A Fannie Mae program to offer 30-year financing for manufactured homes in New Hampshire could be a launching point for the government-sponsored enterprises to offer similar conforming loan terms nationwide.

The GSE is working with the New Hampshire Housing Finance Authority on the program and is available for manufactured housing located in a resident-owned community, or ROC.

The program takes advantage of a New Hampshire law that requires all manufactured homes, whether located on owned land, in an ROC or investor-owned park, to be titled as real property instead of chattel, said Patrick McCarthy, Fannie Mae vice president for community lending.

Interest rates and fees are typically lower for conforming loans than on chattel loans. Loans are available up to a 95% loan-to-value ratio with private mortgage insurance.

This program is similar to loans secured by an apartment in a co-operative, he said.

"The residents own a share of their park, a share of their land," said McCarthy. "They pay for the upkeep in a co-op-type structure."

Since homes eligible for the financing are located in ROCs, Fannie Mae has a bit more comfort from a risk-management perspective, as the borrower is less likely to walk away if there is a problem.

"This mortgage captures all of that so that the lenders are willing to, and Fannie Mae is willing to, lend for 30 years on these manufactured homes," said Ignatius MacLellan, managing director of the New Hampshire Housing Finance Authority's homeownership division.

There is some unique documentation with these loans, MacLellan said. It includes "an agreement with the ROC that says they respect the mortgage and they'll allow the lender to convey the property and convey the shares to the next owner if there happens to be a foreclosure," he said. "We're not looking forward to foreclosure, but when you think about risks, you want to make sure you get all those right."

From a behavior perspective, the homeowner is more likely to plant a $50 shrub because they know they are going to be there for the long term.

"The people know, 'If I add a deck, if I pave my driveway, if I do a carport, if I improve it, it's still mine and no landlord is going to tell me you're out of here,'" MacLellan said.

The participating lenders can close and sell the loan to the New Hampshire HFA. Or they can broker the loan to the agency which has its own warehouse lines and can close in its own name. In either case, the agency then sells the loans to Fannie Mae.

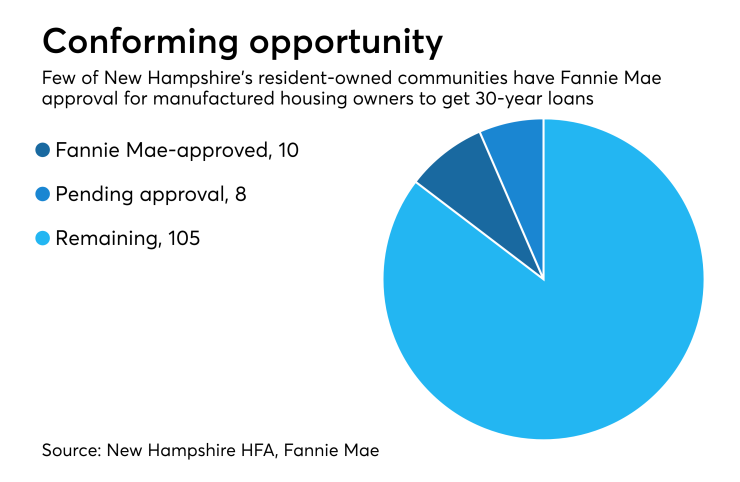

There are 123 ROCs in New Hampshire, with 10 already approved by Fannie Mae and six to eight more expected to be approved in the near future. The New Hampshire HFA made a grant to the state's Community Loan Fund to go out and help other ROCs get Fannie Mae approval.

The program can be adopted by other HFAs, but state laws might need to be changed for that to happen, McCarthy said.

But ROCs are just a tiny portion, 5%, of the 37,624 manufactured home communities nationwide, said Lesli Gooch, senior vice president of government and chief lobbyist for the Manufactured Housing Institute. So the organization is focused on making financing available to all individuals seeking to purchase a manufactured home, no matter how they are titled or where they are situated.

"We have been encouraging Fannie Mae and Freddie Mac to focus on creating a

Fannie Mae already makes loans secured by manufactured housing parks and "the natural next step for them is to move into the chattel space," she said.

The New Hampshire program does not qualify for duty to serve credit because it started before 2018 but it does help Fannie Mae meet its affordable housing obligations, said McCarthy.

The GSEs are "dipping their toe a little bit in the water of looking at trying to understand chattel and we think that they need to move in that direction. Our hope would be is that this experience in New Hampshire would just move that process along," said Gooch.

There are three MIs participating in the program: Genworth, National MI and MGIC.

Genworth already insures loans securing manufactured homes titled as real property up to 95% LTV prior to this program with the New Hampshire HFA, said Sharon Netter, its risk customer relations manager.

"From that perspective we have been comfortable insuring manufactured homes," she said.

And the company has long-standing partnerships with many HFAs, including New Hampshire, added Erika Martin, the director of customer experience and segment marketing.

The investor sets the insurance coverage level. Because these loans are being done through an HFA, there is 16% coverage of the losses if the mortgage is foreclosed upon, which means a lower premium for the borrower, Martin said. Standard coverage on a manufactured home is 30%, although it is 25% for loans originated through Freddie Mac Home Possible or Fannie Mae's HomeReady programs.