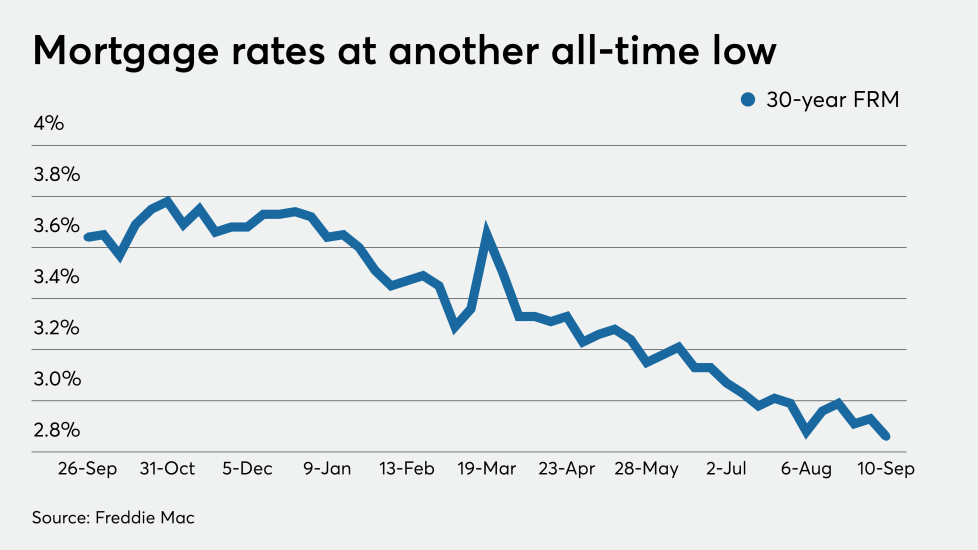

Mortgage rates slip to another all-time low as stock market drops

Citi picks Fraser to be next CEO as Corbat to retire in February

Fraser, who was named the company’s president last year, will join the board immediately, the New York-based bank said in a statement Thursday. Her rise will mark the

CFPB gets tough with debt collectors as it readies rule

Mortgage credit availability plummets to six-year low: MBA

FHFA urged not to come down so hard on credit risk transfers

Tyrrell to head ICE Mortgage Technology as Corr retires from Ellie Mae

Lenders are feeling optimistic about the immediate future

Past forbearance will affect borrowers' ability to get new loans: FHA

Flagstar promotes Lee Smith to head its mortgage business

Smith joined Flagstar in 2013 as executive vice president and chief operating officer. He directed a number of business units, including mortgage servicing, as well as strategy, balance sheet and cost optimization and mergers and acquisitions. (Read full story