Biden transition team replete with housing experts but lacking lenders

What Sheila Bair brings to table as chair of Fannie Mae

LoanDepot confirms it’s considering an IPO again

Mortgage rates rise on positive news about a vaccine

Delinquencies fall in 3Q but 'no guarantee it will continue'

FHA's capital buoyed by house price appreciation despite higher defaults

The FHA said Friday in its annual actuarial report that the fund's capital reserve ratio increased to 6.10% in the 2020 fiscal year, up from 4.84% a year earlier. Meanwhile, the fund's economic net worth increased to $78.95 billion — more than double its value just two years earlier. (Read full story

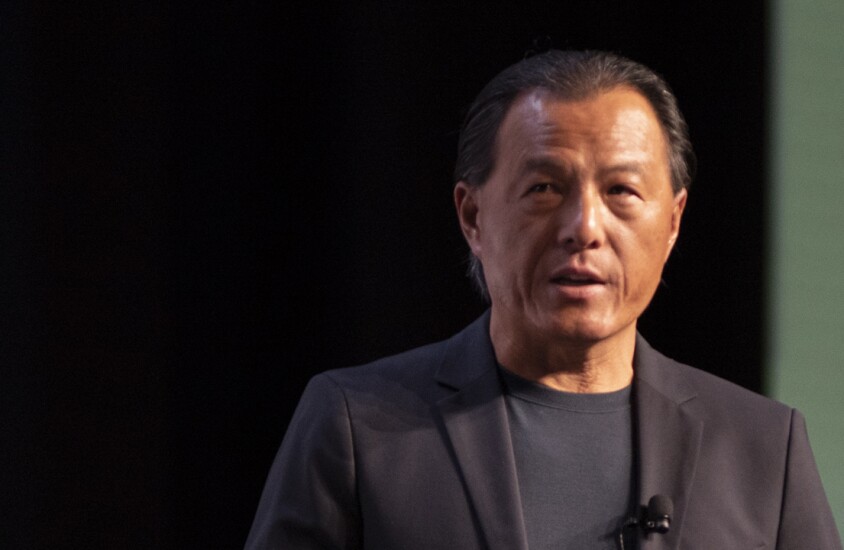

Freddie Mac CEO David Brickman resigns, interim leader appointed

Rocket’s 3Q originations soar as gain-on-sale margins shrink

Rise in mortgage foreclosures reflects unemployment, COVID-19 woes