Instances of fraud in the mortgage industry are generally up annually due to increased use of remote operations amid the pandemic, according to the latest study by LexisNexis Risk Solutions.

Some studies show that in the short term, refi-heavy origination that draws on information from existing borrowers has lowered fraud risk, but

While the majority of mortgage transactions aren't fraudulent, the number of attempts to defraud mortgage lenders is higher. So is the number that are successful. The expenses associated with successful scams on average are more than triple each dollar lost, the True Cost of Fraud study finds.

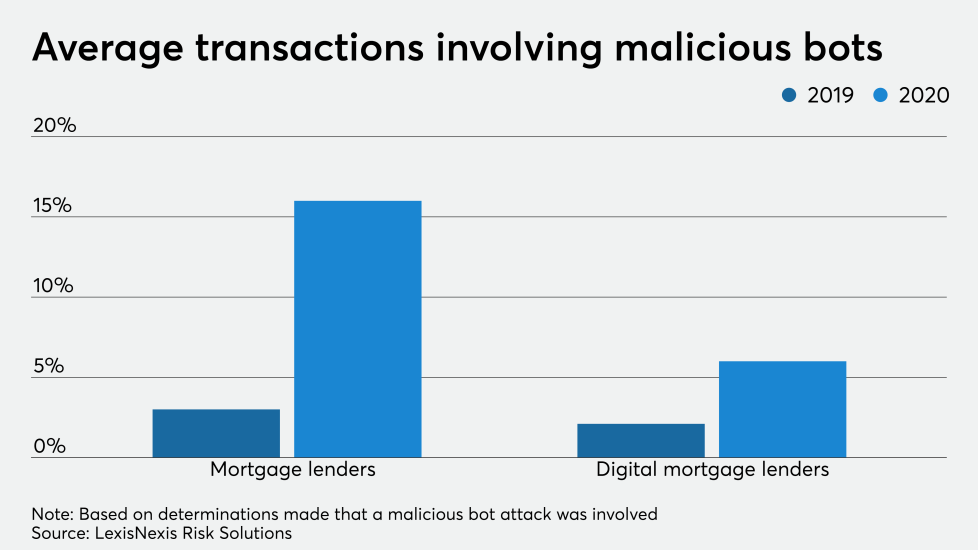

The charts below track the average expenses related to fraud, what the incidence of it is among mortgage lenders this year, and where the real pain points in prevention are.