-

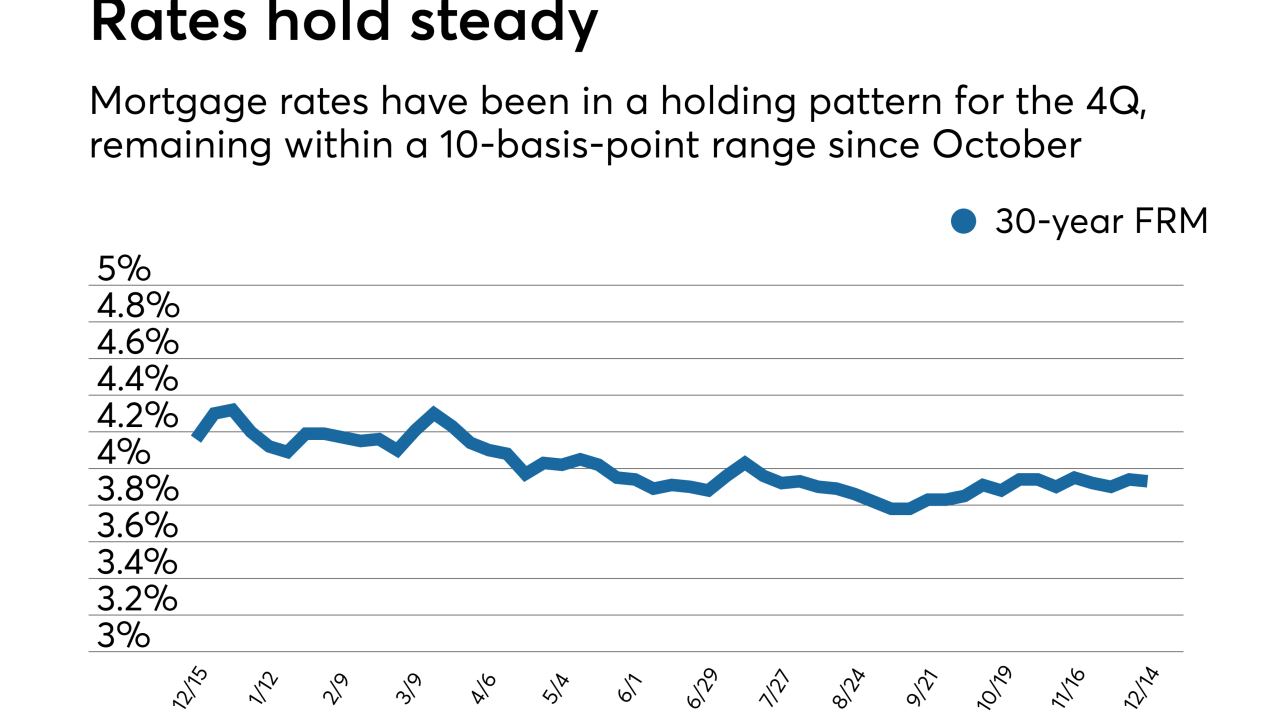

Mortgage rates posted a slight increase this week following the Federal Open Markets Committee's decision to boost short-term rates by 25 basis points, according to Freddie Mac.

March 22 -

After increasing for nine consecutive weeks, mortgage rates dropped for the first time in 2018, according to Freddie Mac's Primary Mortgage Market Survey.

March 15 -

Mortgage rates increased for the ninth consecutive week, moving in reaction to bond and stock market volatility.

March 8 -

The new Federal Reserve Board chairman's testimony in Congress was the driver of this week's mortgage rate increase, according to Freddie Mac.

March 1 -

The 30-year fixed mortgage rate moved up for the seventh consecutive week with further increases possible as bond yields rise over concerns about higher inflation.

