National Mortgage News is proud to present the fourth annual Best Mortgage Companies to Work For list. The awards program is dedicated to recognizing lenders that are supportive employers and providing them with employee feedback on their strengths and weaknesses.

The program is a partnership between National Mortgage News and the Best Companies Group, which conducts extensive employee surveys and reviews employer reports on benefits and policies. The employee survey covers eight topics: Leadership and Planning; Corporate Culture and Communications; Role Satisfaction; Work Environment; Relationship with Supervisor; Training, Development and Resources; Pay and Benefits; and Overall Engagement.

Once the survey data is analyzed, the companies get a score that decides their ranking. The overall score is calculated using the employee survey (worth 75%) and the employer questionnaire (worth 25%). To qualify for consideration, organizations with 25 or more employees need a minimum response rate of 40% while organizations with 25 or fewer employees need 80%.

Participation is open to a standalone mortgage lender, mortgage broker, mortgage servicer, or mortgage unit of a diversified financial services firm with at least 15 permanent employees working in the United States. While companies must opt-in to the rankings, not every entity that participates in the survey makes the list.

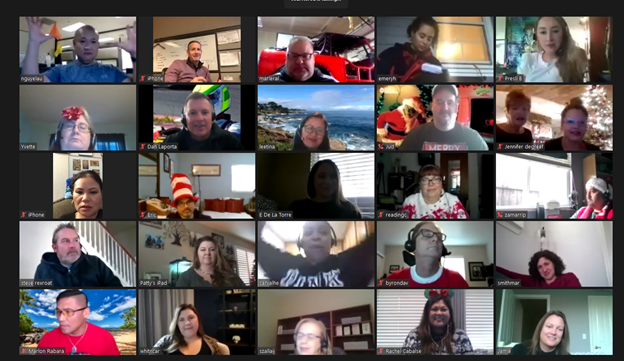

Below, the companies share with us details about their office (or work-from-home) culture, their special events, benefits and broader strategies for fostering communication and a productive working environment.

Throughout the week we'll be posting the rankings categorized according to company size and features that explore more about these top companies from across the country.