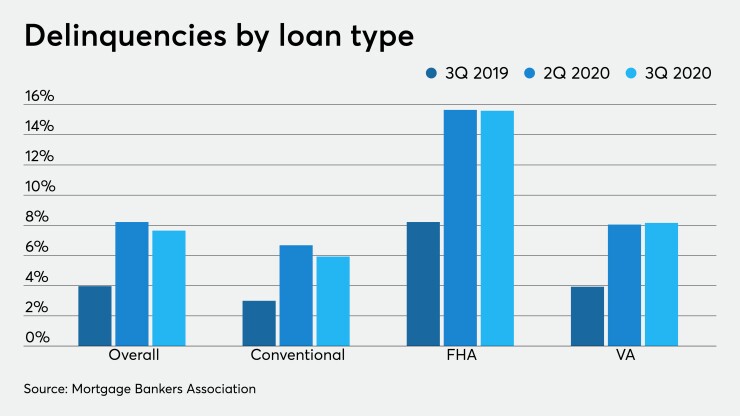

The number of mortgage delinquencies fell after spiking in the second quarter — the first full quarter which suffered coronavirus ramifications, according to the Mortgage Bankers Association.

The third quarter's seasonally adjusted delinquency rate hit 7.65%, dropping quarterly from 8.22% while nearly doubling the 3.97% rate

The short-term improvement came through employment gains, leading to borrowers making more payments. However,

“There are no guarantees that last quarter’s improvement in the delinquency rate will continue," Marina Walsh, the MBA's vice president of industry analysis, said in a press release. "Recent actions to combat another wave of COVID-19 cases could slow or halt the recovery in some sectors — particularly the service industries — and the passage of another stimulus package is still uncertain.

“Despite this ongoing concern,

Delinquencies varied greatly by loan type. Those backed by Fannie Mae and Freddie Mac fell to 5.93% from 6.68% in the second quarter. Federal Housing Administration mortgages declined to 15.59% from 15.65%, while VA loans increased quarterly to 8.16% — the highest rate since 2009 — from 8.05%.

By stage, the 30-day delinquency rate fell to 1.86% — the nadir of the MBA's survey which started in 1979 — down from 2.34% in the second quarter. The 60-day delinquencies dropped to 1.02% from 2.05%. Meanwhile 90-day delinquencies hit the highest point since the second quarter of 2010, rising to 4.78% from 3.72% quarter-over-quarter.

"With forbearance plans still active and foreclosure moratoriums in place until at least the end of the year, many borrowers experiencing longer-term distress will remain in this delinquency category until a loss mitigation resolution is available," Walsh added.