February 22 -

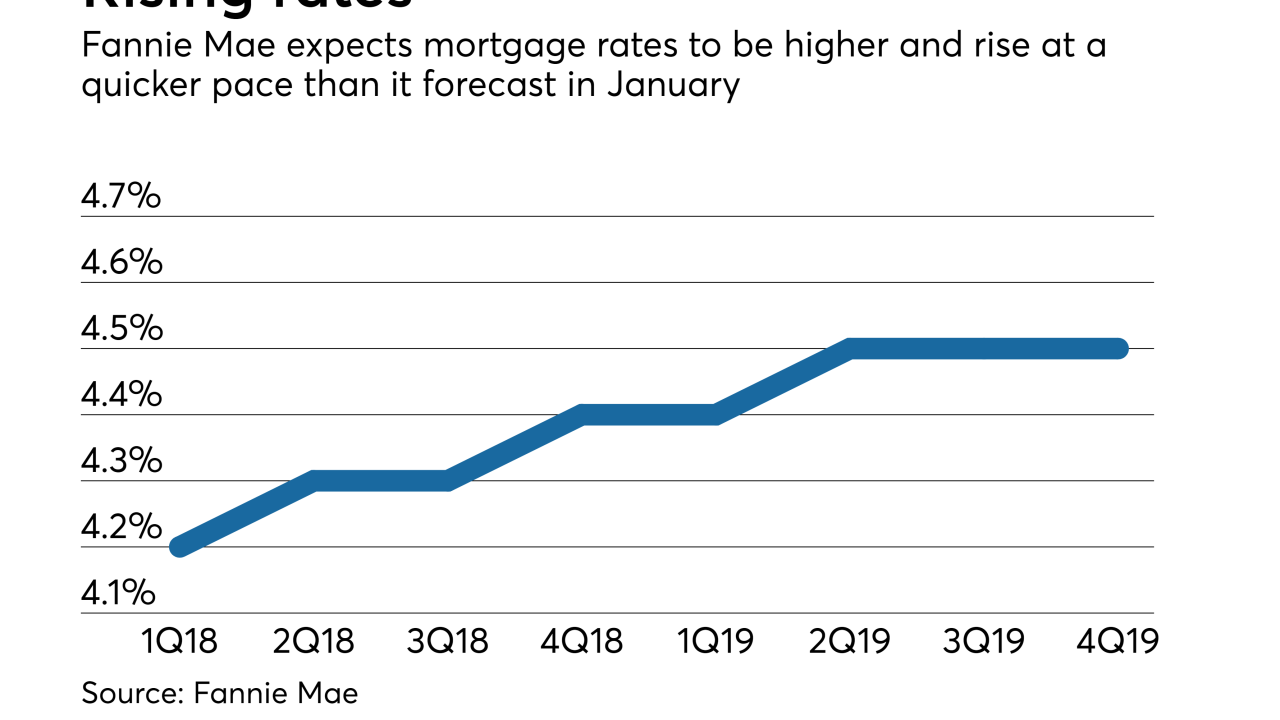

The recent bond market volatility will cause mortgage rates to rise to a higher level than previously projected, according to Fannie Mae.

