-

Rocket enters the crowded DSCR market with a product for experienced investors, joining rivals as non-QM lending grows and demand for single-family rentals stays strong.

November 19 -

Independent mortgage bankers were in the black for each loan originated during the third quarter, as low rates brought an application surge in September.

November 18 -

Application error findings rose over 15%, the second quarter in a row they have moved higher, the post-closing file review from Aces Quality Management found.

November 18 -

Quality Control Advisor Plus is an integrated system which brings together previously separate units, cutting months off of Freddie Mac's current QC process.

November 17 -

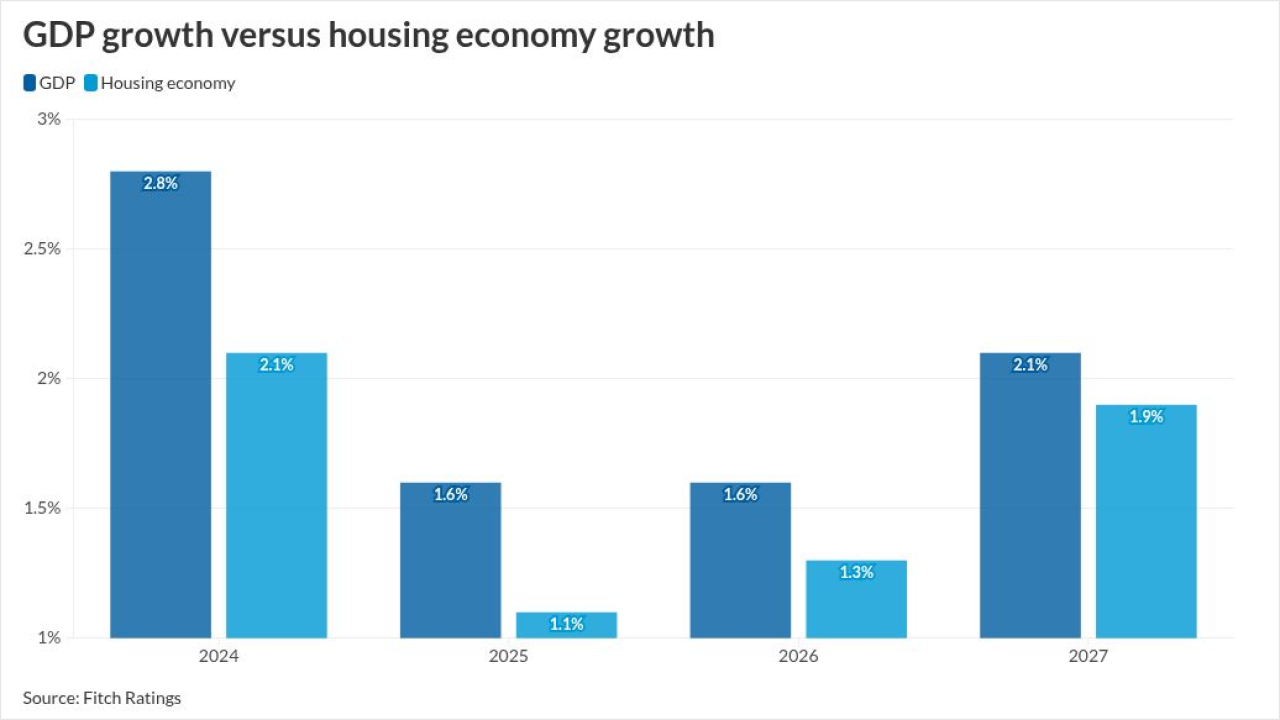

While Fitch and Kroll have differing views on mortgage rates next year, both are looking for mortgage delinquencies to rise in their rated portfolios.

November 14 -

The fintech had over $2 billion in home equity line of credit volume in the third quarter and reported growing production in its crypto and non-QM offerings.

November 14 -

With the increase in investor-owned properties, the risk of undisclosed real estate fraud, including occupancy misrepresentation, rose 9% in the third quarter.

November 14 -

The mortgage company, even though it is owned by a bank, has been profitable for the last two years, when considering its originations operations, as it does.

November 13 -

Two government-sponsored enterprises are looking into expanding mortgage transfers between borrowers, according to the head of their oversight agency.

November 11 -

While the program is still going strong in spite of the shutdown, many misconceptions about its rules, even in normal times, are holding back use.

