-

The President is promising big announcements on housing affordability issues in Switzerland, but will it include ending the GSE conservatorships?

January 20 -

Treasuries sold off sharply after reports Danish pension funds are exiting, steepening the yield curve as stocks fell and gold surged, according to the CEO of IF Securities.

January 20 AD Mortgage and IF Securities

AD Mortgage and IF Securities -

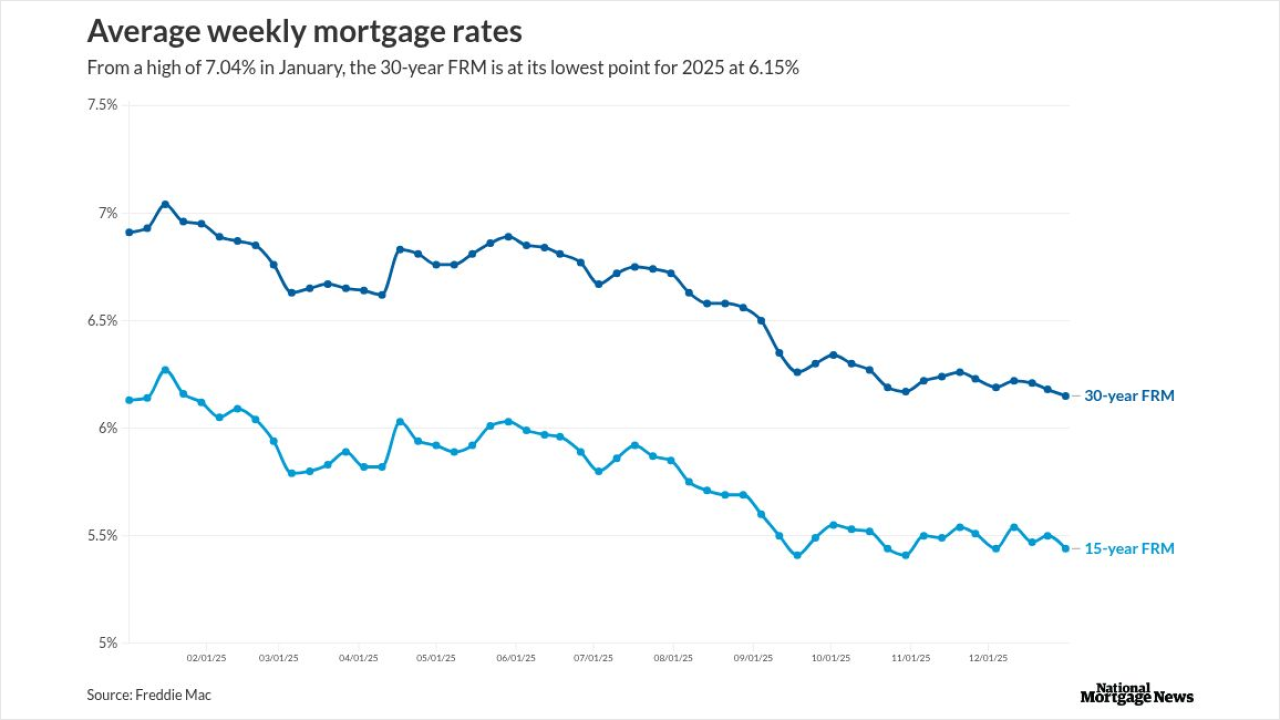

This week the conforming 30-year fixed rate mortgage fell 10 basis points, with Optimal Blue data showing it broke through, at least briefly, the 6% level.

January 15 -

The contract rate on a 30-year mortgage dropped 7 basis points to 6.18% in the week ended Jan. 9, according to Mortgage Bankers Association data released Wednesday.

January 14 -

Total lock volume increased 2% from November and finished 30% higher than last December, according to Optimal Blue's latest Market Advantage report.

January 13 -

The survey, taken before Pres. Trump's $200 billion MBS buy demand, finds panelists worried over inflation, but also see employment as the larger downside risk.

January 12 -

Trump's proposed $200B MBS purchase briefly tightened mortgage spreads, but analysts question the long-term impact on mortgage rates and GSE balance sheets.

