-

Rising interest rates contributed to a 2.5% decrease in mortgage application activity, which fell for the fourth straight week.

May 2 -

As key interest rates grew, the refinance share of mortgage applications hit a low not seen since September 2008, according to the Mortgage Bankers Association.

April 25 -

Better weather allowed consumers to go shopping for homes and drive the increase in mortgage application volume compared with one week earlier, according to the Mortgage Bankers Association.

April 18 -

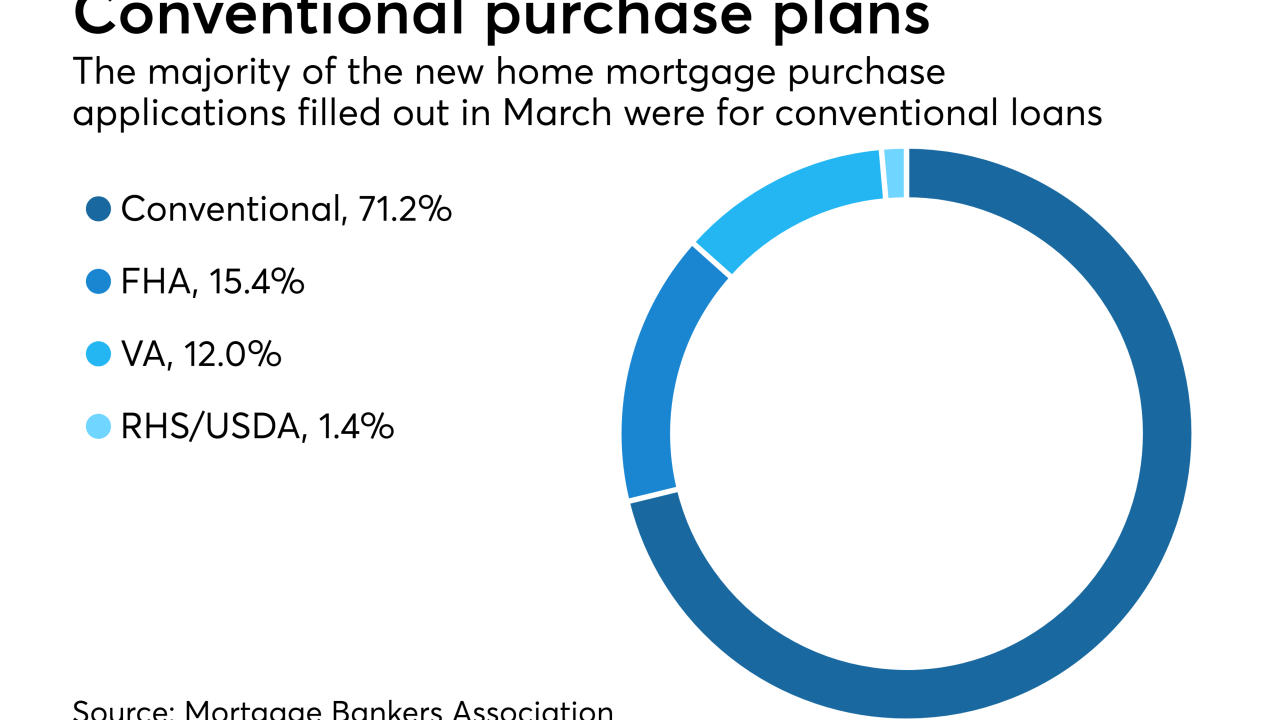

March mortgage applications for new home purchases were stronger than in February but lenders didn't produce as many of them as they did a year ago.

April 13 -

The bank says its partnership with Lender Price will help streamline and simplify its home loan process.

April 12 -

Mortgage applications decreased 1.9% from one week earlier as purchase activity was down again, according to the Mortgage Bankers Association.

April 11 -

Mortgage application activity decreased 3.3% from one week earlier as purchase and refinance volume fell prior to the start of the home buying season, according to the Mortgage Bankers Association.

April 4 -

Banks that scored high in customer-satisfaction ratings did so for their front-line service, not their tech capabilities, a study finds.

March 30 -

Lenda, launched in 2014, currently makes mortgages start to finish in two weeks. But it's aiming to make it a process that can be finished on a borrower's lunch break.

March 28 -

Mortgage applications increased 4.8% from one week earlier and rose for the fourth time in five weeks as key interest rates held steady, according to the Mortgage Bankers Association.

March 28 -

The share of mortgage refinance applications dropped to its lowest level in nearly 10 years as interest rates continued to climb.

March 21 -

Continued increases in mortgage rates caused the refinance loan application share to fall to its lowest level since September 2008, according to the Mortgage Bankers Association.

March 14 -

February's volume of mortgage loan applications for newly constructed homes rose both year-over-year and month-to-month, continuing the momentum from a surprisingly strong showing in January.

March 13 -

Financial data and analytics company FinLocker has gained the approval of a second patent supporting its digital vault functionality.

March 12 -

Mortgage application activity increased slightly from one week earlier even as the rate for the 30-year conforming loan rose to its highest level in four years.

March 7 -

The new Federal Reserve Board chairman's testimony in Congress was the driver of this week's mortgage rate increase, according to Freddie Mac.

March 1 -

Higher levels of purchase activity even with rising interest rates drove the increase in mortgage applications compared with one week earlier.

February 28 -

Financial services groups are calling for more funding for the Internal Revenue Service that could fix flaws in the agency's system for verifying the income of mortgage applicants.

February 22 -

With 30-year mortgage rates reaching a four-year high, loan application activity was lower this past week, according to the Mortgage Bankers Association.

February 21 -

Rising rates, largely tied to the stock market turmoil, took their toll on mortgage application volume during the past week.

February 14