-

Brian Montgomery is examining why the reverse mortgage program has suffered big losses, but he said he opposes any changes that could make it harder for the elderly to stay in their homes.

July 10 -

Optimal Blue is expanding its reach in the secondary mortgage market by acquiring Resitrader, a whole-loan trading marketplace that has integrations with Fannie Mae and Freddie Mac.

July 10 -

Access to mortgage credit inched up in June, as competition for jumbo loans resulted in looser underwriting, but government lending standards got more restrictive, the Mortgage Bankers Association said.

July 10 -

A Fannie Mae test to handle the private mortgage insurance process for lenders may raise concerns that it's going outside the scope of its secondary market mission. But the effort reflects its mandate to explore new credit-risk transfer alternatives, a company executive said.

July 10 -

Freddie Mac will make automation it has been testing in conjunction with servicing-released cash sales available to the broader market next month.

July 3 -

With better-than-expected performance of the underlying mortgages, Fitch Ratings cut its loss projections for seasoned government-sponsored enterprise credit risk transfer deals.

July 3 -

Fannie Mae and Freddie Mac enjoy considerable advantages because of their lower cost of capital and significant government subsidies. But with some conforming loans, the private market is finding a way to compete.

July 3 -

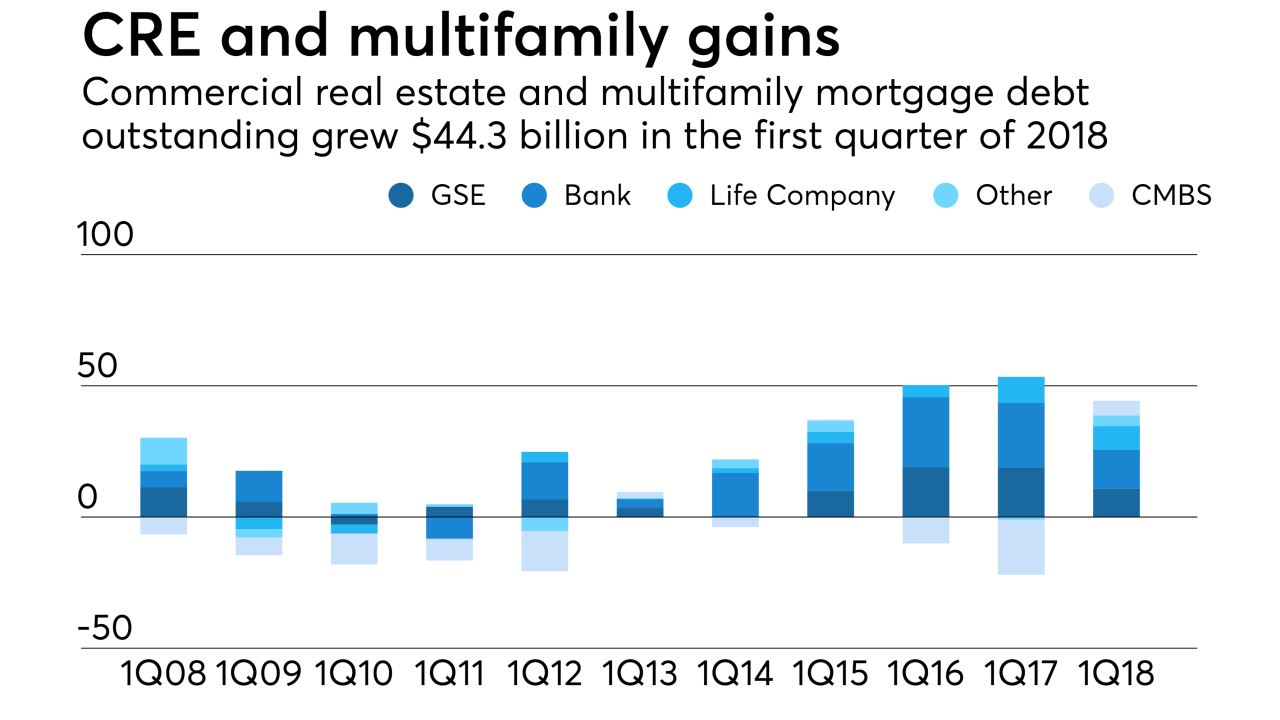

Commercial and multifamily mortgage debt outstanding grew $44.3 billion during the first three months of 2018, the largest first-quarter gain since before the Great Recession, according to the Mortgage Bankers Association.

July 2 -

Fannie Mae and Freddie Mac are making condominium loans eligible for automated appraisal waivers that could reduce mortgage borrowers' fees and shorten closing times for lenders.

