-

Mortgage Bankers Association economist Marina Walsh said lenders could be failing to close more loans as more consumers apply with multiple originators.

October 20 -

Fannie Mae increased its mortgage volume and home sales predictions, but that comes from cutting its forecasts for U.S. gross domestic product growth in 2025.

March 28 -

The potential impacts of import tariffs cloud the outlook, though, and could lead mortgage rates to surge and fall throughout the coming year.

February 20 -

The 30-year fixed rate mortgage continues to close on the 7% mark. With political uncertainty and the U.S. economy remaining strong, it could keep going up.

January 9 -

An interest rate drop spurred an unusually high number of recently originated mortgages to prepay, and one loan type proved to be particularly reactive.

December 9 -

As 2025 approaches, some lenders are already scaling operations, hiring talent, and preparing for the next cycle, despite ongoing market uncertainty, write leaders from Pennymac.

December 2 Pennymac

Pennymac -

Fannie Mae's latest economic forecast no longer expects mortgage rates to go below 6% next year, and that is affecting its views on loan origination volume.

November 21 -

A trade group's estimates point to another quarter of profitability in housing finance, but originations have limits and loan performance is under pressure.

October 28 -

Fannie Mae didn't change its estimate for total originations this year.

October 18 -

Hear what your peers are thinking and doing as the new year approaches paired with thoughtful analysis by your National Mortgage News team.

-

Monetary policy officials have finally gone a month without tightening but made it clear more action could lie ahead, suggesting it could be awhile before housing finance costs consistently fall.

June 14 -

Bond traders are girding for the risk that Federal Reserve Chair Jerome Powell is ready, willing and able to plunge the U.S. into recession to get the inflation bogey under control.

September 22 -

Federal Reserve officials broadly agreed last month they should start reducing emergency pandemic support for the economy, minutes of the Sept. 21-22 Federal Open Market Committee meeting released Wednesday said.

October 13 -

Take our survey to share your views on how the market will develop in the coming year.

October 6 -

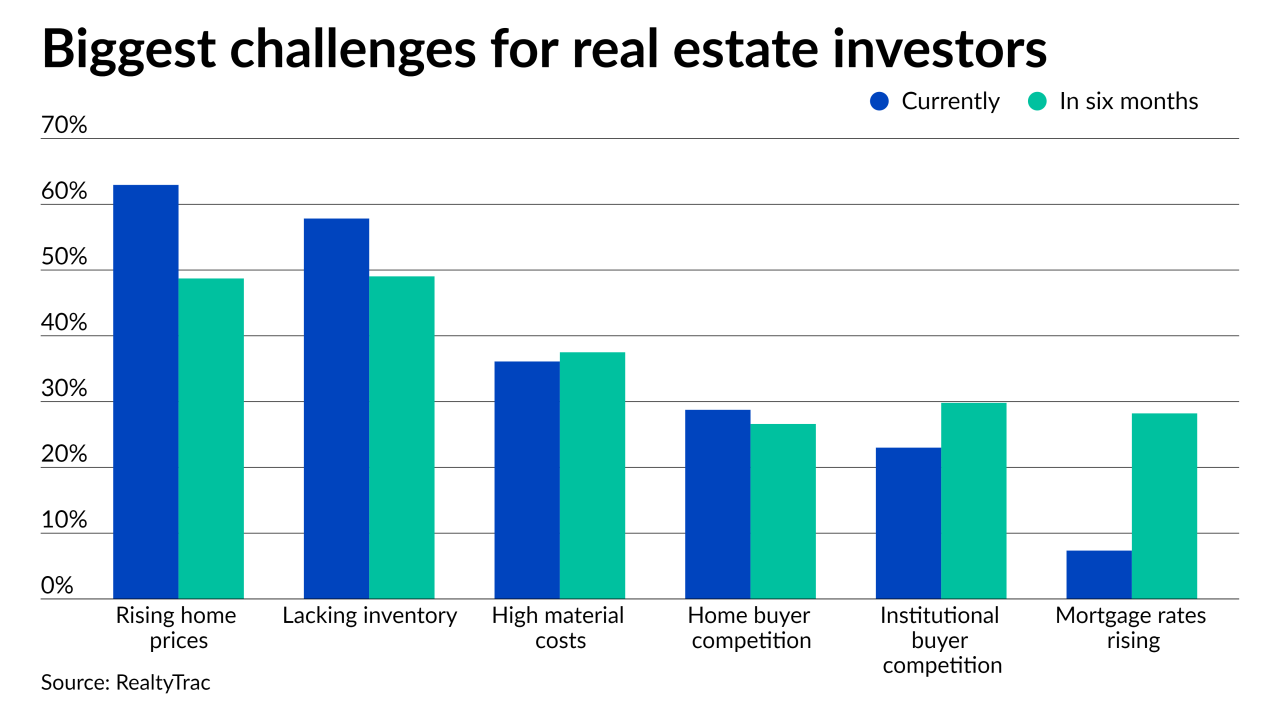

The home price increases and the ongoing inventory shortage made buying conditions difficult and many think it’s only getting more challenging, according to RealtyTrac.

September 29 -

A rising — but still small — share of borrowers believe interest rates and housing price appreciation will fall in the next year, according to Fannie Mae.

September 7 -

Tight inventory and heightened competition kept prime purchasers at bay as property values continued their summer surge, according to Fannie Mae.

August 9 -

Officials have pledged to maintain bond buying until the economy shows "substantial further progress" on inflation and employment as it recovers from COVID-19.

July 23 -

The adverse market fee change could contribute to an increase in refinance volume, adds Mortgage Bankers Association economist Mike Fratantoni.

July 19 -

The GSE forecasts $4 trillion in production this year because refinance activity is stronger than expected.

July 16