-

Mortgage rates jumped across the board as investors sold some of their Treasury bond holdings, which led to higher yields, according to Freddie Mac.

January 11 -

Mortgage rates dropped to start the year as the markets had little new news to react on during the holiday period.

January 4 -

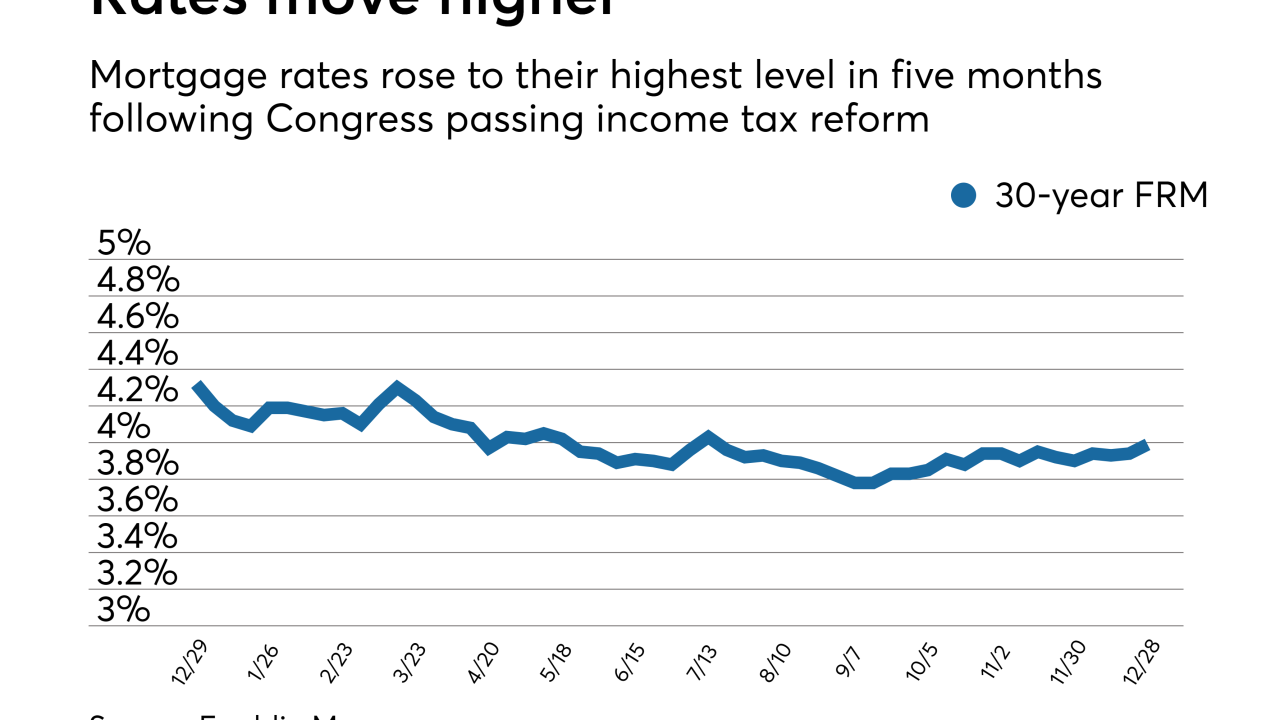

Mortgage rates rose to their highest level since the summer as predicted following Congress passing income tax reform, according to Freddie Mac.

December 28 -

The tax reform bill Congress sent to President Trump's desk this week is likely to prompt at least a short-term spike in mortgage rates.

