-

The Department of Housing and Urban Development increased the share of reverse mortgage assets it will give community organizations a first crack at, in line with goals of the Biden administration.

September 16 -

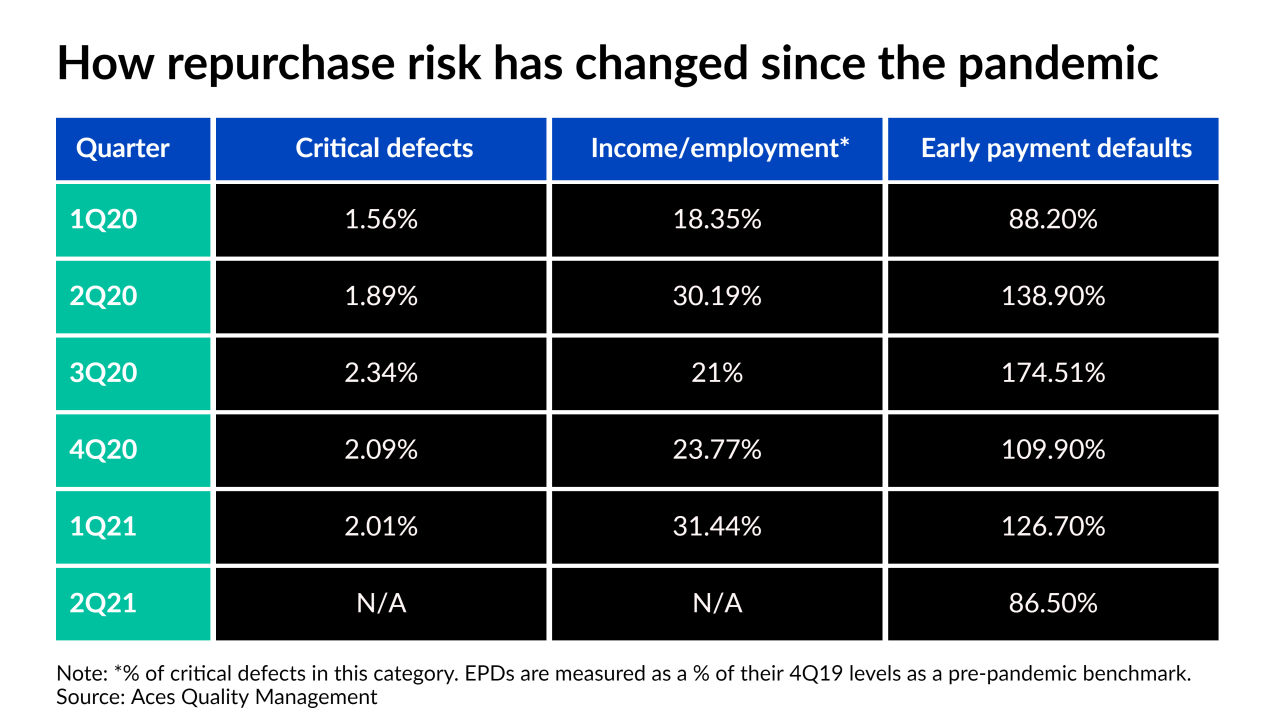

Critical defects fell as well, but the percentage that are related to income or employment concerns set a new record, surpassing the one set in the second quarter of last year.

September 15 -

Fitch Ratings’ second quarter numbers suggest even those facing some of the highest repayment hurdles may have been motivated enough by economic improvement to exit before many expirations were due.

September 14 -

Elizabeth Warren asked the Federal Reserve this week to force the spinoff of the bank’s nonbanking operations. Wells, which was recently hit with another $250 million fine, countered that it has made significant progress in improving its risk management and addressing misconduct.

September 14 -

The number of borrowers leaving plans outweighed a smaller uptick in new requests and re-entries.

September 13 -

The move suggests the government bond insurer doesn’t expect to see loan performance return to normal levels until next summer.

September 13 -

Notable drops were seen across all investor categories, led by declines in portfolio and private label loans.

September 10 -

The industry veteran will be responsible for a division with a mortgage portfolio of almost $1.1 trillion in unpaid balances.

September 10 -

The Office of the Comptroller of the Currency slammed the scandal-plagued bank for violating a 2018 consent order and for problems with loss mitigation practices in its home lending division. The bank will also be restricted from acquiring certain residential mortgage servicing rights.

September 9 -

While the monthly numbers are higher, they remain a far cry from pre-pandemic levels, suggesting it could be awhile before they return to normal.

September 9