June 28 -

The Trump administration's plan to end the conservatorship of Fannie Mae and Freddie Mac marked its first effort to solve a problem left over from the financial crisis, but ultimately raised more questions than it answered.

June 27 -

Meet the new housing finance reform plan, same as the old ones. While that gives it legs, it also presents big challenges.

June 25IntraFi Network -

Incenter Mortgage Advisors is facilitating the sale of more than $10 billion in mortgage servicing rights tied to Fannie Mae and Freddie Mac loans originated by mortgage brokers.

June 21 -

Walker & Dunlop has been approved as a seller and servicer under Freddie Mac's Affordable Single-Family Rental pilot program, allowing the company to focus on middle markets.

June 20 -

Ginnie Mae is looking to start a pilot program to securitize digital mortgages as early as 2019, but issuers would not be able to commingle loans using traditional paper files in those deals.

June 20 -

The groups applauded a proposal to establish minimum GSE capital requirements, but called for more immediate steps to release the companies from conservatorship.

June 19 -

Risk management and technology systems at the Federal Housing Administration lag decades behind Fannie Mae and Freddie Mac and desperately need to be revamped, according to a top official at HUD.

June 18 -

The bill aimed at helping struggling homeowners also requires documentation of servicer behavior and FHFA evaluation of the services provided to borrowers.

June 18 -

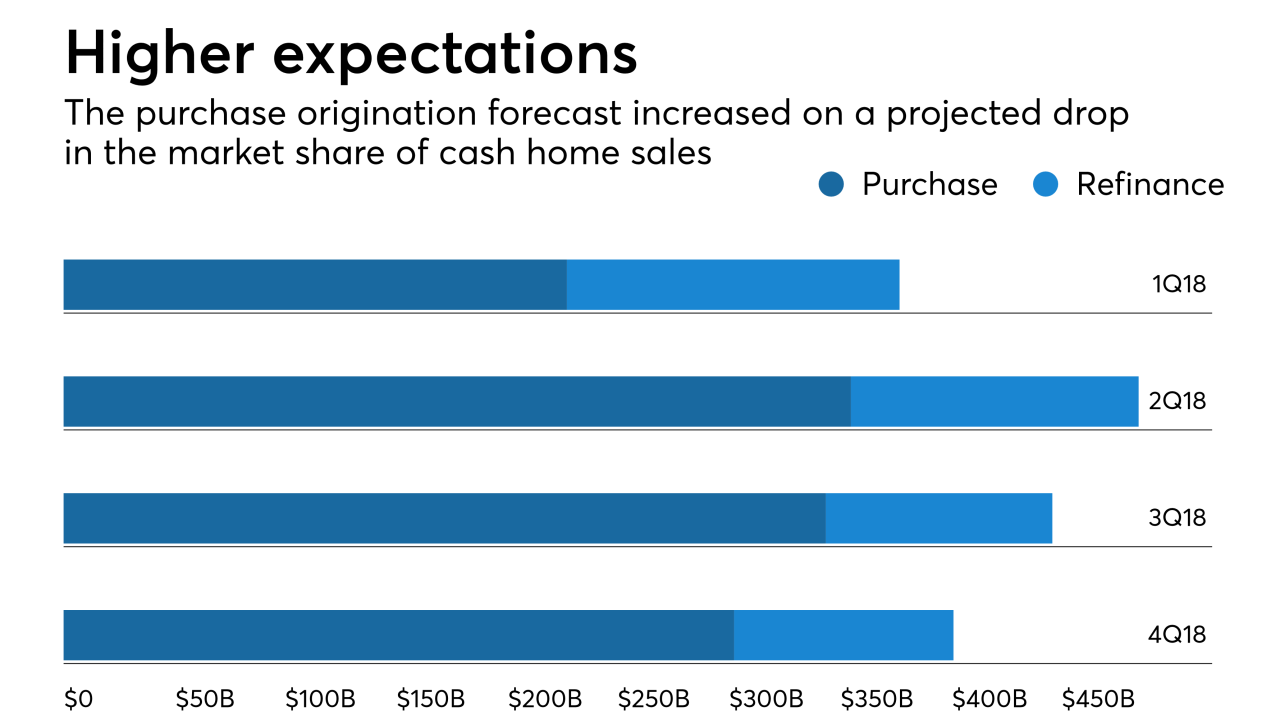

A declining share of cash home sales will drive purchase home originations higher than previously expected through 2019, according to Fannie Mae.

June 18 -

Sales of nonperforming loans by Fannie Mae and Freddie Mac slowed during the past year as the number of delinquent loans on their books continued to drop.

June 14 -

Freddie Mac hit the $1 trillion mark on credit risk sharing for single-family mortgage loans with its second lower LTV deal of the year.

June 13