Loan applications for newly constructed homes slowed on a month-to-month basis in December as the storm-driven spike in volume ended.

There was an 18% drop in mortgage applications to purchase a new home in December from November, according to the Mortgage Bankers Association's Builder Application Survey. But on a year-over-year basis, application volume improved by 7.8%.

"After playing catch-up for two months following the slowdown caused by hurricanes Harvey, Irma and Maria, mortgage applications for new homes declined in December to a more normal growth rate of 7.8% on a year over year basis," said Lynn Fisher, the MBA's vice president of research and economics, in a press release. "Looking at all of 2017, applications increased by 7.1% compared to 2016.

The seasonally adjusted annual pace of new home sales fell by 16.4% in December to 554,000 units from the previous month's 663,000. On an unadjusted basis, there were 40,000 home sales in December, down 14.7% from November's 47,000, according to the MBA's estimate.

"We are anticipating only modest year-over-year growth for new home sales in 2018," said Fisher. "Despite robust demand, a lack of labor and land will continue to constrain homebuilders."

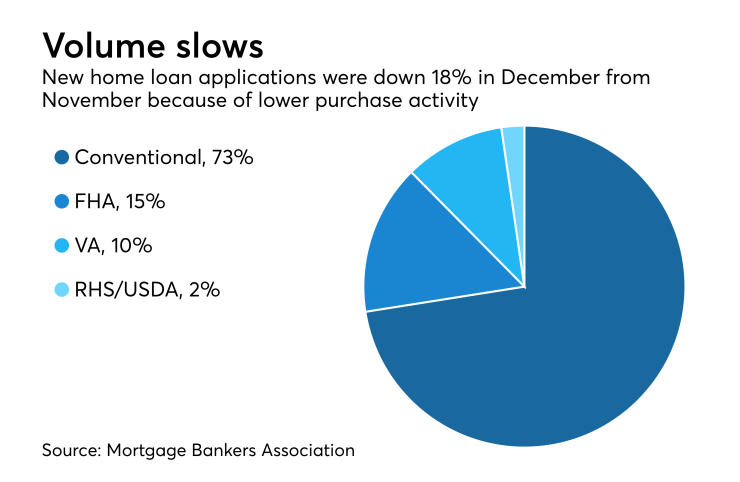

By product type, 72.5% of purchases applied for a conventional loan, while 15.1% sought a Federal Housing Administration-insured mortgage. Applications for Veterans Affairs-guaranteed loans had a 10.1% share, while 2.3% of buyers applied for a Rural Housing Service/U.S. Department of Agriculture mortgage.

The average loan size of new homes increased to $339,203 in December from $337,427 in November.