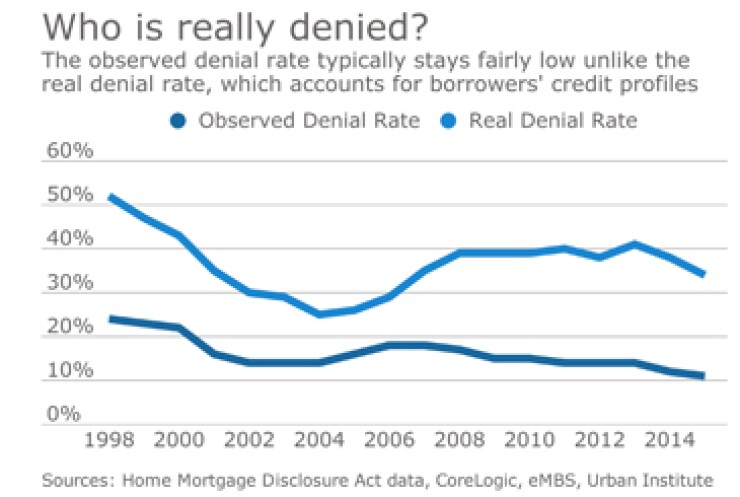

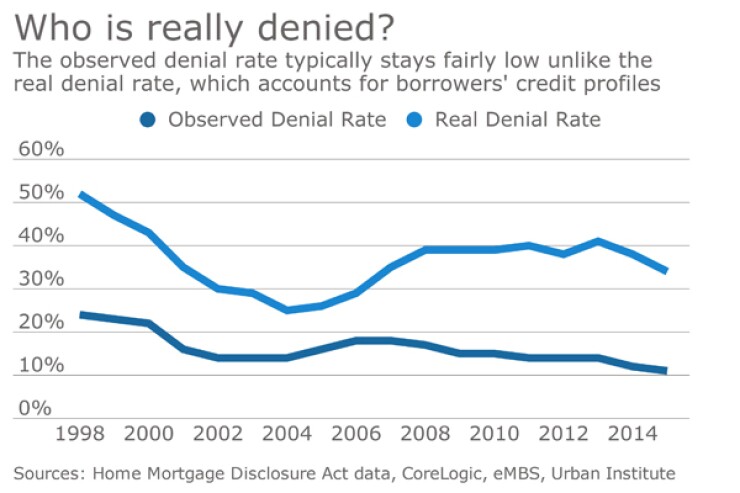

The denial rate traditionally used by the mortgage industry is hiding the fact that fewer borrowers with lower credit are applying for loans, according to a report from the Urban Institute.

The report examines the difference between this traditional denial rate, which the Urban Institute calls the observed denial rate, and the real denial rate, which is calculated to exclude high-credit borrowers who would never be denied for a loan. The latter rate suggests that while it is harder to get a mortgage today than in the bubble years from 2005 to 2007, credit access is beginning to ease for conventional and government loans alike.

The observed denial rate, as the institute contends, is a flawed metric. During the boom years, the rate reached 18%, while it progressively dropped to 11% by 2015. That goes against what is known about credit standards, which became more strenuous in the wake of the financial crisis. The real denial rate reflects the tighter access to credit, rising to 41% in 2013.

"In the boom years, more lower-credit consumers were encouraged to submit applications; the likelihood of being rejected increased despite of loose lending standards," the report's authors — Bing Bai, Laurie Goodman and Bhargavi Ganesh — wrote.

Therefore, it's easy to see why the observed denial rate seems to suggest looser credit when the opposite is true.

"The percentage of lower-credit applicants is lower," the researchers wrote. "Marginal borrowers are not applying for mortgage loans."

The institute's researchers further confirmed that credit is tighter in the conventional channel than in the government channel. Loan denial rates are typically higher in the conventional channel — and that's to be expected, since the government channel is intended to serve low-income, moderate-income and minority borrowers who often have lower credit.

But following the crisis, data suggest that the observed denial rate for conventional loans was lower than the government channel. Once again, this is a reflection of a change in volume.

"Following the crisis, the conventional channel likely discouraged more lower-credit consumers from applying for mortgages than the government channel, leading to fewer borrowers being rejected by the conventional channel than by the government channel," the researchers wrote.

The report also found that conventional and government loan denial rates lead to interesting discrepancies between the denial rates for different minority groups. According to the Urban Institute, the real denial rate shrinks the racial and ethnic gaps in observed denial rates. For instance, while the observed denial rates suggest black applicants were twice as likely to be denied a loan as their white counterparts in 2015, they were only 1.2 times more likely according to the real denial rates.

And with the real denial rates, Asian applicants appear to be the most likely to be denied of any ethnic or racial group, 1.5 times more likely than white applicants. This is a result of the types of loans Asians apply for, according to the researchers.

"Asians have the highest RDRs — higher than white, black, or Hispanic applicants — because Asian applicants use the conventional channel more frequently than the other groups," the researchers said. "We believe this is because Asian borrowers tend to live on the high-cost coasts, areas that rely more heavily on conventional financing. Because the denial rate is higher for conventional loans than for government loans, higher Asian denial rates make sense."