-

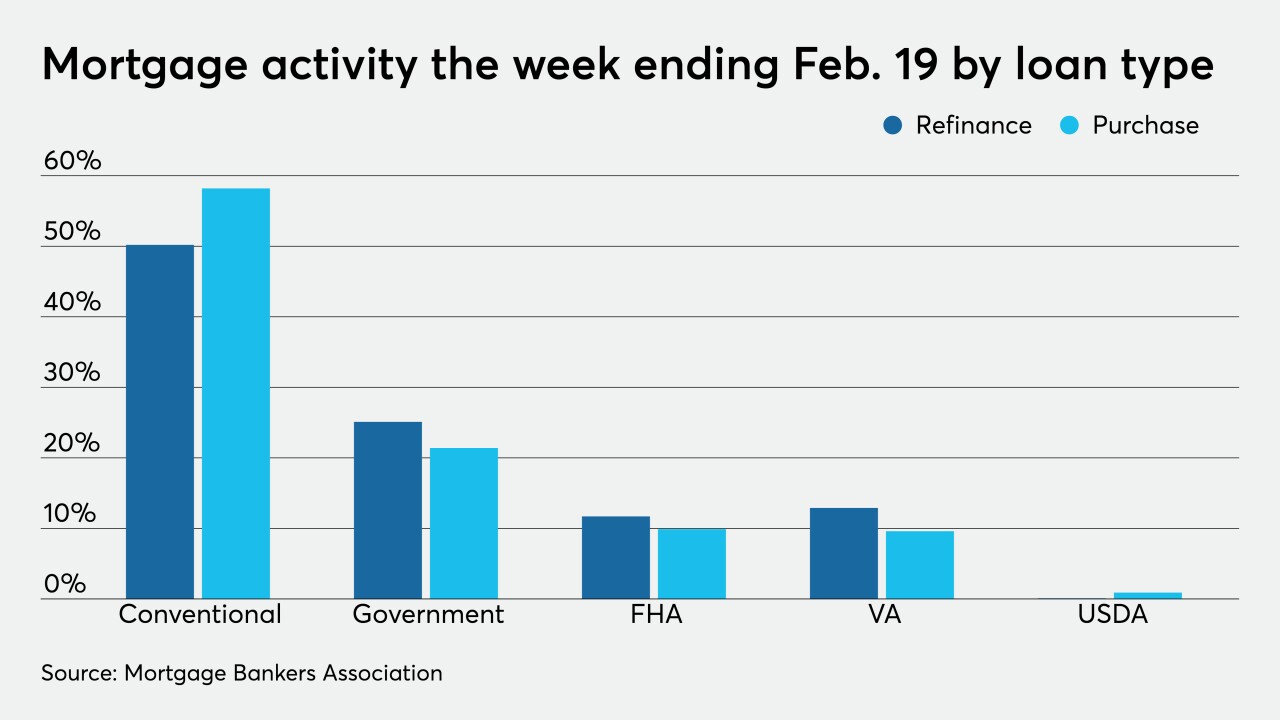

Severe winter weather and another hike in mortgage rates stifled loan volume for the week, according to the Mortgage Bankers Association.

February 24 -

Just because the Fed is staying put doesn’t mean that mortgage rates, and prices of MBS, are staying put as well, writes Vice Capital Markets Principal Chris Bennett.

February 19 Vice Capital Markets

Vice Capital Markets -

“Sales could be even higher,” if more homes were put on the market, NAR’s chief economist Lawrence Yun said

February 19 -

Today, the mortgage players who most actively hedged — Fannie and Freddie, real estate investment trusts and large bank servicers — have significantly reduced their need to to do so, analysts said.

February 19 -

With the most recent stimulus aiding economic recovery, mortgage lending’s feeding frenzy could be coming to an end.

February 18 -

While sales shot up from the same time last year, inventory reached its lowest level since Remax started its National Housing Report in 2007.

February 17 -

Between the dip in refis and the approach of the spring buying season, mortgage lenders are likely to start paying a little more attention to the purchase market, which is less rate-sensitive.

February 17 -

With pandemic conditions in place for a second spring, lenders and brokers discuss the indicators that will reveal whether the market is shifting away from the traditional selling season to one that runs hot throughout the year.

February 15 -

The cost associated with borrowing money to finance homes now appears more likely to remain stable rather than continuing to decline, which should eventually slow refinance activity.

February 11 -

Home loans accounted for the bulk of the industry’s lending gains in 2020, but inventory shortages in some markets and an uneven economic recovery may dim prospects this year.

February 9