-

With rents rising and homeownership rates still low, here's a look at eight reasons why more renters may want to become homeowners.

January 18 -

The Home Affordable Refinance Program recorded a 45% drop in volume in October from the previous year as it continunes to wind down, according to the Federal Housing Finance Agency.

December 15 -

Despite rapid price gains and tight inventory nationally, prices in many of the largest housing markets are still below the peaks reached before the Great Recession.

December 6 -

Here's a look at the 10 cities where strong employment and for-sale inventory are expected to keep housing markets bustling with activity during the normally slow year-end months.

November 30 -

Clearinghouse CDFI will use funds from the $2 million investment to support affordable-housing and economic development projects in communities and Native American reservations in California, Nevada and Arizona.

November 20 -

The numbers tantalize leery minds: Housing prices, population growth and job creation in Southern Nevada all rebounded from the Great Recession over the past few years.

November 8 -

Here's a look at the 12 housing markets with the largest percentages of mortgages over $500,000 — the new threshold House Republicans have proposed for the mortgage interest deduction in their tax plan.

November 8 -

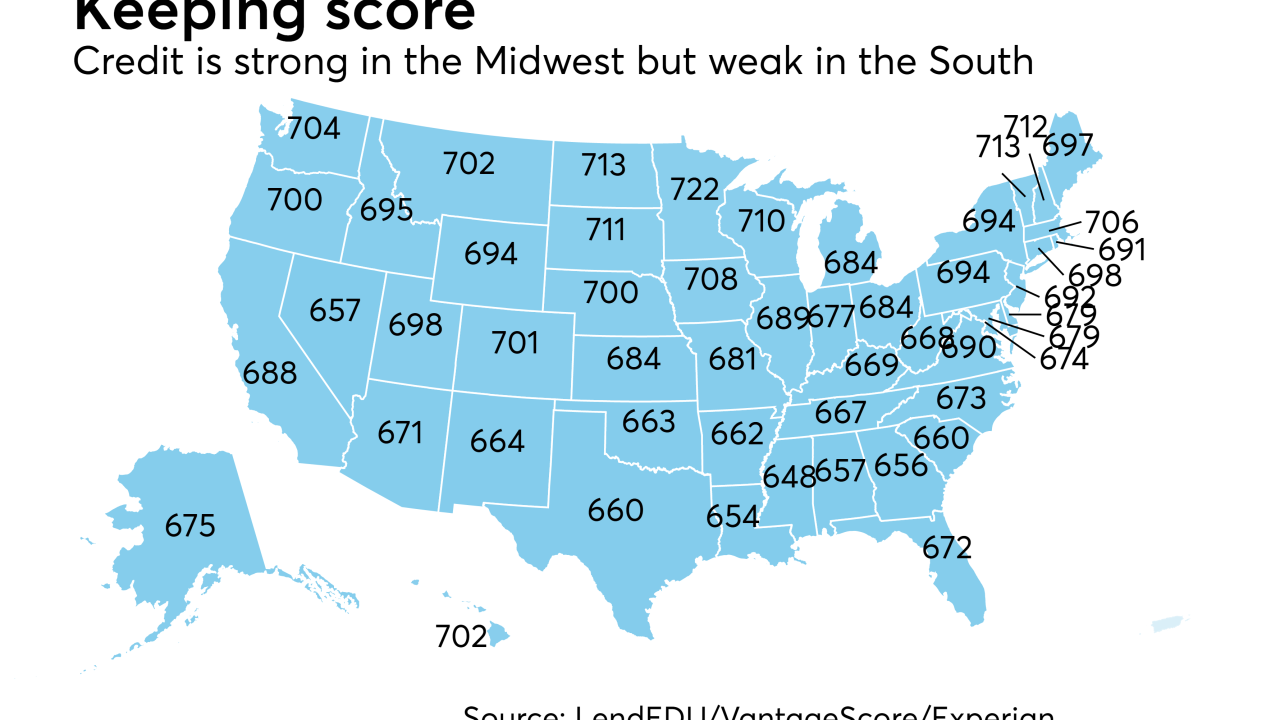

Consumer credit varies nationally due to regional variations in income and the cost of living. To get a sense of where it's strongest and weakest, here's a look at the five best and worst states for consumer credit scores.

October 23 -

Sens. Dean Heller and Catherine Cortez Masto of Nevada called on mortgage industry leaders to provide relief and financial assistance to victims of the Oct. 1 mass shooting at the Route 91 Harvest Festival in Las Vegas.

October 16 -

Home prices in 20 U.S. cities climbed more than forecast in July, reflecting solid demand against a backdrop of modest listings of properties, figures from S&P CoreLogic Case-Shiller showed.

September 26 -

U.S. home prices reached a new record high in June, with values increasing 5.5% since the beginning of the year, according to Black Knight Financial Services.

August 28 -

Mortgage holders could see their security interest wiped out if a borrower in Texas or Nevada gets a property tax loan where the lien has priority over the first mortgage.

August 18 Lereta

Lereta -

From Indianapolis to Nashville, here's a look at the 15 hottest residential real estate markets of summer 2017.

July 13 -

The city of Las Vegas is strengthening its effort to identify homes at risk of becoming blighted or taken over by squatters.

July 5 -

Summer usually ushers in prime homebuying season in Southern Nevada, but that could change drastically in 2017.

June 6