Rocket reports steep decline in profit in 2Q

Mortgage players confirm more sweeping layoffs

Slammed with poaching suits, CrossCountry Mortgage drops its own

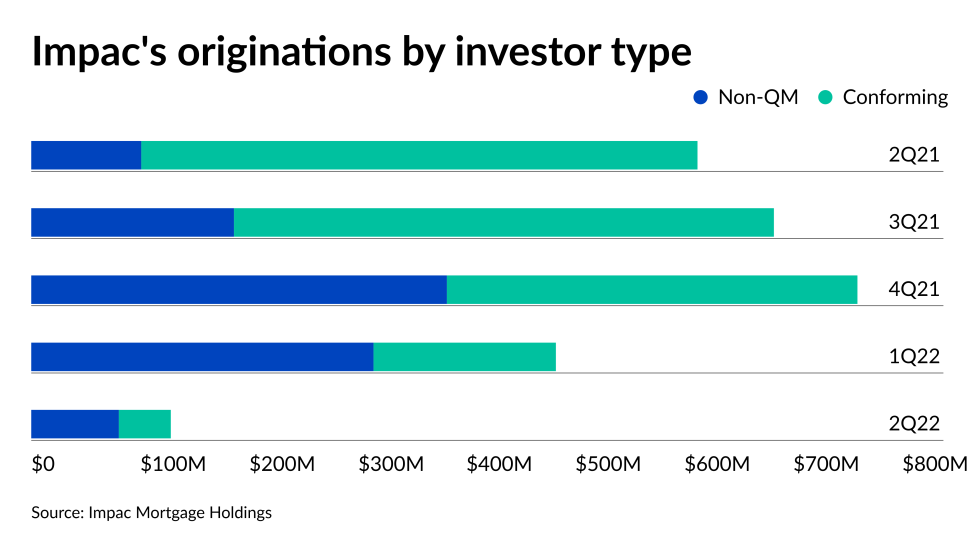

Impac's losses in 2Q grow as volume, margins drop

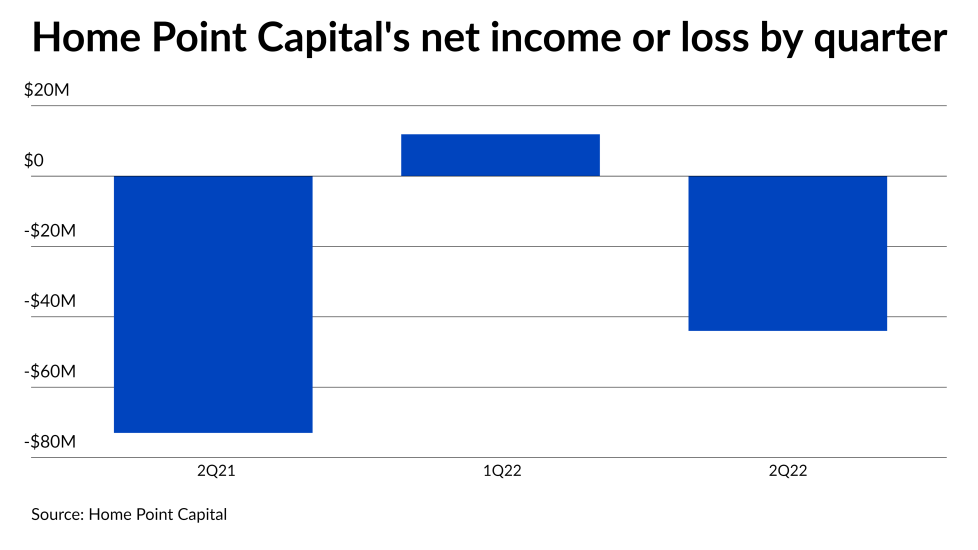

Home Point slips into the red as price war intensifies

Closing speeds aren't meeting mortgage borrower expectations

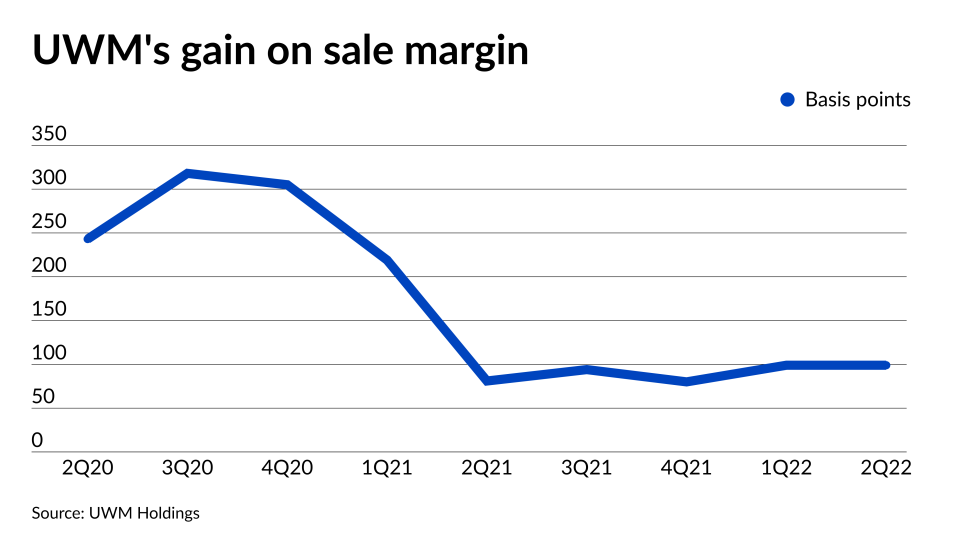

