Numbers for late-stage delinquency cure rates in the securitized nonprime mortgage market improved notably in the second quarter, suggesting recovery rates are strong even for nontraditional borrowers.

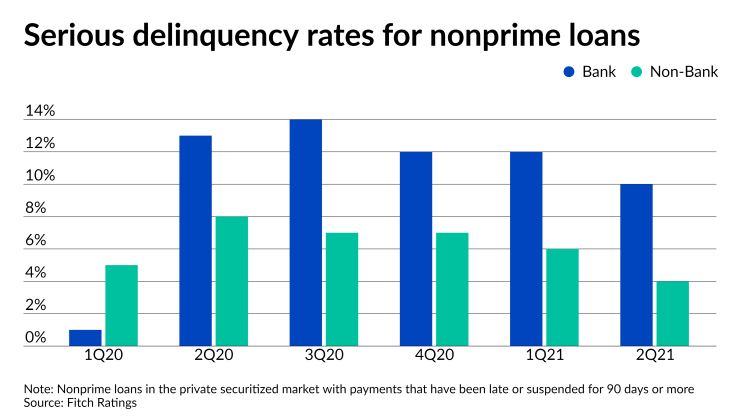

The aggregate 90-plus day delinquency rate for securitizations held in bank servicers’ portfolios dropped to 10% from 13% a year ago and from 12% the previous quarter, according to a Fitch Ratings report published Tuesday. The equivalent nonbank delinquency rate for private nonprime securitizations in this category fell to 4% from 8% in a year earlier, and from 6% in the first quarter. The 2 percentage-point declines compared to the first quarter in both categories were the most notable seen in the past 12 months. Since the second quarter of last year, consecutive-quarter declines have been no larger than 1 percentage point.

The numbers may indicate that those facing some of the highest hurdles within the large pool of borrowers with long-term forborne payments may have been motivated by economic improvement and individual recovery to

“With the caveat that it is aggregate data, I think the numbers give us cause to be cautiously optimistic,” said Richard Koch, a director at Fitch Ratings, and author of the second-quarter Servicer Metric Report. “I think what we saw in the second quarter suggests, with some continued improvement in the economy and unemployment, people in the nonprime market may be coming off extensions and going back to work. That may be why delinquencies began to go down a little bit more significantly.”

Anecdotal conversations with servicers suggest that some of the exits were made by borrowers who continued to make regular payments on their loans even though they were in forbearance, Koch said. Some borrowers requested payment suspensions on a just-in-case basis given the uncertainties associated with the pandemic but ultimately never needed it due to government rescue funds available or for other reasons.

Nonbank delinquency rates for securitized subprime were generally lower than for banks because they tend to be higher-touch servicers, said Koch. Aggregate bank numbers also remain far higher than during the first quarter of last year, when the pandemic was first getting underway in the United States.

The long-term trend line for nonprime bank delinquencies since the first quarter shows them increasing, even though declines have been seen in the short term. The long-term trend line in the same category for nonbanks is down.

Nonprime borrowers who get loans in the private securitized market may have lower credit scores, nontraditional incomes or other needs that disqualify them for government-related mortgages with lower rates and more standard forms of forbearance.

However, the fall expiration dates for COVID-related forbearance in the larger government-related market may have played a role in motivating these borrowers. When agreements governing individual securitizations allow it, even private servicers may prefer to structure their forbearance in line with broader market practices. Some states have issued missives calling for even private servicers to do this, Koch noted.

Declines in forbearance rates and

All aggregate trends in the report reflected a broad range of performance by the individual servicers Fitch rates. Performance varied considerably by company based on several factors such as their size, and the type of institution or loans involved.