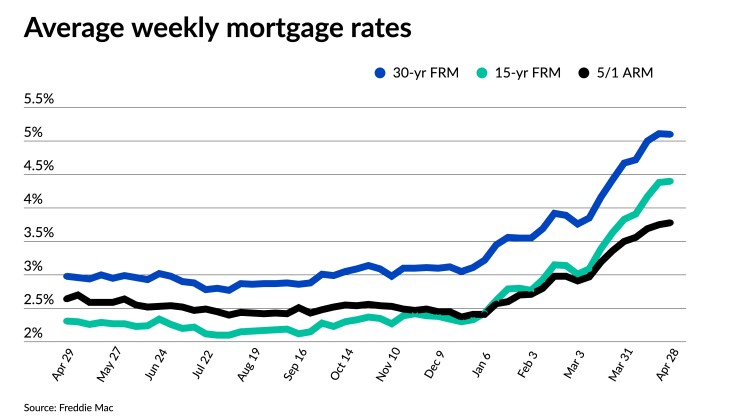

Average mortgage rates took a slight pause from their steep upward acceleration in April, falling for the first time since early March, Freddie Mac said.

The 30-year fixed-rate average remained nearly unchanged over the past seven days, according to Freddie Mac’s Primary Mortgage Market Survey, edging down by a single basis point to 5.1% for the week ending April 28.

“With light economic data in the prior week, markets were reacting to comments from Fed officials that action will be taken “expeditiously” to address inflation,” said Paul Thomas, vice president of capital markets in a research blog post.

With few surprises to upset the cart, “investors appear to be pricing in 50-basis-point rate hikes in each of the next four Federal Open Market Committee meetings,” he added.

But the week’s rate data came just as the Bureau of Economic Analysis announced that U.S.

“The good news is that consumer spending remained strong, particularly for services, as much of that sector has returned close to pre-pandemic levels,” said Joel Kan, associate vice president of economic and industry forecasting at the Mortgage Bankers Association, in a press release. “Households continue to benefit from a strong job market and wage growth.”

The impact of recent mortgage-rate movements are showing up, though, in the housing market, according to Sam Khater, chief economist at Freddie Mac. “The combination of swift home price growth and the fastest mortgage rate increase in over 40 years is finally affecting purchase demand,” he said in a press release,

Several recent reports from various research groups also indicate

“We expect the decline in demand to soften home-price growth to a more sustainable pace later this year,” he said.

While the 30-year rate decreased, averages for other loan terms headed in the opposite direction, but generally remained near the previous week’s level. The 15-year mortgage inched up 2 basis points to 4.4%, from 4.38% the previous week. Over the same period one year ago, the 15-year rate averaged 2.31%.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage also climbed 3 basis points to an average of 3.78% from 3.75% seven days earlier. One year ago, the 5-year ARM came in at 2.64%.