January 9 -

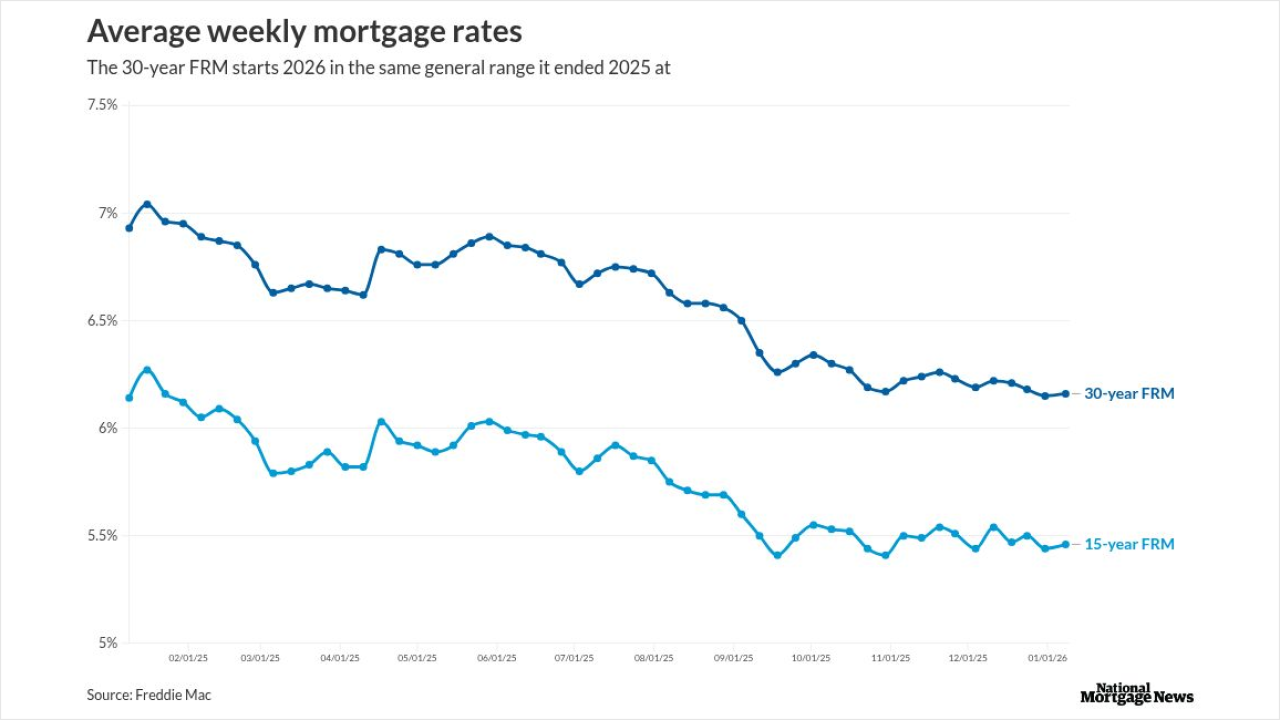

The 30-year fixed remains in its current range, but most expect the rate to reach 6% for 2026, and one observer feels it could actually break under this point.

January 8 -

US mortgage rates fell last week to the lowest level since September 2024, a hopeful sign for the sluggish housing market to start the new year.

January 7 -

Late last year, commercial bank holdings of mortgage paper reached the highest level since 2023 as these depositories are flush with deposits.