November 11 -

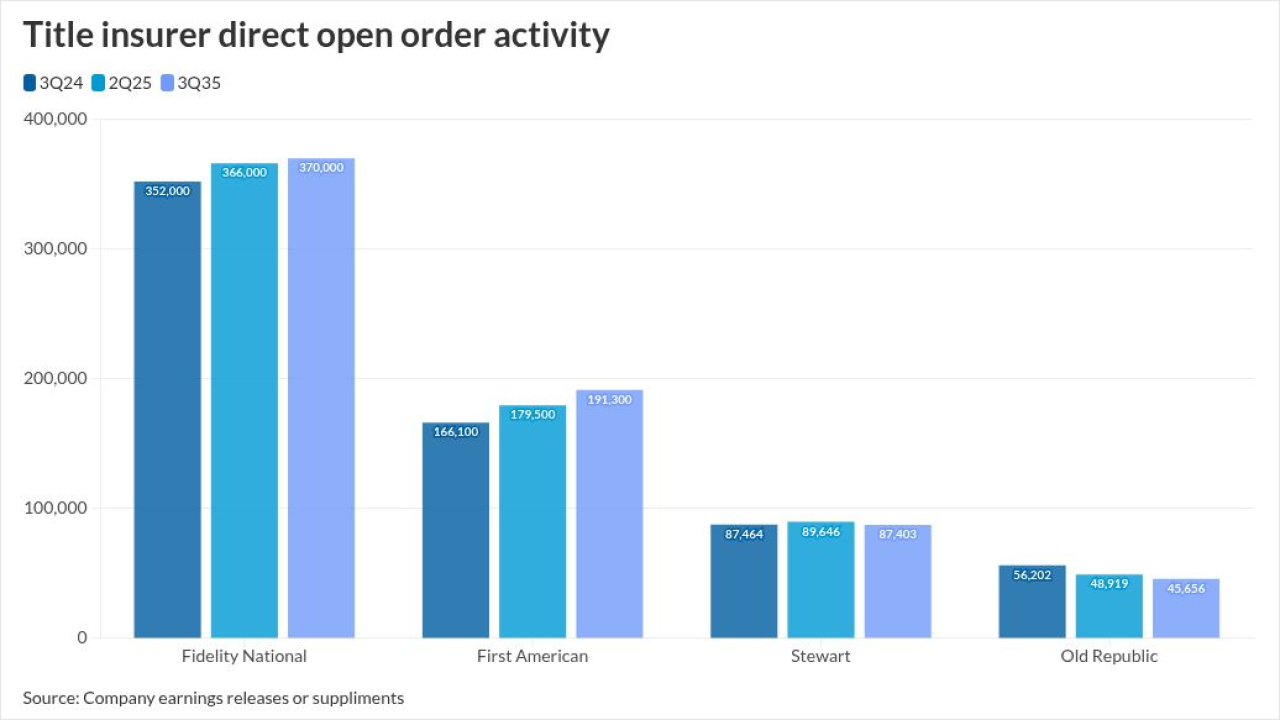

All five publicly traded title insurance companies reported a year-over-year increase in earnings during the third quarter, but only two had higher orders.

November 10 -

The impacts of the federal government shutdown are hitting both originators and servicers, and as things drag out, the disruptions will increase.

November 9 -

A successful summer pilot led to wider rollout of a program, whereby Robinhood Gold subscribers will be able to find discounted rates and closing costs.

November 3 -

Bill Pulte's X post has the industry excited that loan level price adjustments could change, but the impact would not be as beneficial as some think, KBW said.

October 27 -

While purchase volume is up 20% from last year, it was 5% lower than one week ago, although a 4% increase in refinance activity helped pick up the slack.

October 22 -

The NRMLA/Riskspan Reverse Mortgage Market Index set a new high of 502.42, with the dollar amount of home equity for those 62 or over reaching $14.4 trillion.

October 21 -

The lender, which reported over $200 million in home equity line of credit volume in the recent quarter, suggests the business can deliver massive scale.

October 21 -

The rollout comes as the company looks to build out offerings for originators, launching after PHH returned to the proprietary reverse-mortgage arena this year.

October 20 -

The appointment of the mortgage veteran comes as the lender undergoes marketing and branding pivots, including its recent name change from Nexa Mortgage.

October 20 -

While borrowing activity increased from a year ago, seasonal patterns and economic concerns suggest near-term slowing, the Mortgage Bankers Association said.

October 17