-

Steven Mnuchin's time as OneWest CEO is expected to draw ample attention at his nomination hearing, but it will not be the only issue to come up as senators try to gauge how he would lead President-elect Trump's financial policies.

January 18 -

The startup, known for refinancing millennials' student loans, is now writing more than $100 million of home mortgages a month, and expects this to be its fastest-growing product. Here's why.

January 17 -

The Federal Housing Administration program could see a $50 billion increase in single-family loan endorsements this year if a planned 25-basis-point annual premium cut goes into effect on Jan. 27.

January 13 -

Housing and Urban Development Secretary-designate Ben Carson is open to finding alternatives to the 30-year fixed-rate mortgage, but believes there must be some government backstop to the housing market.

January 12 -

Mortgage rates moved lower for the second consecutive week on the market's reaction to November's employment numbers, according to Freddie Mac.

January 12 -

Fannie Mae and Freddie Mac have hiked the standard modification benchmark interest rate.

January 12 -

Treasury Secretary-designate Seven Mnuchin will divest himself of his investments and interests in a number of companies and funds once confirmed, including a fund that has bet on Fannie Mae and Freddie Mac being recapitalized and released from government control.

January 11 -

The Federal Housing Administration said it would cut the annual premium by 25 basis points starting on Jan. 27, giving President-elect Donald Trump a limited window to delay or scrap the cut.

January 9 -

Americans' desire to be homebuyers decreased for the fifth consecutive month in December as interest rates continued their post-election climb, according to Fannie Mae.

January 9 -

New approaches to credit scoring lower the standard of the criteria required to receive a mortgage loan, at greater risk to the industry.

January 9 FICO

FICO -

The House Financial Services Committee will see a shuffling of deck chairs among the leadership of its subcommittees in the new Congress as it also welcomes 10 new Republican members.

January 6 -

Ohio has prohibited the use of plywood to board up certain vacant or abandoned properties in foreclosure.

January 6 -

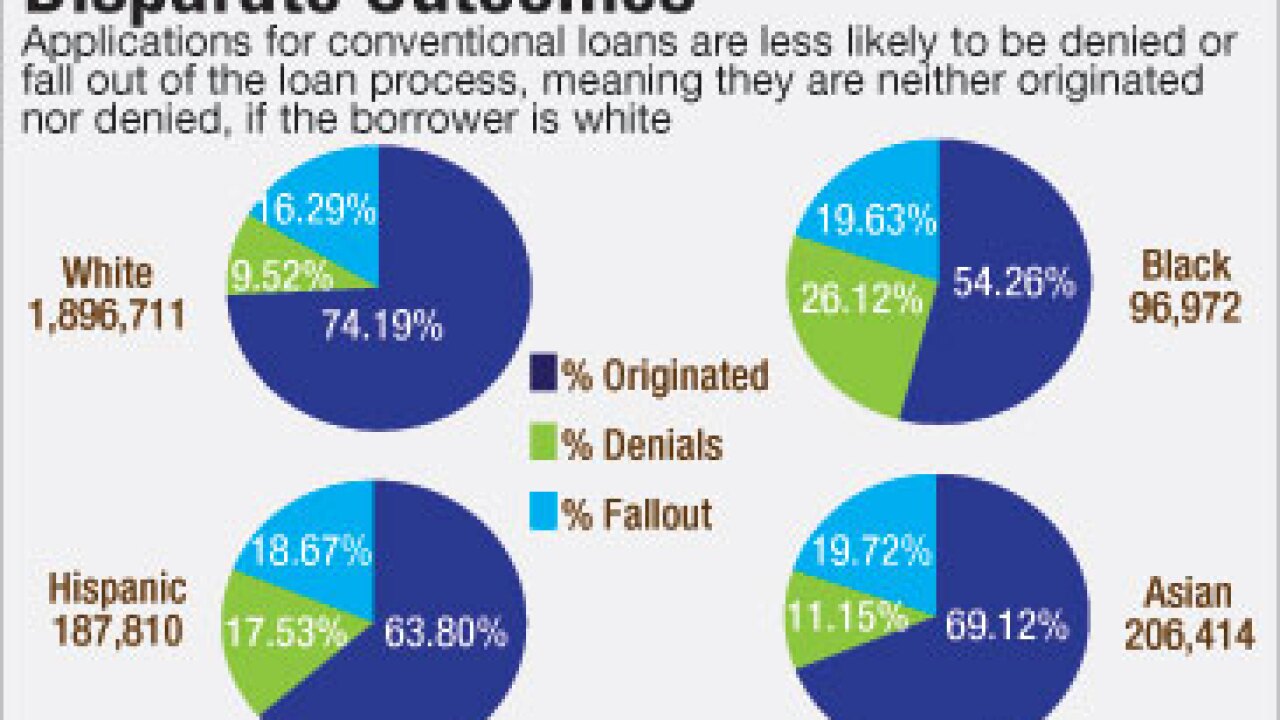

Initiatives aimed at a more inclusive credit box have long relied on costly approaches that are difficult to scale. Now, demographic shifts are intensifying industry demand for a more automated and efficient solution.

January 6 -

Demographics are shifting, creating more prospective minority homebuyers than ever before. But predominant underwriting processes and these would-be borrowers' financial backgrounds are holding them back.

January 5 -

Mortgage credit availability grew for the fourth consecutive month in December, the Mortgage Bankers Association reported.

January 5 -

Mortgage interest rates dropped for the first time since the presidential election in the first week of the new year, Freddie Mac reported.

January 5 -

Origin Bank in Addison, Texas, has begun offering warehouse financing for electronic mortgages.

January 4 -

In hindsight, the U.S. Treasury's support of Fannie Mae and Freddie Mac was structured in a way that proved to be counterproductive.

January 4

-

The Senate Banking Committee will have six fresh faces in the new Congress as Republicans grapple with a slimmer majority.

January 3