December 21 -

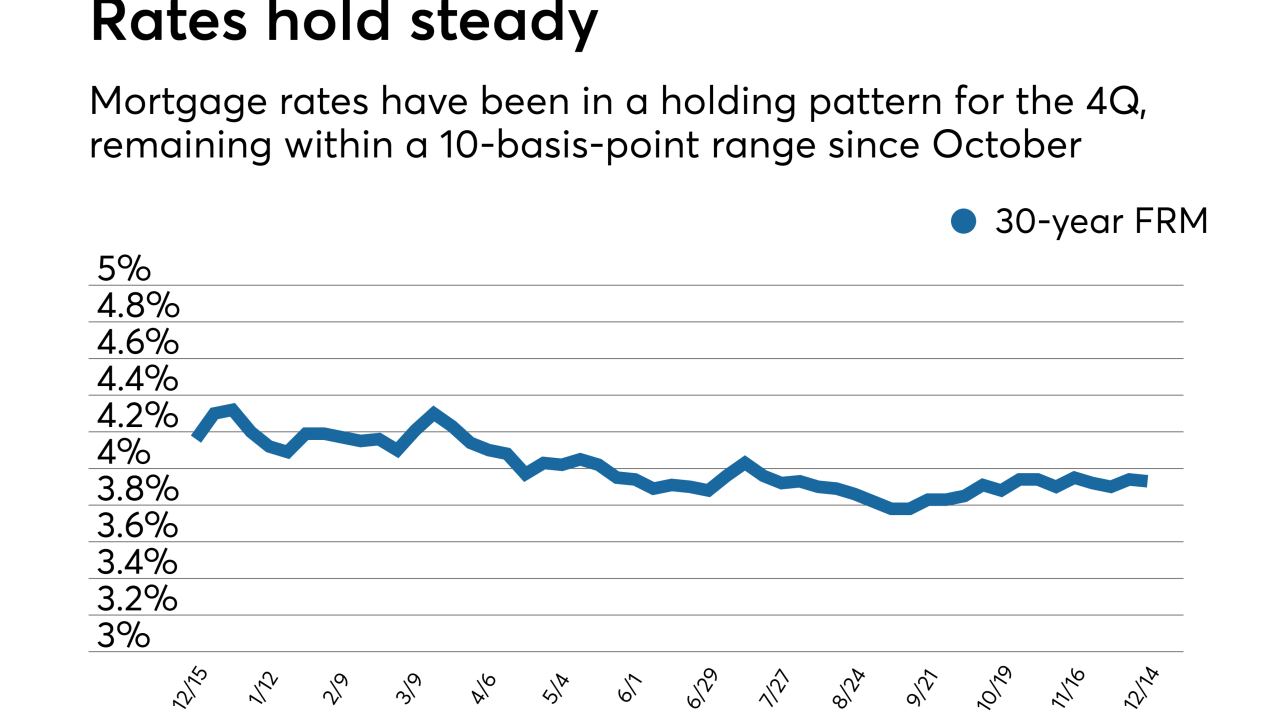

The mortgage market had already priced the Federal Open Market Committee's 25-basis-point hike into its rates so there was little change, according to Freddie Mac.

December 14 -

Mortgage rates ticked up this week, but a larger rise is possible next week depending on what Congress does about tax reform and the budget.

December 7 -

Mortgage rates moved lower this week, but strong economic data and comments by the outgoing Federal Reserve chair left many anticipating higher rates, according to Freddie Mac.

November 30 -

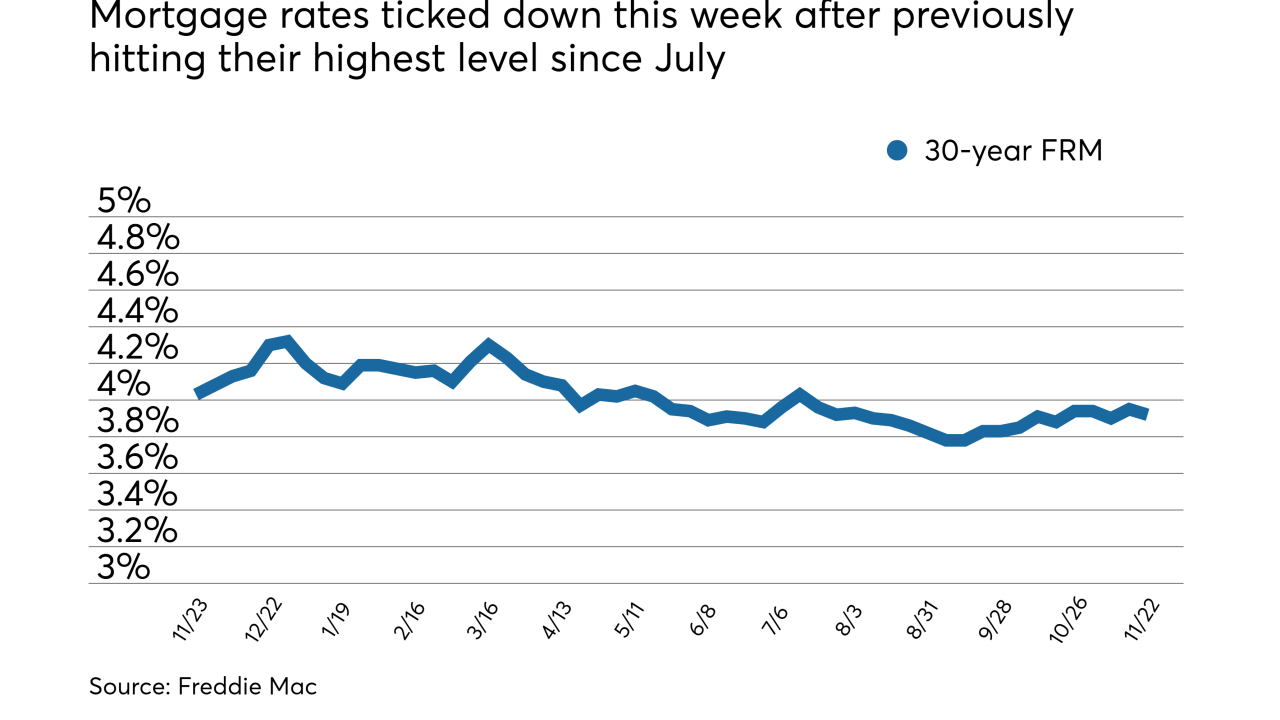

Mortgage rates ticked down this week after previously hitting their highest level since July, according to Freddie Mac.

November 22 -

Mortgage rates moved to their highest mark since July and the 10-year Treasury yield ticked up 6 basis points, according to Freddie Mac.

November 16 -

Mortgage rates fell slightly across the board after the release of the Republican Party tax plan and the nomination of a new Federal Reserve chairman.

November 9