Want unlimited access to top ideas and insights?

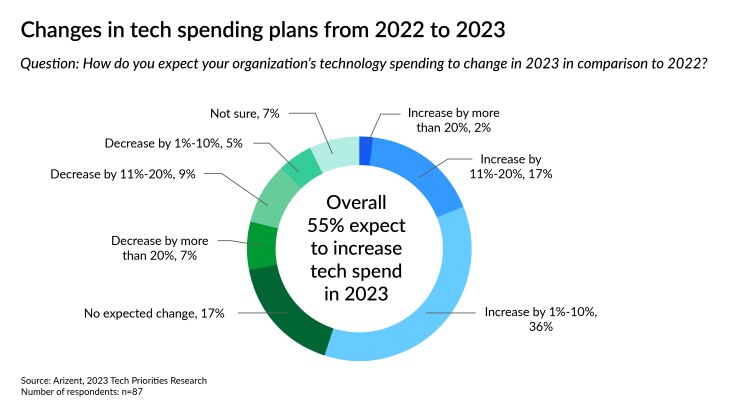

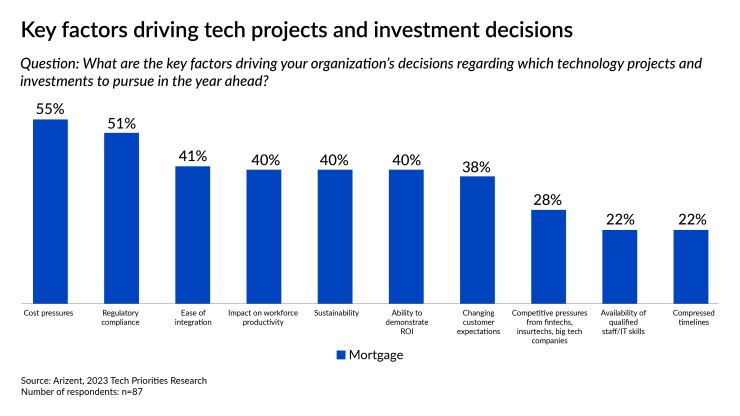

Even with a recession looming, mortgage companies are planning to invest in new technology, with a majority of organizations surveyed saying they expect to increase their tech spending in 2023.

Arizent, publisher of leading brands in financial and professional services, conducted original research to find out which types of technology mortgage companies are focusing on in the current economic climate and the key factors that are likely to impact their spending decisions.

This research was conducted online in December 2022 among 87 respondents with knowledge of and/or involvement in their institution's tech initiatives.

Scroll through to find out what the research reveals.