-

Cloudvirga, in collaboration with Freddie Mac, has created the capability for loan officers to submit mortgage loan data to both government-sponsored enterprises' automated underwriting systems simultaneously with a single click.

April 12 -

Situs subsidiary MountainView Financial Solutions is brokering a $6.1 billion package of government-sponsored enterprise and Ginnie Mae servicing rights.

April 11 -

The future secondary mortgage market entities will receive high investment grade ratings, even as there is no clarity on their scope or form, Fitch Ratings said.

April 10 -

The reserve bank's proposal to address banks and nonbanks that remain "too big to fail" does not include two of the largest such institutions: Fannie Mae and Freddie Mac.

April 9

-

Mortgage credit availability tightened during March to its lowest level in over a year, adding another headwind to a market challenged by rising interest rates and a shortage of homes for sale.

April 5 -

Momentum to overhaul the mortgage finance system had been slipping, and with Democrats divided over the Senate's banking relief bill there's virtually no chance more bipartisan deals can be worked out.

April 2 American Banker

American Banker -

The annual progress report on the Fannie Mae and Freddie Mac conservatorships reiterated that a new credit score model will likely not be operational until after the implementation of a new Single Security Initiative.

March 29 -

Servicers are still trying to figure out how they can best take advantage of the growing use of electronic notes and other digital mortgage tools by lenders and the secondary market.

March 27 -

Fannie Mae and Freddie Mac had a 9% increase in total foreclosure prevention actions taken during 2017 as a result of three September hurricanes, according to the Federal Housing Finance Agency.

March 26 -

News that the GSEs need an infusion from Treasury to cover quarterly losses underscores problems with the government’s 2012 decision to “sweep” the housing giants’ profits.

March 23 The Delaware Bay Company

The Delaware Bay Company -

As policymakers take another crack at housing finance reform, federal leaders and the housing lobby are once again perpetuating the false notion that ending government guarantees would cause the 30-year, fixed-rate mortgage to vanish.

March 21 American Enterprise Institute

American Enterprise Institute -

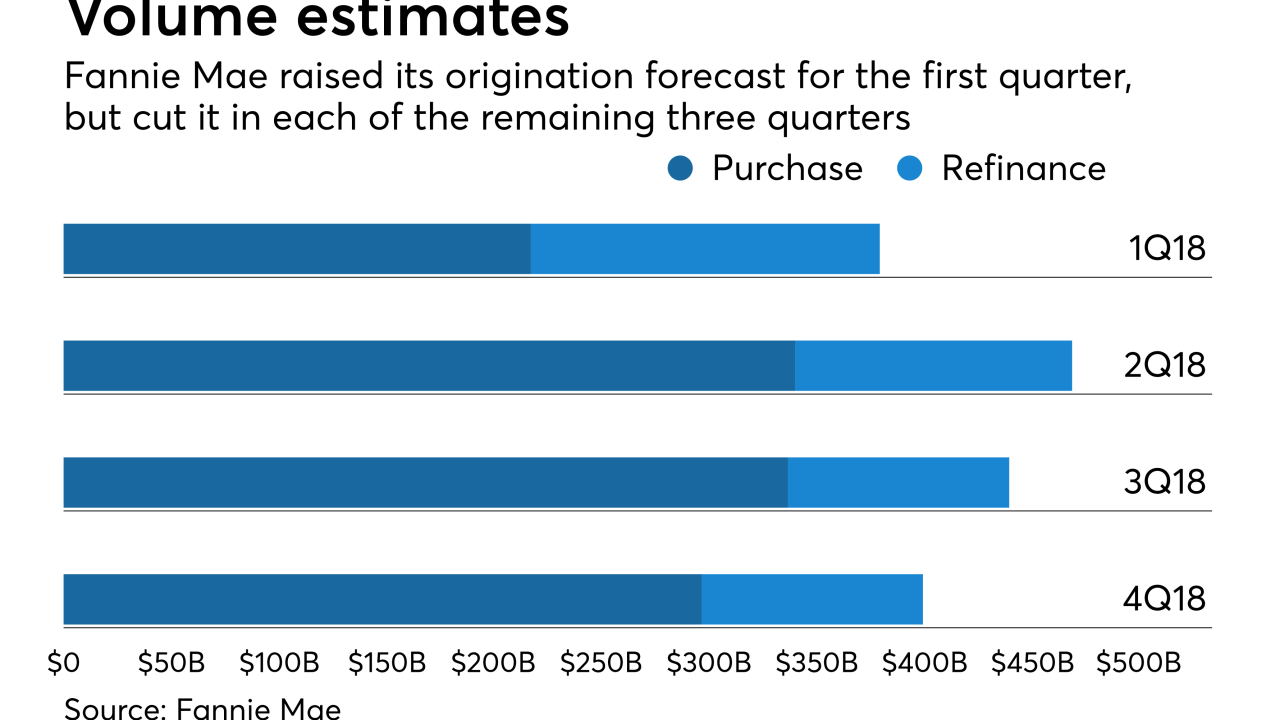

A stronger than expected refinance market led Fannie Mae to increase its origination projections for the first quarter by nearly 4% in its March outlook.

March 19 -

Fannie Mae is about to roll out a new underwriting system that will address some concerns about layered risk that cropped up after it raised its maximum debt-to-income ratio.

March 16 -

Freddie Mac and Arch Capital are testing a new form of risk-sharing deal to boost investor appetite for low down payment mortgages. But the pilot is raising concerns about "charter creep" because it dictates private mortgage insurance decisions typically made by lenders.

March 14 -

A mortgage program created by a 2015 partnership between the Federal Home Loan Bank of Chicago and Ginnie Mae has securitized over $1 billion in government-backed mortgages, the partnership announced.

March 14 -

A late addition to regulatory relief legislation would direct the Federal Housing Finance Agency to review credit-scoring alternatives, but some say the provision is redundant.

March 13 -

February's volume of mortgage loan applications for newly constructed homes rose both year-over-year and month-to-month, continuing the momentum from a surprisingly strong showing in January.

March 13 -

If GSE reform leads to the 30-year mortgage's demise, homebuyers' monthly payments could soar by $400, according to a recent Zillow estimate. But lenders aren't convinced this housing finance staple is in any danger of being replaced.

March 12 -

Essent Guaranty is marketing $360.75 million of notes linked to the performance of a pool of residential mortgages that it insures; its following in the footsteps of Arch Capital.

March 12 -

The Federal Agricultural Mortgage Corp. reported significant gains in new business volume, but also realized a big jump in 90-day delinquencies.

March 9