February 15 -

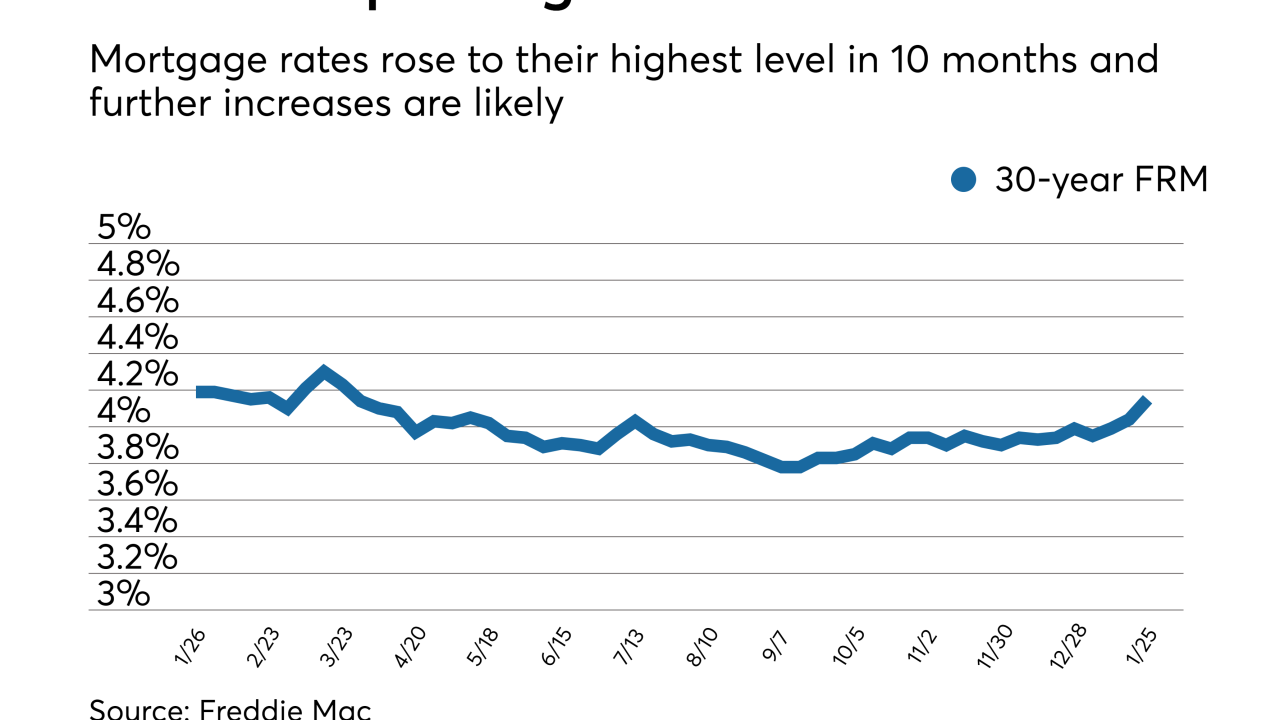

Mortgage rates rose to their highest level in almost four years, as worries over inflation drove the 10-year Treasury yield to just shy of 3%.

February 15 -

Mortgage rates hit their highest mark since December 2016 as bond yields were affected by the roller coaster stock market, according to Freddie Mac.

