-

The White House and congressional GOP leaders are eyeing a tight window between tax reform passage and the 2018 midterms to pass housing finance reform. And with key policymakers readying their exit, the effort could be the most concerted push yet.

November 17 -

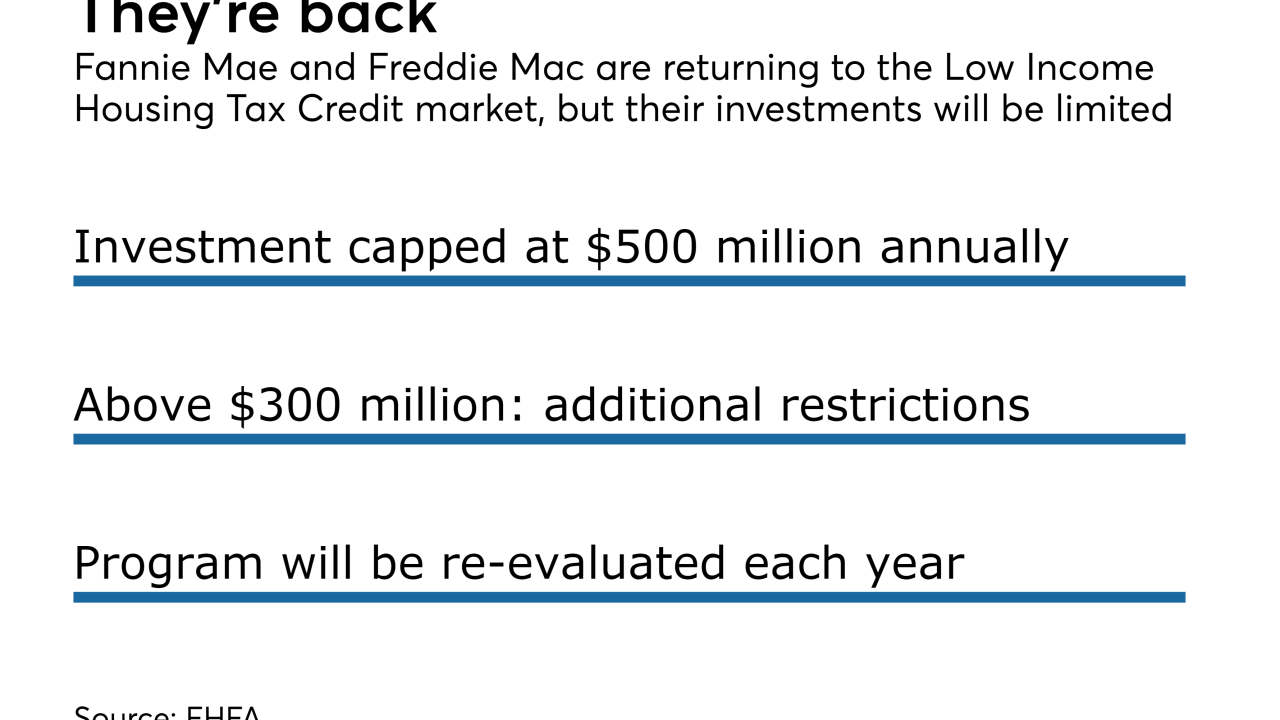

The FHFA is allowing Fannie Mae and Freddie Mac to invest in the credits for the first time since they entered conservatorship. Its purpose is to promote affordable housing in underserved markets.

November 16 -

The battle lines are drawn between those seeking to protect the mortgage interest deduction and a legislative effort to greatly reduce its use. Hopefully, this is a battle that taxpayers will win.

November 10 American Enterprise Institute

American Enterprise Institute -

Equifax reported earnings that were 27% lower and mortgage services revenue was 2% lower on a year-to-year basis after revealing a major breach and taking steps to improve security.

November 10 -

Fannie Mae is considering a series of pilot programs to address an issue that has plagued the real estate market for years: a lack of affordable homes.

November 9 -

More FHA homeowners than expected are refinancing out of the program and into conventional mortgages, despite an increase in mortgage rates over the past year.

November 7 -

Lenders selling loans through Freddie Mac's system experienced access difficulties Monday afternoon, when the government-sponsored enterprise sent out an alert to lenders about the problem.

November 6 -

Growth in loans with higher debt-to-income ratios is reviving focus on a regulatory exemption for Fannie Mae, Freddie Mac and other federal agencies that back mortgages.

November 3 -

The Federal Housing Finance Agency must set fees equal to the cost of capital that private banks hold against similar risk, not just the amount of capital that Fannie and Freddie think are right for themselves.

November 3

-

Fannie Mae servicers are facing pressure from the recent hurricanes, but so far are bearing up under the strain.

November 2 -

Mark Calabria, the chief economic adviser to Vice President Mike Pence, said the administration is focused for now on more pressing issues than GSE reform, including addressing housing damage from recent hurricanes.

November 1 -

Fannie Mae is allowing in some situations where mortgage payments are made by someone other than the borrower for the full monthly housing expense to be excluded from debt-to-income calculations.

November 1 -

A securities settlement, portfolio asset sales and greater interest among smaller lenders helped Freddie Mac compensate for potential losses from the catastrophic hurricane season.

October 31 -

Fannie Mae is testing a conforming loan product that makes use of a New Hampshire law that lets manufactured housing in resident-owned communities get treated like units in a co-operative building.

October 27 -

Fannie Mae is staging more pilot projects with lenders and vendors, including one that consolidates submissions of different types of loan data potentially eligible for immediate representation and warranty relief.

October 23 -

Federal Housing Finance Agency Director Mel Watt said the agency is poised to examine alternatives to how a Fannie Mae and Freddie Mac assess creditworthiness of home buyers, including seeking public comment on the issue later this fall.

October 23 -

Fannie Mae is authorizing additional suppliers of reports that can give lenders immediate representation and warranty relief on certain data, diversifying beyond an exclusive partnership with Equifax in one category.

October 23 -

The way lenders need to submit payment information on certain student loans in order to calculate a borrower's monthly debt-to-income ratio is changing at Freddie Mac.

October 19 -

In a moment of rare unity, the Independent Community Bankers of America and National Association of Federally-Insured Credit Unions sent a joint letter to FHFA arguing to stop the GSEs' profit sweep.

October 19 -

Called Structured Agency Credit Risk Securitized Participation Interests, the new securities are backed by mortgage loans, and are not general obligations of the government-sponsored enterprise.

October 18