JPMorgan lays off hundreds in mortgage business after rate surge

Flagstar Bank says hack impacted 1.5 million customers

Meta settles claims that ads violated fair housing laws

LoanCare lays off undisclosed number of workers

UWM's latest promo slashes pricing by 50 to 100 bps

"While others have incentives that bring them inside and outside of the market, one of the main reasons we are the fastest growing lender serving brokers is because we are one of the most consistently competitive priced lenders in America," executive vice president of Rocket’s wholesale division Austin Niemiec said in a statement. "One of the ways Rocket Pro TPO stays competitive is by making adjustments to make sure our broker partners are in a position to win against others in the market and we will continue to do that."

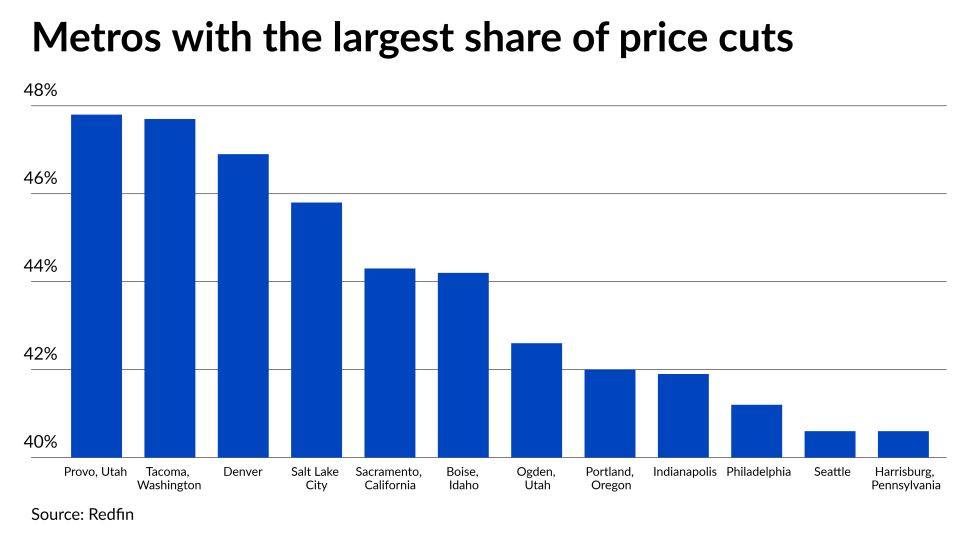

Price cuts hit the pandemic’s hottest housing markets: Redfin

Mortgage rates inch higher amid inflation control measures

Reverse mortgage lenders vie for baby boomers amid rate surge

Two reports present very different pictures of appraisal bias

Mortgage activity increases for second straight week

Housing construction is near a 49-year high, but is it enough?

First-mortgage default rate rises to high not seen since March 2021

How technology will reshape mortgage jobs of the future

As home flipping skyrockets, profit margins sink to 2009 levels

Increased hurricane damages likely in 2022

Lennar starts cutting prices in cooling U.S. housing market