February 8 -

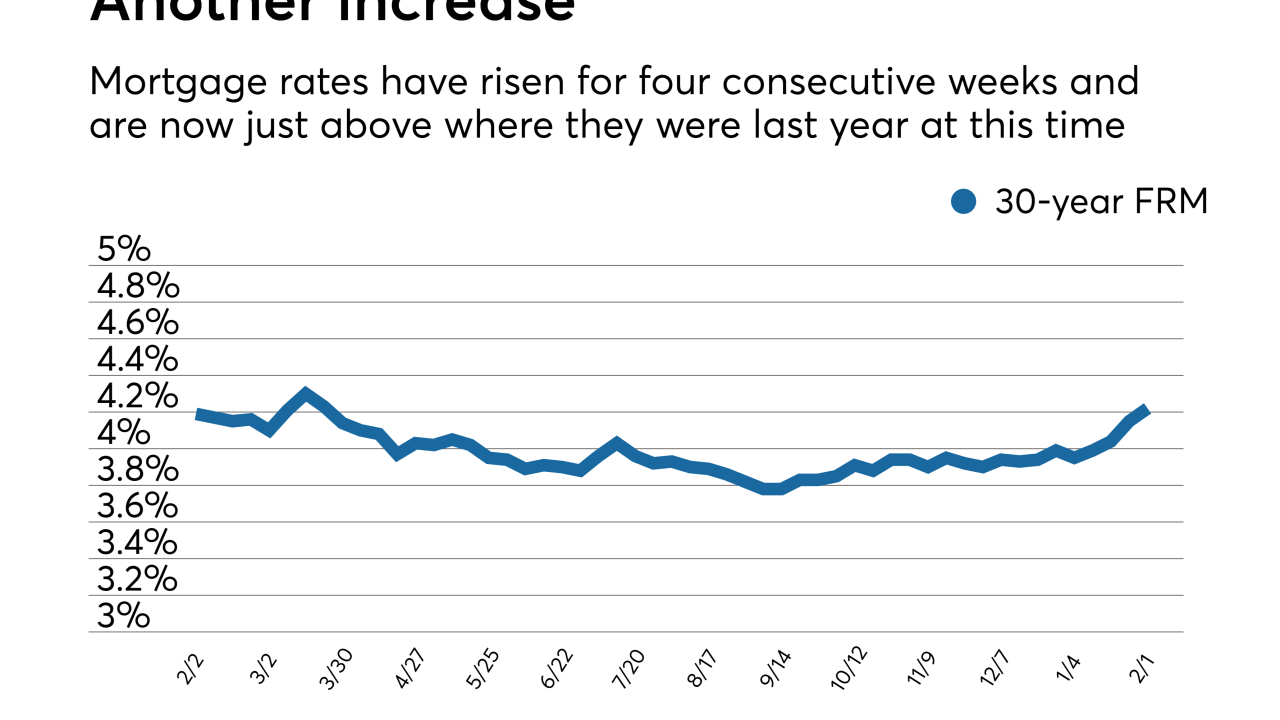

Mortgage rates, which are significantly higher since the start of the year, are likely to rise for weeks to come, according to Freddie Mac.

February 1 -

Mortgage rates rose for the third consecutive week and with expected continued economic growth, further increases are likely.

January 25 -

Given the improving U.S. economy, mortgage rates will probably not fall back under the 4% mark anytime soon.

January 18 -

Mortgage rates jumped across the board as investors sold some of their Treasury bond holdings, which led to higher yields, according to Freddie Mac.

January 11 -

Mortgage rates dropped to start the year as the markets had little new news to react on during the holiday period.

January 4 -

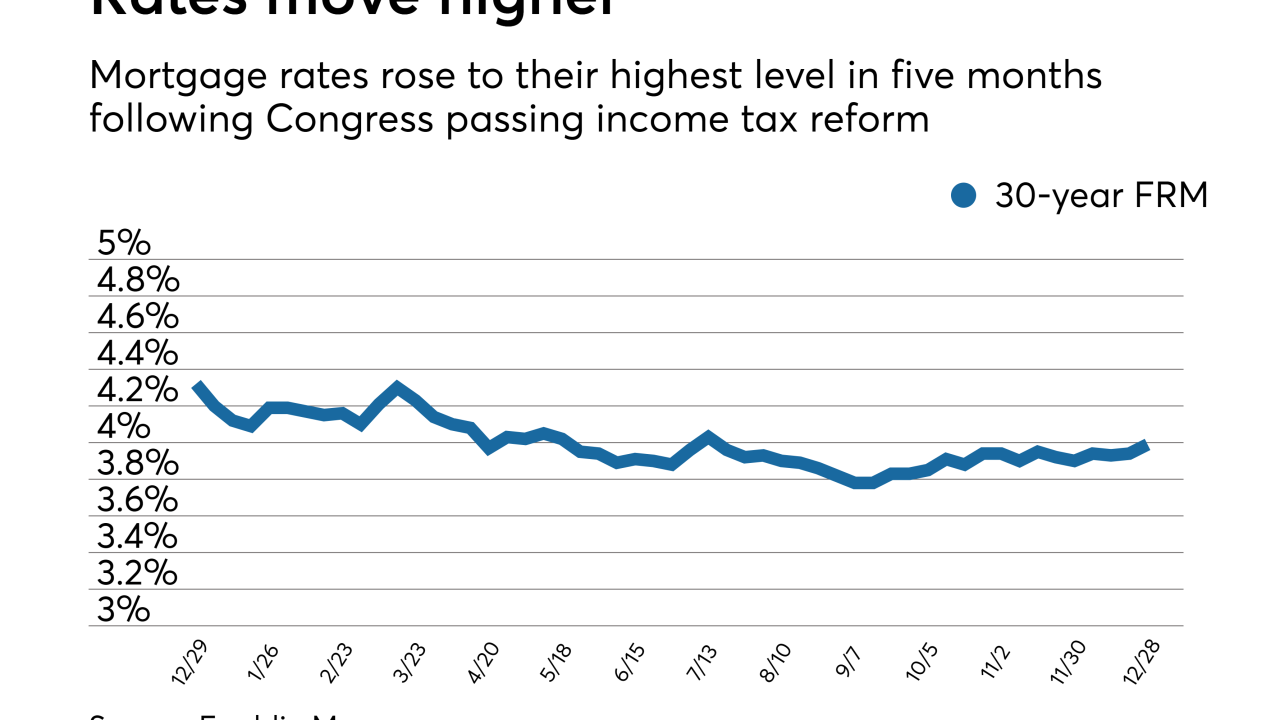

Mortgage rates rose to their highest level since the summer as predicted following Congress passing income tax reform, according to Freddie Mac.

