-

Decision makers have voiced support for lower financing costs but researchers have said achieving it could be complicated. Part 3 in a series.

December 3 -

Planet Home Lending, helped by growing recapture and distributed retail volume, did 64% more originations in the third quarter than one year prior.

December 1 -

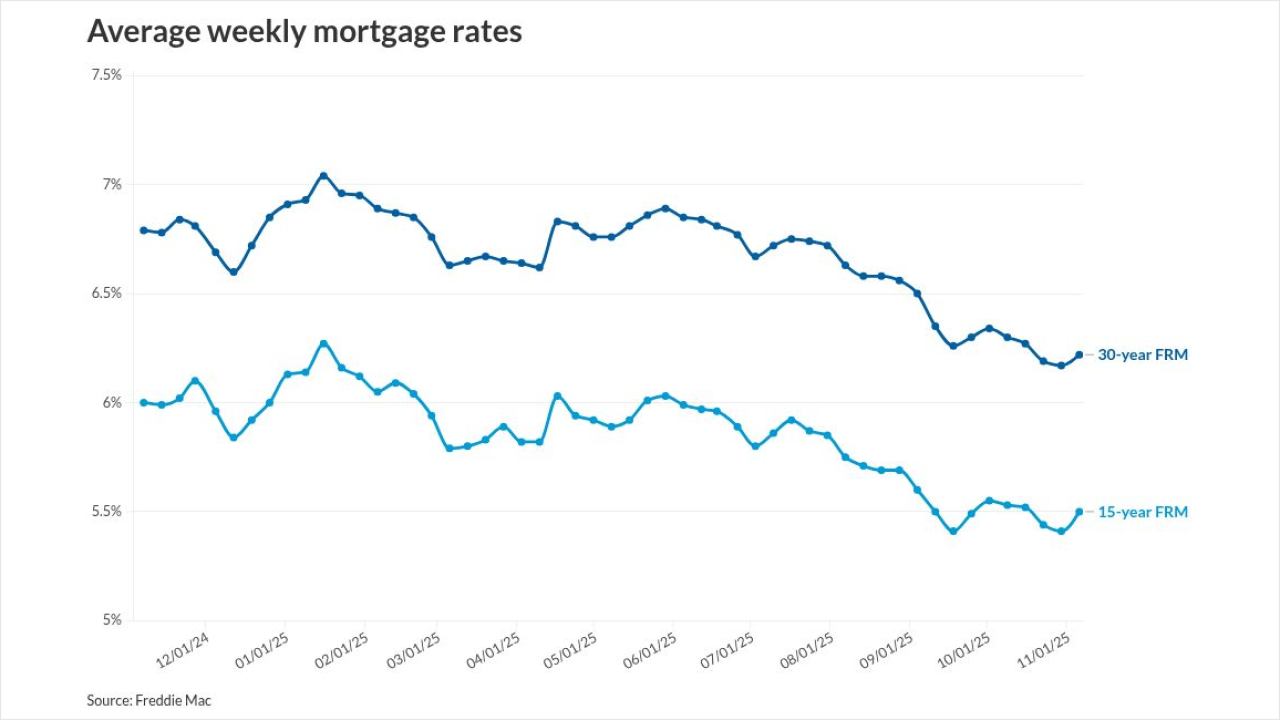

After three consecutive weeks of increases, the 30-year fixed mortgage rate dropped 0.3 basis points to 6.23% this week, according to Freddie Mac.

November 26 -

The administration has previously said the finalists are Fed Governors Christopher Waller and Michelle Bowman, former Governor Kevin Warsh, National Economic Council Director Kevin Hassett and BlackRock Inc. executive Rick Rieder.

November 25 -

The prepayment rate grew by 37% over September as mortgage rates fell leading to higher refinancing volume in October, ICE Mortgage Technology said.

November 25 -

Even with this week's increase, mortgage rates have remained within a 13 basis point band since mid-September, with industry pundits saying that's where they will stay.

November 20 -

Trump's remarks — made in a joking tone — come amid increased pressure on the administration from voters to lower the cost of living.

November 20 -

Even to the detriment of greater profits, the sector is offering ultra-low terms via temporary buydowns combined with larger forward commitments.

November 20 -

Consecutive weeks of mortgage rate increases resulted in a 5.2% decrease in mortgage loan application volume, according to the Mortgage Bankers Association.

