-

Freddie Mac has released a new online tool for lenders that determines whether a borrower's income qualifies them for a low down payment mortgage on a particular property.

August 9 -

Marketplace lender Lending Club has added Fannie Mae Chief Executive and President Timothy Mayopoulos to its board of directors.

August 8 -

Deval LLC in Dallas has received Fannie Mae servicer approval.

August 8 -

Fannie Mae and Freddie Mac could need as much as $126 billion in bailout money from taxpayers in a severe economic downturn, according to stress test results released by their regulator.

August 8 -

Fannie Mae reported that the Home Purchase Sentiment Index rose 3.3 points in July to 86.5, an all-time survey high.

August 8 -

The former officers and directors for Midwest Bank & Trust have reached a $26.5 million settlement with the Federal Deposit Insurance Corp. over charges of negligence during the financial crisis.

August 8 -

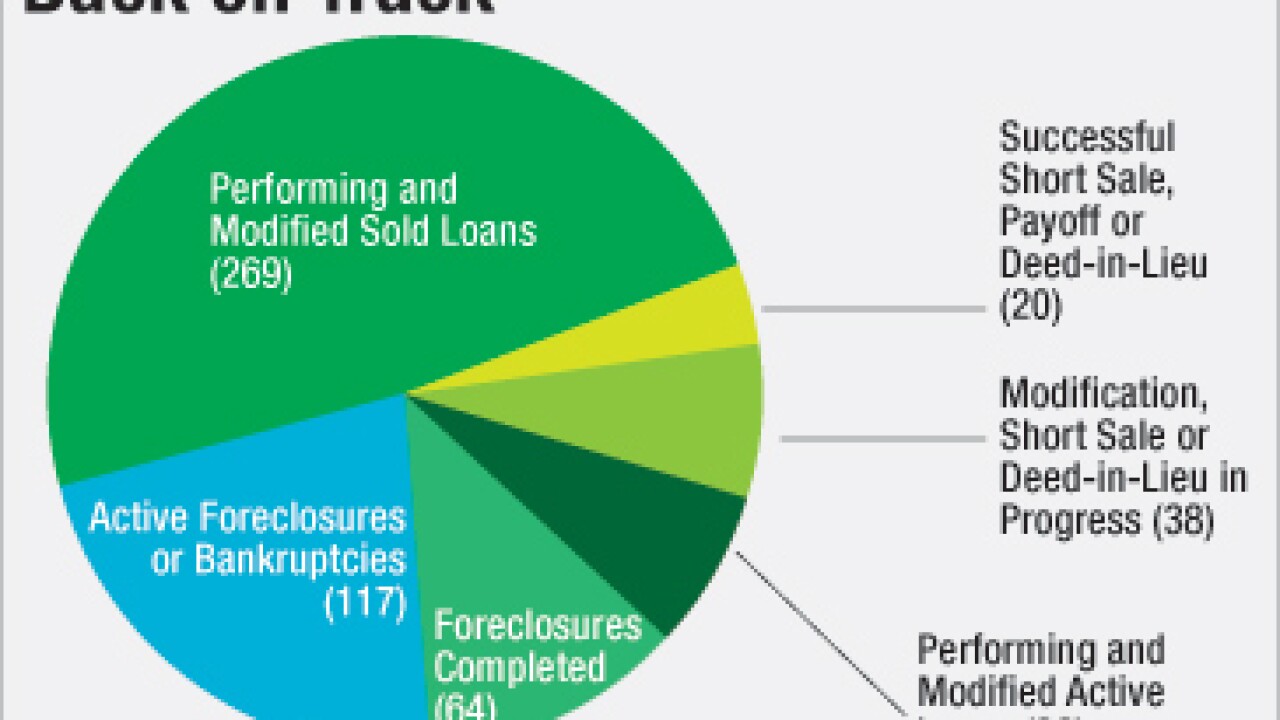

Community development entities like New Jersey Community Capital and Hogar Hispano are being guaranteed a portion of the secondary market for distressed mortgages. They are doing a good job of forestalling foreclosures, but skeptics question whether that run will last.

August 5 -

The U.S. asked a federal appeals court to reconsider its May decision to toss out an almost $1.3 billion judgment against Bank of America's Countrywide Financial unit, claiming the panel overlooked "a wealth of evidence."

August 5 -

Returning Fannie Mae and Freddie Mac to their status as privately owned public utilities is consistent with their mandate and makes the most policy sense.

August 4

-

Incenter Mortgage Advisors is brokering the sale of an $8.9 billion Ginnie Mae bulk residential mortgage servicing rights portfolio.

August 4 -

Fannie Mae earned $2.9 billion in the second quarter, a step up from its first-quarter earnings, but Chief Executive Timothy Mayopoulos reiterated warnings about future volatility.

August 4 -

Mortgage rates declined for the first time in four weeks as the bond market reacted to the news from the Federal Reserve Board's July meeting, according to Freddie Mac.

August 4 -

Walker & Dunlop's net income increased 59% year-over-year during the second quarter, as the company saw growth in its commercial mortgage origination volume.

August 3 -

NMI Holdings reported second-quarter net income of $2 million, making it the first time the company founded in 2012 has ended a period in the black.

August 3 -

Benefiting from higher loan guarantee income and lower derivative losses, Freddie Mac said Tuesday it had made $993 million in the second quarter, a dramatic reversal from its $354 million loss a quarter earlier.

August 2 -

The average single-family guarantee fee paid to Fannie Mae and Freddie Mac only increased by two basis points in 2015 to 59 bps, according to the Federal Housing Finance Agency.

August 1 -

The Federal Housing Administration is promoting a particular kind of financing for residential energy retrofits that another regulator staunchly opposes. Mortgage lenders and investors have qualms, too, about the impact on their standing in collateral claims.

July 29 -

Those with student loan debt but no college degree are less likely to own a home relative to a debt-free high school graduate, according to Fannie Mae.

July 29 -

Fannie Mae has released historical performance data on a portion of its modified single-family loans.

July 29 -

Fannie Mae has selected Corona Asset Management XVIII as the winner of its fourth and latest "community impact" pool of nonperforming loans.

July 28