While the mortgage industry has been notably slow to adapt to new technologies, use of remote online notarization software

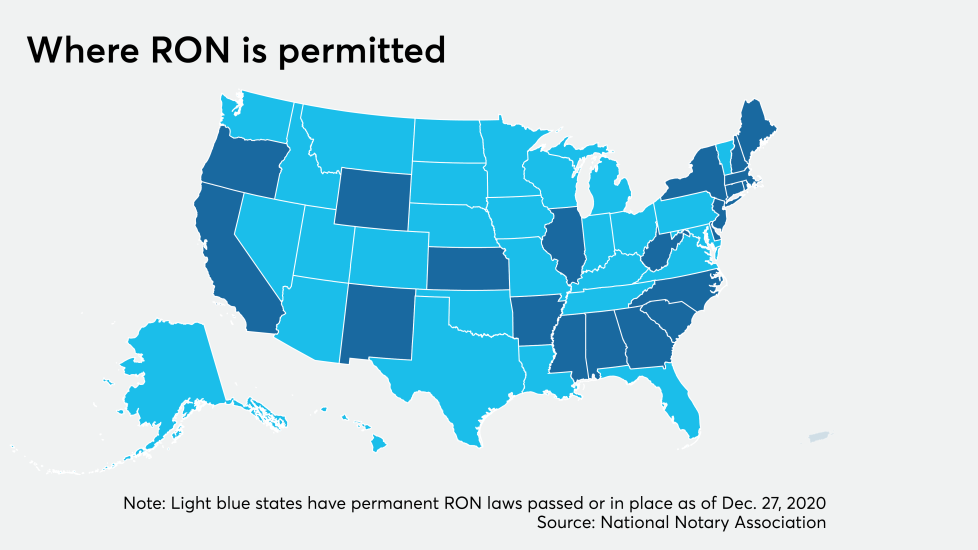

While temporary authorizations of RON use span the U.S., permanent RON laws now exist in 25 states as of Dec. 27, 2020 with four more — Alaska, Colorado, Hawaii and Louisiana — enacted and waiting to go into effect.

When or, more likely, if every state gets RON laws in place beyond temporary orders remains to be seen. A lack of political will and abbreviated legislative sessions may prevent more states from allowing its use permanently, while concerns around fraud, a commitment to in-person only transactions and a lack of bandwidth are all factors delaying wider use by lenders.

Below experts discuss how they used RON and detail what it will take for the industry at large to fully embrace it.