Want unlimited access to top ideas and insights?

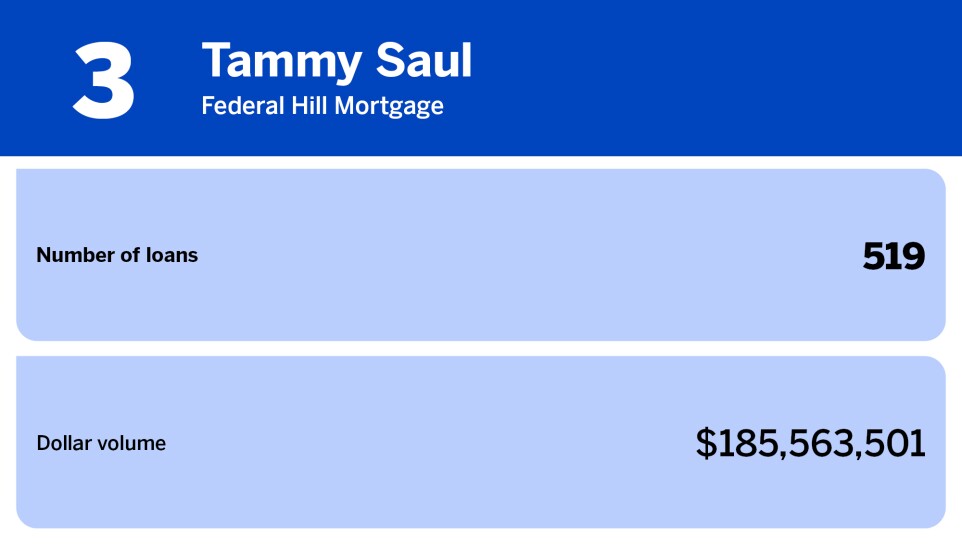

The top five loan officers in this ranking produced an average of 628 loans in 2023. The five loan officers also produced an average of more than $271 million.

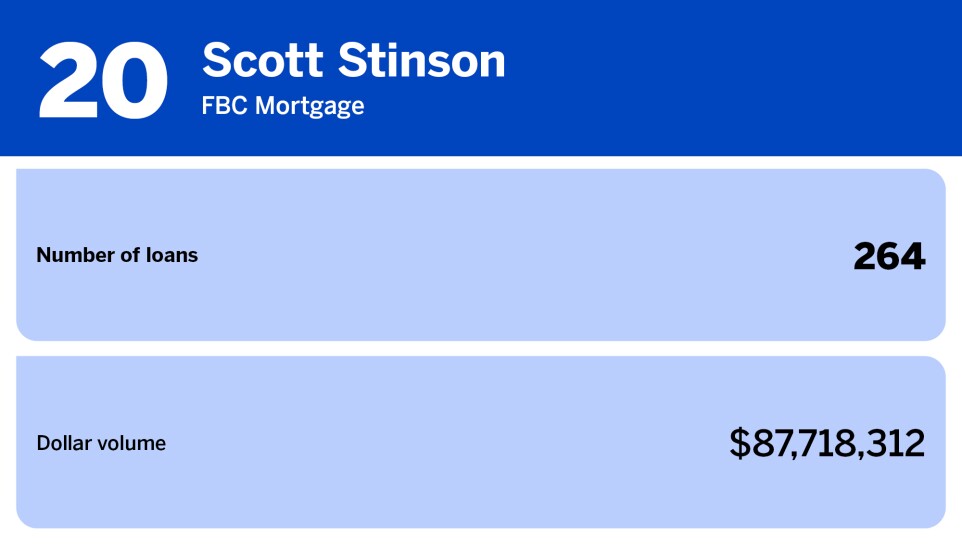

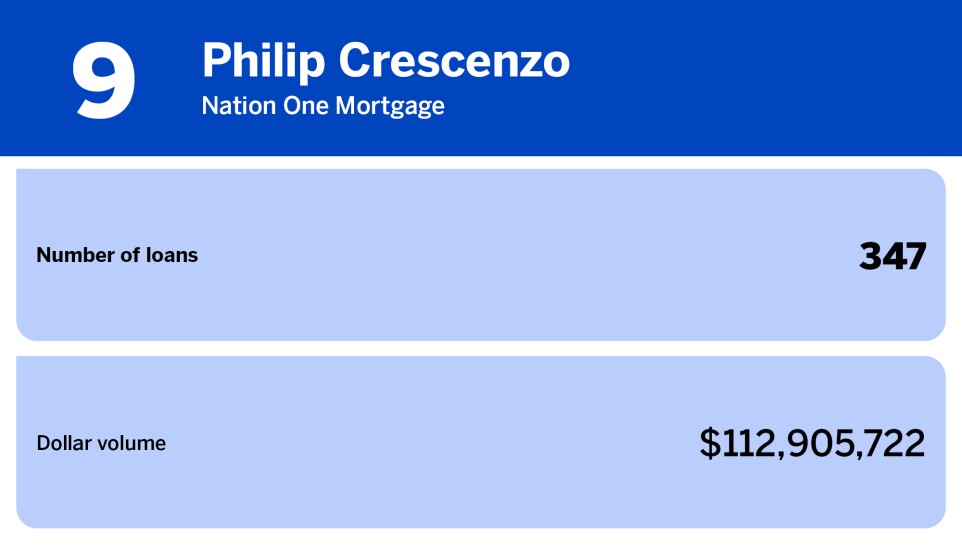

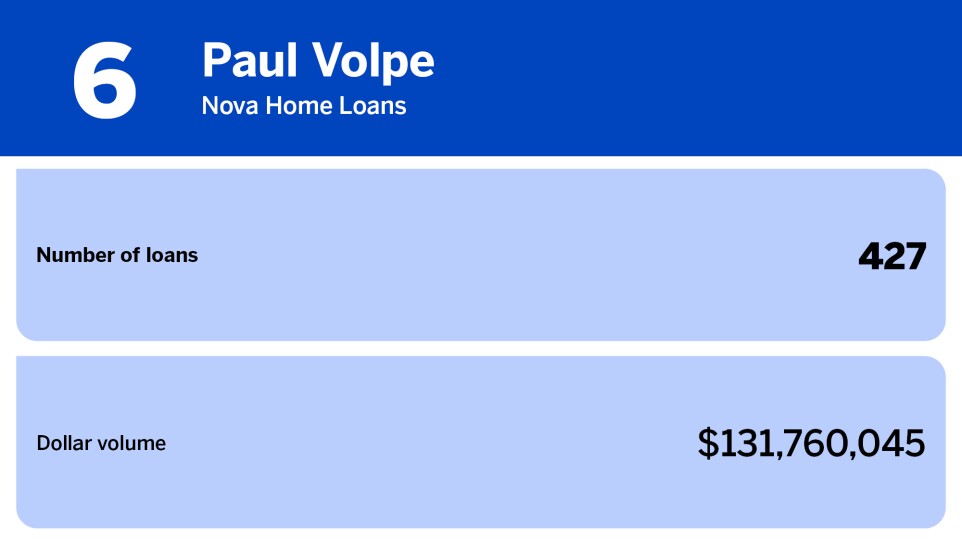

Scroll through to see which loan officers are in the top 20 and how they fared in 2023.