UWM touts aggressive pricing promotion as key to future

FHFA adds fair lending reporting mandate for servicers

Angel Oak posts 2Q loss due to non-QM market uncertainty

Fannie, Freddie both pass 2022 stress test despite misalignment on risk rating

Mortgage insurer earnings grow in 2Q

Celebrity Home Loans drops correspondent business

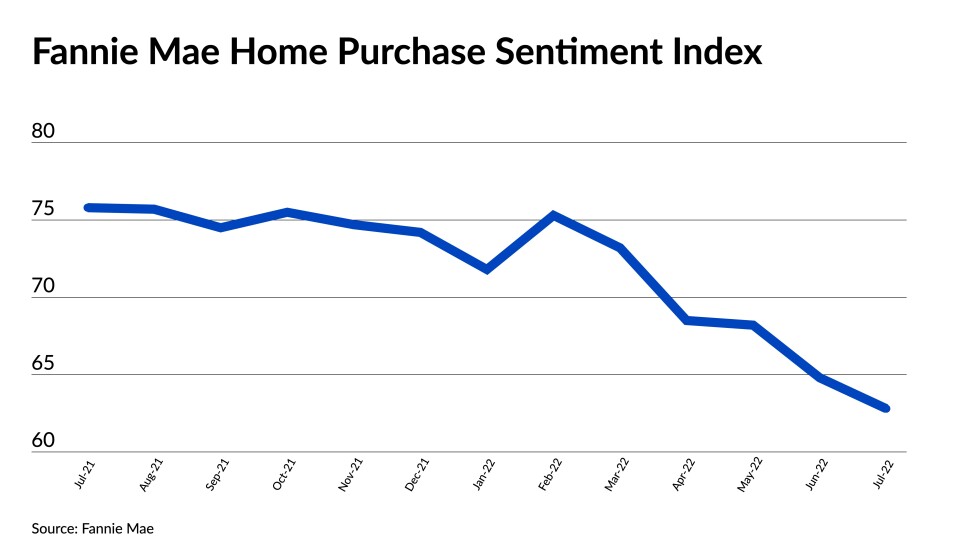

Home buyer sentiment falls to its lowest level since 2011

Fitch downgrades PacWest, citing 'deterioration' of key capital ratio