December 28 -

The tax reform bill Congress sent to President Trump's desk this week is likely to prompt at least a short-term spike in mortgage rates.

December 21 -

The mortgage market had already priced the Federal Open Market Committee's 25-basis-point hike into its rates so there was little change, according to Freddie Mac.

December 14 -

Mortgage rates ticked up this week, but a larger rise is possible next week depending on what Congress does about tax reform and the budget.

December 7 -

Mortgage rates moved lower this week, but strong economic data and comments by the outgoing Federal Reserve chair left many anticipating higher rates, according to Freddie Mac.

November 30 -

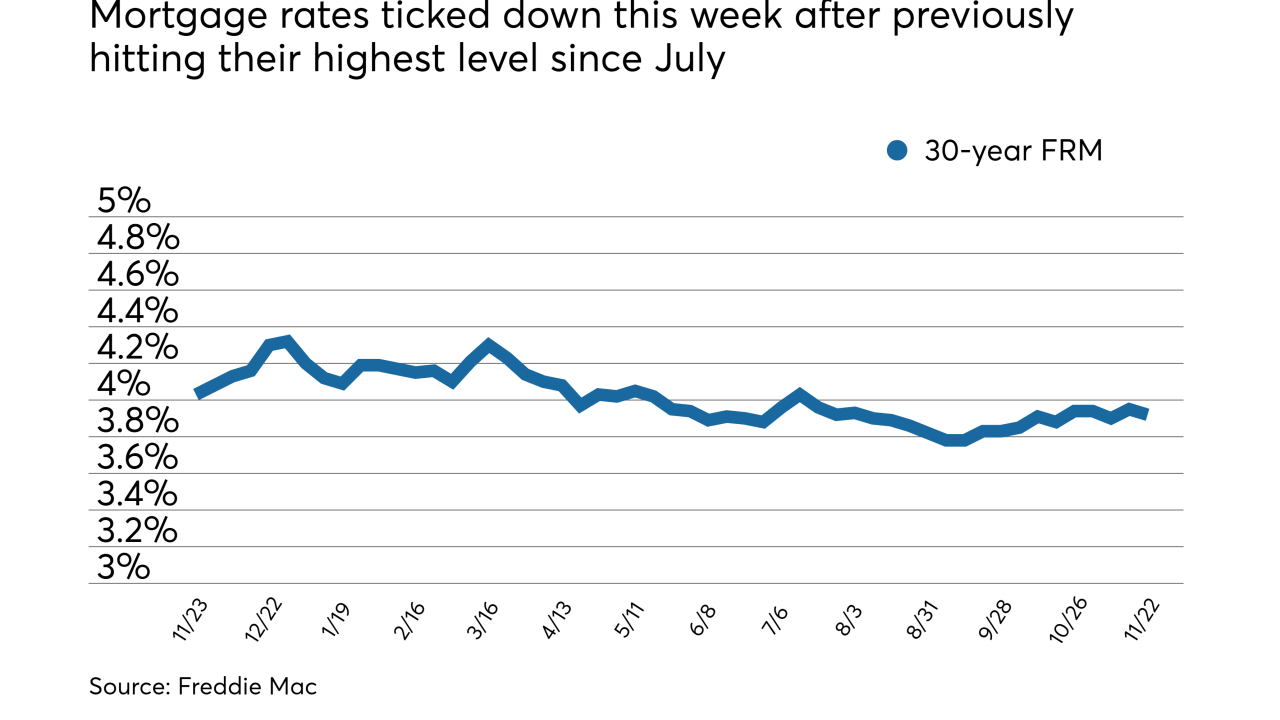

Mortgage rates ticked down this week after previously hitting their highest level since July, according to Freddie Mac.

November 22 -

Mortgage rates moved to their highest mark since July and the 10-year Treasury yield ticked up 6 basis points, according to Freddie Mac.

November 16