November 19 -

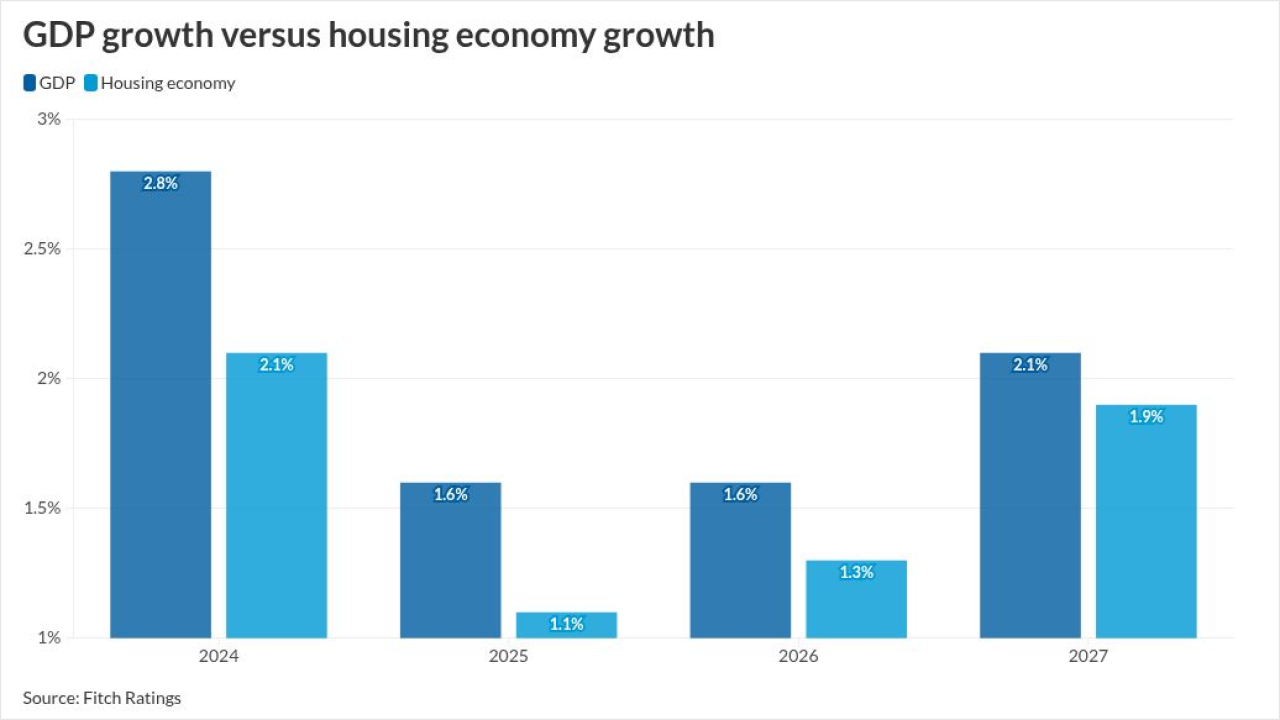

While Fitch and Kroll have differing views on mortgage rates next year, both are looking for mortgage delinquencies to rise in their rated portfolios.

November 14 -

For the second consecutive week, the 30-year fixed rate mortgage increased as investors were still sorting through the lack of information due to the shutdown.

November 13 -

Yields were higher by as much as three basis points, led by tenors more sensitive to changes in Fed policy.

November 13 -

The government shutdown added an additional dose of pessimism about the U.S. economy to panelists' outlooks, Wolters Kluwer said in its latest survey.

November 12 -

The number of highly qualified refinance candidates rose to 1.7 million, the most in three and a half years, as mortgage rates ease.

November 10 -

The 30-year fixed-rate mortgage rose five basis points from last week to 6.22%, while the 15-year rate increased nine basis points to 5.50%

November 6 -

Treasuries fell after the US government signaled that larger auction sizes are on the horizon, while signs of economic resilience hurt the odds a Federal Reserve interest-rate cut in December.

November 5 -

Now that quantitative tightening is ending, the debate on who should be the MBS buyer of last resort, Fannie Mae and Freddie Mac, or the Fed, is taking hold

November 3 -

Wall Street dealers expect Bessent to signal as soon as Wednesday, when his department releases a quarterly statement on debt sales, that issuance in the $30 trillion Treasury market will keep shifting in that direction.

November 3 -

Three Federal Reserve officials said they did not support the US central bank's decision to cut interest rates this week, citing inflation that remains too high.

October 31 -

The 30-year rate dropped just 0.2 percentage points, as Federal Reserve Chair Jerome Powell's recent comments caused Treasury yields to rise.

October 30