January 6 -

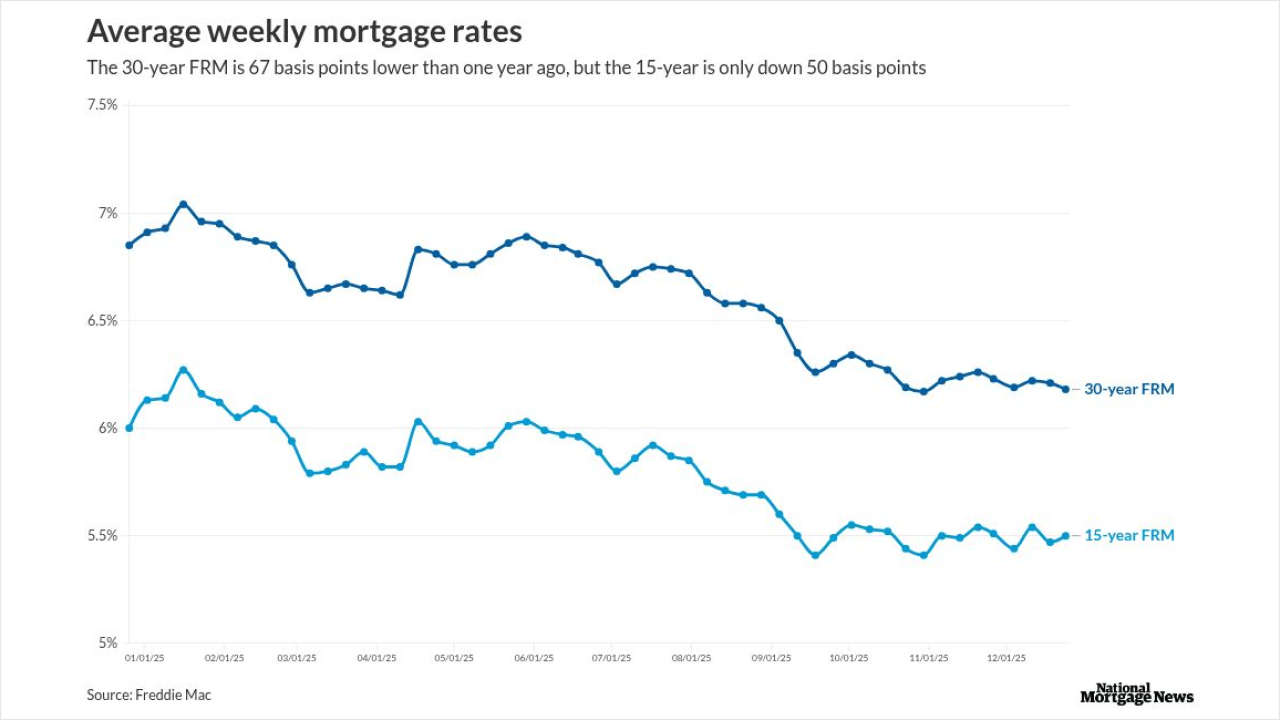

Keefe, Bruyette & Woods attributes Fannie Mae and Freddie Mac portfolio growth for the narrower spreads, but other reasons include lower volatility.

January 5 -

Fitch Ratings' outlooks for mortgage and title insurers this year are neutral, as housing deals with affordability challenges and a likely economic downturn.

January 2 -

After piercing the 7% ceiling in January, the 30-year fixed trended lower the rest of the year, dropping 89 basis points from peak to trough, Freddie Mac found.

December 31 -

The Federal Reserve is slated to undertake a number of important rules and regulations in 2026, but decisions around agency leadership and the Trump administration's avowed effort to exert greater control over the central bank are likely to leave a lasting legacy at the agency.

December 29 -

The MBA's Market Composite Index, a measure of mortgage loan application volume, dropped 5% on a seasonally-adjusted basis and 6% on an unadjusted basis.

December 24 -

The 30-year fixed rate mortgage dropped 3 basis points this week, its lowest level since October and just over its 52-week bottom, Freddie Mac reported.

December 24 -

The president's latest commentary comes as he is looking to new leadership at the Fed to help reduce borrowing costs, as he increasingly feels political pressure to address voter concerns over affordability.

December 23 -

Our experts expect a mortgage market reset in 2026 with an uptick in originations, but warn lenders not to skimp on compliance even as the reins loosen.

December 22 -

While the 30-year average has hovered near the same level for weeks, the past year brought with it promising trends that may ease affordability in 2026.

December 18 -

Mortgage activity fell 3.8% from one week prior for the week ending Dec. 12, led by a 4% drop in refinance applications, the Mortgage Bankers Association said.

December 17