Losses widened at Impac Mortgage Holdings as the ongoing secondary market dislocation and a competitive landscape curtailed origination activities.

Impac lost $13.5 million in the second quarter, compared with a loss of $1.2 million in

"Beginning in the first quarter, we were deliberate and decisively more conservative in our lending approach, sacrificing short term results for liquidity and stability, which we felt was the appropriate path heading into steep rate headwind," Jon Gloeckner, principal accounting officer, said on the call.

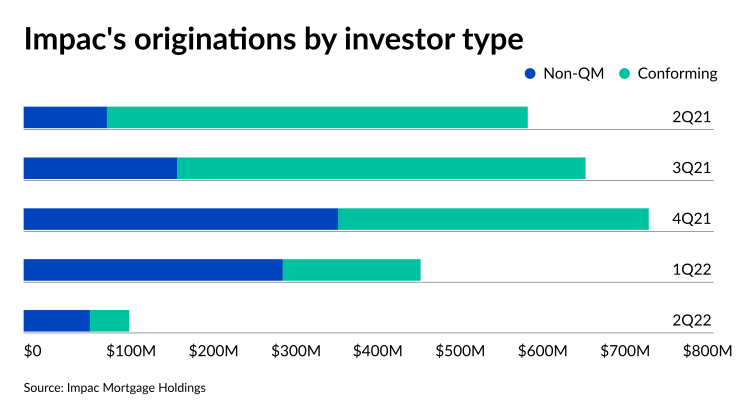

As a result, originations fell sharply to $128.1 million, of which $80.2 million was non-qualified mortgages, with a total margin of just 14 basis points. This compared to $482.1 million ($314.3 million of which was non-QM) with a 124 bps margin in the first quarter. One year ago, Impac originated $611.5 million, but only $100.6 million was non-QM and the margin was 175 bps.

"While layered risks cannot assuredly be hedged in times of acute market dislocation, since the end of the first quarter of 2022, the company's non-QM pipeline has been fully deliverable into forward best efforts arrangements with a variety of counterparties," George Mangiaracina, chairman and CEO, said on the call. "We've consciously elected to discourage down-in-coupon non-QM origination volume."

However, the call center business, for the first time since the company resumed doing non-QM, was the source for most of these originations, at $49.2 million in the second quarter, versus $31 million for wholesale. The call center also did $43.8 million of government-sponsored enterprise mortgages.

Impac's operating expenses decreased to $14.7 million in the second quarter from $19.4 million in the first quarter, primarily due to a reduction in personnel costs, to $8 million from $11.9 million in the first quarter. That was a result of lower variable compensation paid due to lower volume and a reduction in headcount, from "approximately 330 at year-end 2021, to approximately 225 at the end of the second quarter, and it sits at approximately 170 today," Gloeckner said.

Business promotion expense was cut to $1.3 million in the second quarter from $2.3 million in the first quarter.

The marketing spend was affected by competition for non-QM loans, especially in California, and lower conversion rates drove up Impac's cost per lead.

"The drop in lead conversion is attributable in part to higher rates and credit box adjustments by non-QM investors throughout the quarter," Justin Moisio, chief administrative officer explained. Both the non-QM and GSE marketing spend at the call center have been adjusted to focus on lead quality.

Impac currently has $400 million of warehouse capacity but it expects to reduce that to $350 million by the end of the third quarter.

"We continue to balance capacity needs to meet funding demands for non-QM production goals. We continue to carefully manage our liquidity as evidenced by our unrestricted cash position of $60 million on the balance sheet at the end of the second quarter," giving Impac enough liquidity to meet its near-term production goals, Gloeckner said.

"With production in our TPO platform being nearly all non-QM, the need to manage market risk to credit and pricing remains critical in light of volatility and illiquidity in

Still, Impac remains "committed to its core competency of alternative credit originations," in all channels, Moisio said.

Even with those difficulties in the secondary market, because of rising rates, those investors remain committed

The company also provided an update regarding its Series B and Series C preferred stockholders, for which a Maryland court ruled it owed

Registration statements have been filed with the Securities and Exchange Commission for an exchange of these shares but have not yet been declared effective.

Each class must approve the deal in a two-thirds vote, while a majority of Impac's common stockholders also need to vote in favor of the exchange.